Samburu women boost economic prospects through savings and loan model

As a Form 2 dropout, Akai believes that empowerment through the groups has also advanced girl child education.

Amid the ongoing marginalisation of women in pastoralist communities due to entrenched cultural practices, a group of women from Suguta Marmar in Samburu County is gradually breaking through barriers.

Their progress is driven by a financing model that enables them to save, access loans, and secure emergency insurance, fostering economic empowerment.

More To Read

- Digital experts sound alarm as tech-facilitated GBV continues to target Kenyan women

- 16 days global campaign spotlights growing threat of gender-based violence

- North Eastern Commissioner urges multi-sectoral cooperation to bolster regional security

- UN warns AI, anonymity fuel violence against women online

- Ending violence against women ‘a matter of dignity, equality and human rights’

- Gender CS Cheptumo calls for collective action against teenage pregnancies

Jackline Lelegwe, a mother of two who was married off during her primary school years, is now pleased to have a source of income.

Growing up in a community that largely disregards girls' education, Lelegwe was thrilled to have had the opportunity to attend school, even if briefly, alongside her two brothers.

Due to the belief that married women depart for their husbands' homes and may not assist their parents, girls rarely receive an education.

"Out of seven children, only three of us went to school. Regrettably, my marriage prevented me from finishing my studies. I could not question the decision that was detrimental to my life," Lelegwe told the Eastleigh Voice.

Disregarding their education makes many girls vulnerable to early marriages and gender-based violence, making it challenging for them to realise their full potential.

Her life didn't change until 2021, when she learnt about the Village Savings and Loaning Association.

"I solely relied on my husband for every need as I undertook domestic chores as well as herding goats," she recalled.

Lelegwe launched a beadwork business with Sh5,000 in capital after receiving training from Stella Akai, with partial support from her husband. Akai has trained and helped in the formation of over 40 VSLA groups in the county.

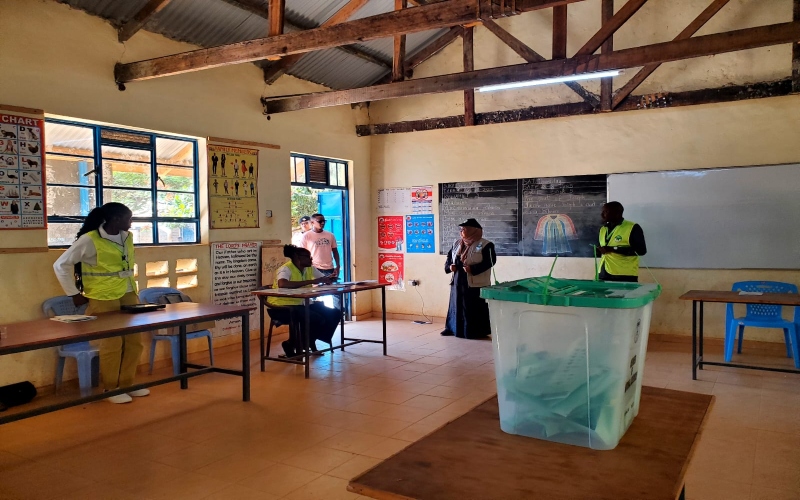

Samburu women at a past event. (Photo: Handout)

Samburu women at a past event. (Photo: Handout)Samburu women at a past event. (Photo: Handout)

"I used to sell bead products at local markets before I later opened an agrovet where local farmers could access a range of inputs. I also do home deliveries," she said, adding that she makes at least Sh20, 000 monthly from the business and the sale of milk from her dairy cow.

Raisa Lekuraiyo, from the Ngusoro area, is also a beneficiary of the microfinance model, which provides people from poor and vulnerable families with access to financial services that are otherwise hard to come by in remote areas, much like Lelegwe.

"It has helped inculcate a saving culture in us and enabled us to access loans to start income-generating projects for economic empowerment," she said.

She admits that initially her husband, Francis, was initially hesitant to support the idea but eventually embraced it after witnessing its benefits.

During last year's shareout, Lekuraiyo received Sh30,000, which she invested in the goat business she co-owns with her husband.

"We lost more than 300 goats during the recent drought, but I am happy VSLA is helping us build our resilience."

Stella Akai said the microfinance model has been instrumental in helping women achieve self-reliance and financial independence. As a Form 2 dropout, Akai believes that empowerment through the groups has also advanced girl child education.

"The groups are committed to protecting girls from female genital mutilation and early marriages while ensuring they attend school and pursue their dreams, just like boys," she said.

"Domestic violence has drastically reduced as women are now contributing to family needs, including paying school fees for their children, something that men have come to appreciate," Akai, a renowned Village Savings and Loan Associations (VSLA) trainer, added.

Last year, 24 groups collectively saved Sh21 million.

Akai revealed that the pioneer groups began by saving Sh50 and contributing Sh20 to a social fund on a weekly basis, progressively increasing these amounts based on individual capabilities.

The World Food Programme supported the capacity-building sessions that prepared the women to participate in group savings.

Top Stories Today