IMF to begin review Egypt's loan programme on Tuesday

By Reuters |

Egypt had requested financing under the RSF since 2022, with hopes it could unlock up to an additional US$1 billion.

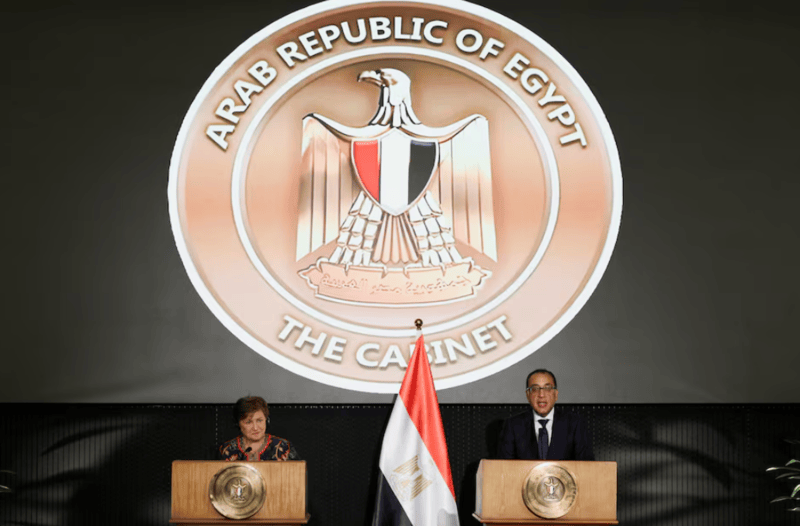

The International Monetary Fund will begin its review of Egypt's loan programme on Tuesday, Egyptian Prime Minister Mostafa Madbouly said on Sunday at a press conference with IMF managing director Kristalina Georgieva.

The review, which could unlock more than $1.2 billion in financing, is the fourth under Egypt's latest 46-month IMF loan programme that was approved in 2022 and expanded to $8 billion this year after an economic crisis marked by high inflation and severe foreign currency shortages.

Keep reading

- Thousands of refugee children in Egypt left out of school, HRW reports

- IMF cautions Kenya’s financial stability amid plans for Sh194 billion UAE loan

- Exclusive: Kenya in talks for fresh Sh112.8bn loan from World Bank, AfDB, says official

- Senegal's president faces budget challenge after likely parliamentary win

Madbouly emphasised the mutual cooperation with the IMF, adding that Egypt "expects continued successful and fruitful partnership in the coming period".

Georgieva also praised the fund's cooperation with Egypt and highlighted the current global challenges.

She noted that the IMF's discussions with Egypt next week will also look into ways of supporting the Egyptian objectives in the area of greening the economy and Egypt's access to the Resilience and Sustainability Facility in the pursuit of this effort.

Egypt had requested financing under the RSF since 2022, with hopes it could unlock up to an additional US$1 billion.

Egyptian President Abdel Fattah al-Sisi has recently cautioned that Egypt may need to reassess its expanded loan programme if international institutions do not factor in the exceptional challenges the region currently faces.

Madbouly later said that talks with the IMF during the fund's annual meetings in October did not include additional financing but aimed to reassess Egypt's commitments, targets, and timings.

When the IMF completed its third review in July, it said that inflationary pressures were gradually abating, foreign exchange shortages have been eliminated, and fiscal targets (including related to spending by large infrastructure projects) were met.

It also underscored the need for greater efforts to accelerate a programme of divestment of state-owned enterprises and carry out reforms to prevent them from using unfair competitive practices.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!