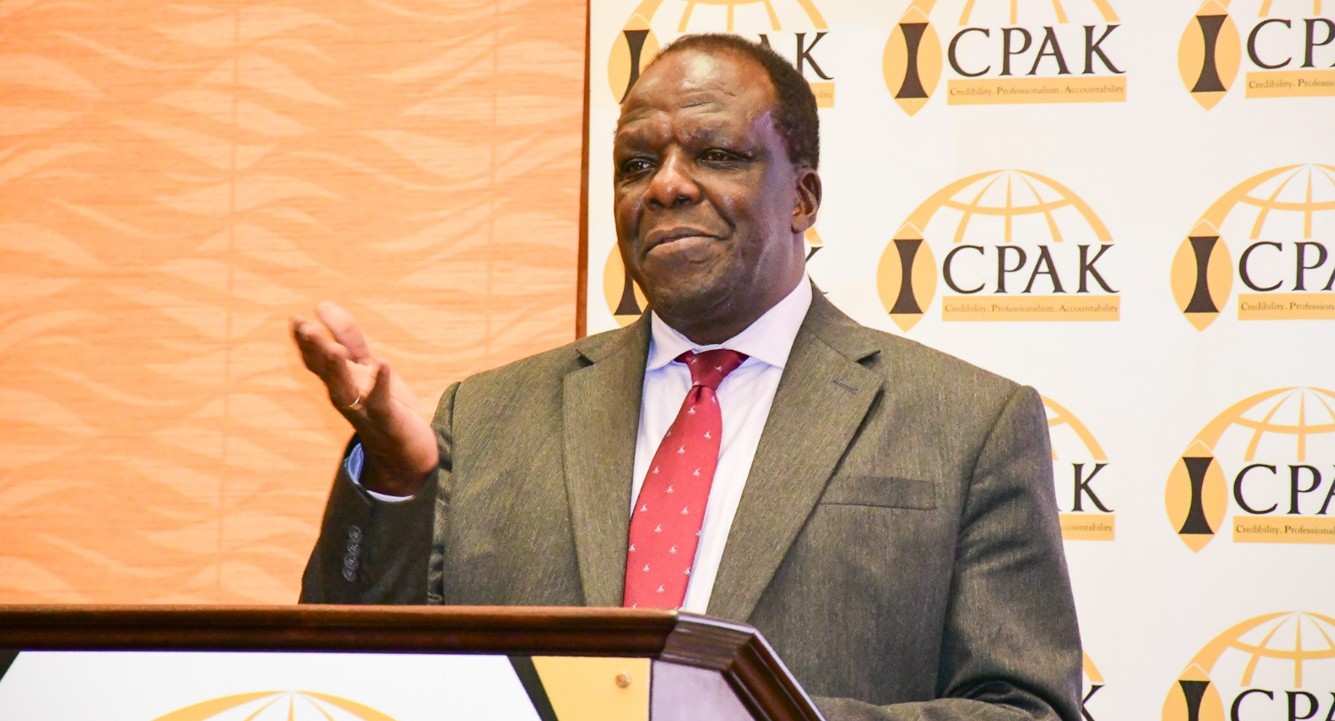

Oparanya suspends sacco registrations for 3 months as experts review governance laws

Oparanya announced that registration of new saccos will be paused for three months to allow a newly constituted committee of experts to undertake a review of existing sacco laws and policies.

Registration of new saccos has been suspended for three months pending recommendations from a newly formed committee of experts reviewing sacco governance and policy alignment.

Co-operatives Cabinet Secretary Wycliffe Oparanya said the suspension is part of broader reforms aimed at strengthening sacco management following recent scandals.

More To Read

- MSME census set to provide fresh data for targeted support, says Oparanya

- Oparanya faults counties for SACCO liquidity crisis, says non-remittance crippling operations

- Mismanagement of Co-operatives funds amid delayed audits sparks probe

- Mudavadi urges shift from harambees to cooperatives to shield economy from political shocks

- Corrupt coffee society leaders to lose properties, CS Wycliffe Oparanya warns

- Sh3 billion SACCO fraud exposes deep governance, regulatory gaps

Oparanya announced that registration of new saccos will be paused for three months to allow a newly constituted committee of experts to undertake a review of existing sacco laws and policies.

“This suspension will give the committee adequate time to evaluate existing legislation and propose reforms that enhance the operational efficiency of saccos,” Oparanya said.

The five-member committee, chaired by Marlene Shiels, the CEO of Capital Credit Union in Scotland, has been tasked with reviewing the Sacco Societies Act of 2008.

Other members of the committee are Maurice Smith of the African American Credit Union Coalition (USA), Gina Carter, a former partner who retired from the law firm Husch Blackwell earlier this year and board member of Redwood Credit Union (USA), Kenyan constitutional law expert Counsel Odhiambo Collins Harrison, and Gamaliel Hassan, CEO of Stima DT Sacco.

Supporting the committee is a technical team led by Morris Muriungi and John Ongatta.

Their broader mandate includes aligning the Sacco Societies Act with Cabinet-approved policy frameworks. These include proposals to establish a central liquidity facility for saccos — similar to the interbank safety nets used by commercial banks — a deposit guarantee fund to safeguard members’ savings, and improved regulation for shared services within the saccos ecosystem.

“These reforms aim to build a sustainable future for over 14 million sacco members. We believe in the transformative power of cooperatives, and that starts with strong governance and policy alignment,” Oparanya said.

KUSCCO transition board

Alongside the legal review committee, the ministry also inaugurated a new 11-member transition board for the Kenya Union of Savings and Credit Cooperatives (KUSCCO), which will serve for two years. This replaces the previous interim board, whose one-year term ended on May 1, 2025.

The new board has been tasked with restructuring KUSCCO to improve governance, recover assets, and oversee its transformation into a national cooperative federation.

“This board will guide KUSCCO into becoming a modern and efficient cooperative apex body. It must work to protect members’ interests, recover assets, and ensure accountability,” the CS said.

The board is chaired by David Mategwa of the Kenya National Police Sacco, with Mhasibu’s Jennifer Mburu serving as vice chair.

Other members include Brenda Obondo (Kenya Medical Association Sacco), Robert Njue (WINAS), Osmane Khatolwa (Stima DT Sacco), John Ziro (Imarika DT SACCO), Philip Rirei (Noble), Michael Muriithi (Unaitas), Priscilla Maranga (Office of the Commissioner), Mary Kweyu (Invest and Grow), and Charles Kioko (Geothermal Development Company).

“These reforms are part of a wider strategy to full-proof the country’s cooperative movement amid recent controversies,” Oparanya said.

“On behalf of the Ministry, I congratulate the newly inaugurated Committee of Experts and KUSCCO Board Members. We look forward to their leadership in implementing reforms that benefit millions of sacco members across Kenya.”

Troubling practices

The overhaul follows recent inspections by the Ministry and KUSCCO’s interim board, which revealed troubling practices, including the exaggeration of dividend declarations—a key indicator of mismanagement.

Commissioner of Co-operatives David K. K. Obonyo disclosed that these findings prompted new regulatory proposals to ensure saccos remain focused on their core mandates—mobilising deposits and issuing loans.

“The exaggeration of dividends is one of the major financial irregularities affecting saccos. We are working to regulate sacco investments to ensure they align with their primary functions,” Obonyo said.

The ministry’s ongoing reform agenda is closely linked to the Co-operative Societies Bill of 2024, which is currently under review in the Senate. The Bill, along with the new appointments and policy changes, marks a turning point in the government’s effort to modernise and stabilise Kenya’s cooperative sector.

“We are committed to fostering inclusive financial systems rooted in sound cooperative structures. This journey begins with firm governance, policy clarity, and a shared vision for transformation,” Oparanya said.

Top Stories Today