Police medical insurance renewed as Sh1.2 billion hospital remains unused

Awarded to APA Insurance and a joint venture partner, the one-year medical cover runs from April 1, 2025, to March 31, 2026.

Police officers will continue relying on private medical insurance after the National Police Service quietly renewed a lucrative contract, despite leaving a fully equipped police hospital in Nairobi unused and owing nearly Sh834 million to the contractor.

Awarded to APA Insurance and a joint venture partner, the one-year medical cover runs from April 1, 2025, to March 31, 2026. This is according to a memo dated April 11, 2025, from Apeles Chacha, issued on behalf of the Nairobi regional police commander to all sectional heads.

More To Read

- Reports urge mindset shift, collaboration for effective community policing in Kenya

- IG reshuffles top police ranks as six senior officers moved

- Senators order agencies to reconcile records on injured police officers’ claims amid conflicting figures

- Reprieve for Garissa police as Sh227 million stalled housing project resumes

- Senate orders insurers to compensate injured police officers within 14 days

- Government seeks out-of-court deal to end police recruitment stalemate

“You are required to inform officers that NPS has renewed the medical insurance contract with APA and a joint venture with effect from April 1, 2025, to March 31, 2026,” the memo reads in part as quoted by Nation.

The memo was circulated to all sub-county police commanders in Nairobi, as well as officers in charge of law courts and depots.

But even as the new cover takes effect, questions persist over the government’s failure to operationalise a Sh1.23 billion, fully furnished, 150-bed level 4 police hospital at Mbagathi, Nairobi. The facility remains idle as the National Police Service has only paid Sh400 million to the contractor, leaving a balance of Sh833.63 million.

The hospital was built to reduce the government’s reliance on costly private insurance schemes, while also improving access to specialised healthcare for police officers and their families.

According to the Auditor General’s 2023/2024 report, the hospital construction and equipping, supervised by the Kenya Defence Forces (KDF), was completed during the 2022/2023 financial year. However, the value for money remains unrealised due to delayed payments and a lack of operationalisation.

“Value for money spent on the project has not been realised,” the Auditor-General, Nancy Gathungu said in her report.

KDF, which oversaw the project, has insisted it will not hand over the facility to the police until the full amount is paid.

Although the memo does not indicate the value of the newly awarded insurance contract, Chacha noted, “The benefit cover provided under this renewed contract remains the same.”

This suggests the value could be similar to the Sh6.7 billion the government paid to the now-defunct National Hospital Insurance Fund (NHIF) for a year-long police cover between January 1 and December 31, 2023.

“To ensure accurate record keeping, officers are encouraged to update the list of their beneficiaries before April 30, 2025. Kindly inform all officers under your command,” Chacha said.

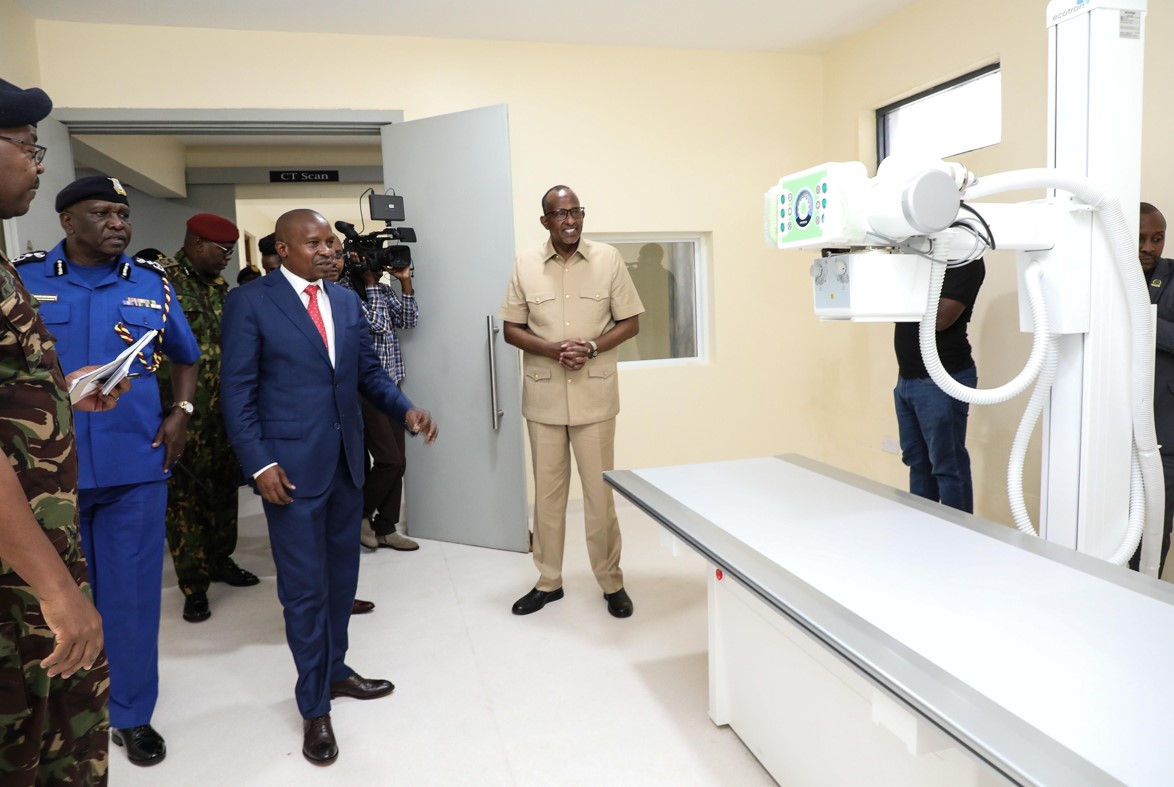

Deputy President Kithure Kindiki and Health CS Aden Duale during the hand over of the National Police Service Hospital Level Four Hospital in Mbagathi, Nairobi on May 17, 2024. (Photo: MINA)

Deputy President Kithure Kindiki and Health CS Aden Duale during the hand over of the National Police Service Hospital Level Four Hospital in Mbagathi, Nairobi on May 17, 2024. (Photo: MINA)

The instruction has sparked concern that children born or spouses married after April 30 may not be eligible for coverage under the new policy.

Multiple irregularities

The Auditor-General also flagged multiple irregularities in how the police medical insurance scheme and related benefit covers were managed in the previous financial year.

In her audit, Gathungu questioned the Sh6.3 billion spent on Group Life, Work Injury Benefits (Wiba), and Group Personal Accident (GPA) insurance covers. Of that, Sh5.1 billion covered police officers between January and December 2023, before the contract was extended by three months to March 2024 at an additional cost of Sh1.3 billion, bringing the total to Sh6.4 billion.

The medical insurance contract with NHIF was also extended by three months, from January to March 2024, at a cost of Sh2.2 billion, pushing the total cost of police medical cover for that period to Sh10.9 billion.

“However, review of insurance records revealed anomalies,” reads the audit, adding that some officers and their dependents may have missed out on rightful benefits.

Specifically, the audit highlighted; Unpaid GPA claims noting, “As at the time of the audit, the insurer had not settled 262 unpaid GPA claims despite having been notified.”

It also revealed delayed group life payments: “As at the time of the audit, the insurer had not paid 21 claims worth Sh43.5 million in respect of group life sum assured,” the report states. This violated contract terms that require payment within five days after notification and submission of necessary documents.

Clause 2.3.1 of the contract provides that upon a member’s death, their declared next of kin should receive a lump sum equivalent to five years of their annual basic salary.

The audit further shows that the insurer had not compensated 509 Wiba claims and two Wiba-related deaths at the time of review. According to the contract, such claims are supposed to be compensated based on a maximum of 10 years of gross salary in the event of death or permanent disability arising from work-related injuries.

The contract also specifies that temporary disablement should be compensated through monthly payments equivalent to the officer’s salary for a maximum of 12 months.

Despite these provisions, the Auditor General concluded that critical benefits were delayed or denied, raising concerns about whether the multibillion-shilling insurance arrangements truly serve their intended purpose or merely drain public funds.

Meanwhile, the Sh1.23 billion police hospital, intended to cut down these very costs, continues to gather dust in Mbagathi.

Top Stories Today