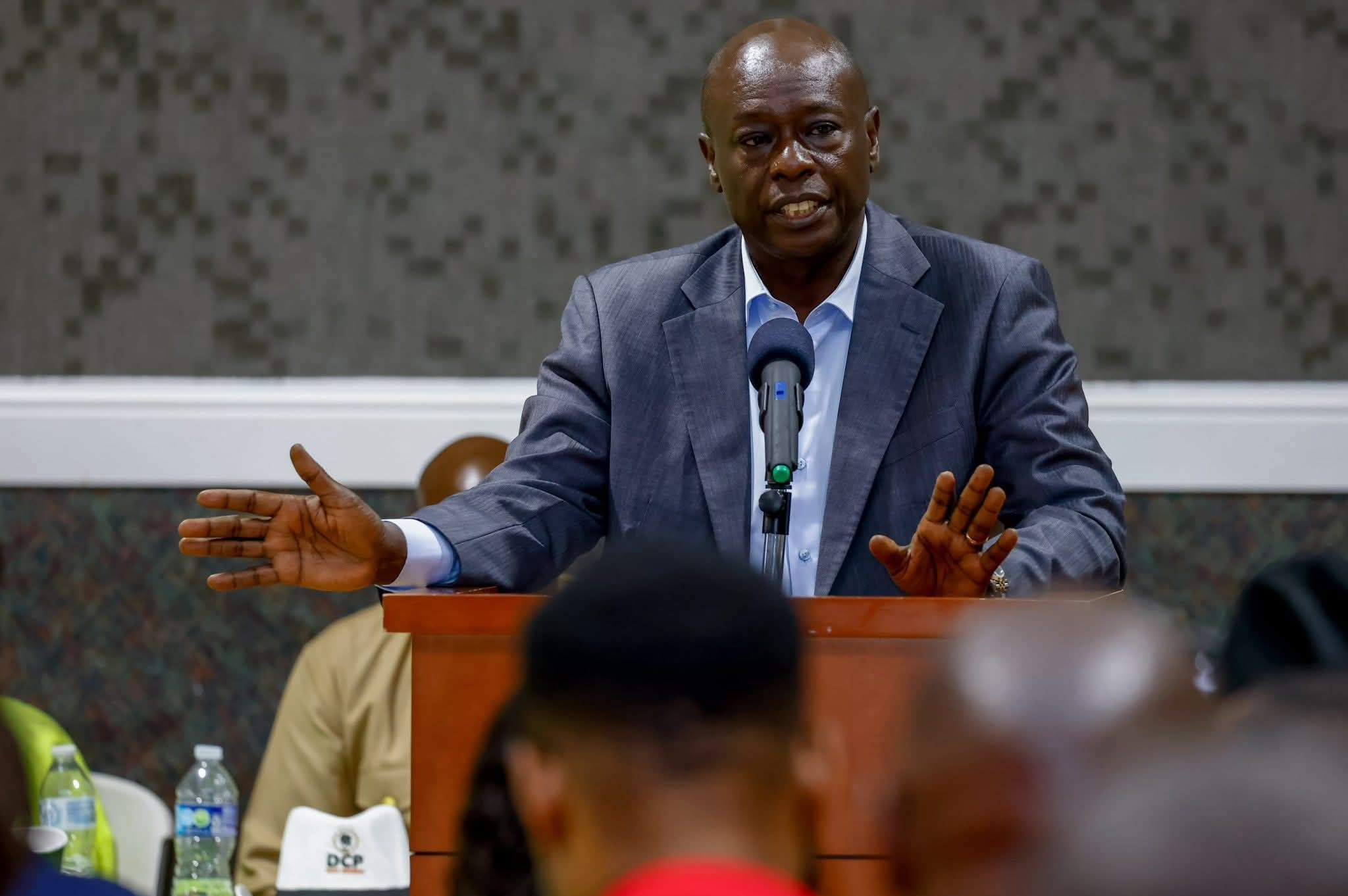

Eldas MP Adan Keynan calls for expansion of banking services in Northern Kenya

The MP emphasised the crucial role that financial institutions play in unlocking economic potential in marginalised areas, stating that they help foster innovation, resilience, and prosperity.

Eldas MP Adan Keynan has called on the government to urgently expand financial services in Northern Kenya, saying the lack of adequate banking infrastructure continues to hinder development in the region.

Speaking during a sitting of the National Assembly on Wednesday, the MP asked the Chairperson of the Departmental Committee on Finance and National Planning to explain what strategies are being taken to address the limited access to financial institutions across Northern Kenya.

“There has been a shortage of adequate banking and financial institutions in Northern Kenya. This shortage has negatively affected the residents, who are predominantly dependent on pastoralism, trade, and informal micro-enterprises,” he said.

The MP emphasised the crucial role that financial institutions play in unlocking economic potential in marginalised areas, stating that they help foster innovation, resilience, and prosperity.

“Financial institutions serve as engines of economic development. Expanding banking infrastructure, both physical and digital, is essential to transition households from subsistence to stability,” the Jubilee MP stated.

Adan said that for inclusive growth to take root, financial services must be tailored to the unique lifestyles and challenges of pastoralist communities. He pressed the government to develop banking solutions that are responsive to insecurity, poor infrastructure, and nomadic livelihoods.

"What are the plans that the Government is putting in place to ensure that financial institutions model their services to a nomadic lifestyle, address insecurity and infrastructural challenges being faced by the pastoralist communities of Northern Kenya?" he asked.

The legislator further urged the development of a clear framework to encourage both traditional banks and fintech players to reach underserved populations, especially by making credit more accessible and affordable.

“We must ensure that the financial divide is bridged by partnering with government agencies, non-governmental organisations, and the private sector,” he added.

He also requested a detailed report on plans to boost both the physical and digital reach of financial services in the region, alongside targeted financial literacy programmes.

"What measures have you put in place to ensure financial literacy programmes targeting women, youth, and persons with disabilities, and what incentives do you have to promote access to affordable credit?" he asked.

The Committee on Finance and National Planning is expected to issue a formal response within two weeks.

Top Stories Today