Why decision nullifying Finance Act 2023 should be overturned- State

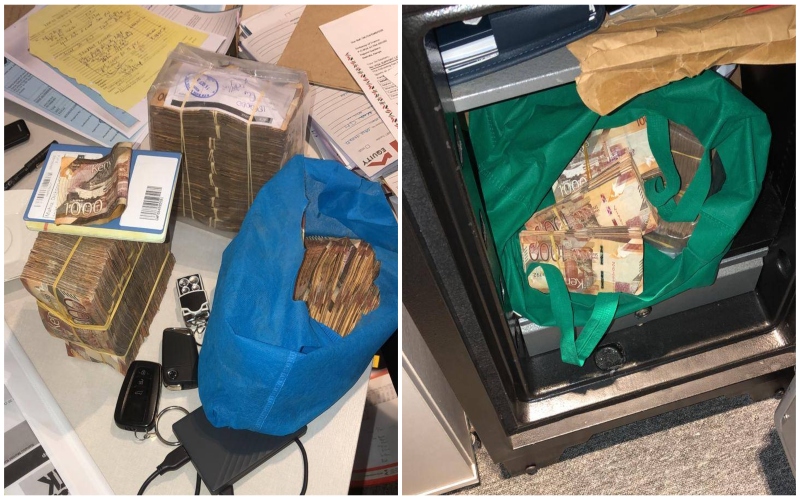

An affidavit from former Treasury CS Njuguna Ndung’u was presented to the court, highlighting that the government stood to lose Sh211 billion following the Act's nullification.

The government has urged the Supreme Court to overturn the Court of Appeal's decision to nullify the Finance Act 2023, warning that the ruling has severely impacted service delivery and threatens the country's financial stability.

Represented by a team of top lawyers, including Prof. Githu Muigai, Paul Nyamodi, and Kiragu Kimani, the Treasury and Attorney General argued that without the Act, the government risks defaulting on debts, halting essential services, and failing to pay public officers.

More To Read

- From colonial cells to court reforms: A walk through Kenya’s Judiciary Museum preserving legal, freedom struggles

- Judiciary rolls out staff census in push for data-driven reforms

- Supreme Court to begin year-end recess on December 21

- High Court sides with DPP, quashes Magistrate's ruling in Sh112 million fraud case

- Court dismisses petition on alleged discrimination in appellate appointments

- Justice Isaac Lenaola issues demand letter to Captain Kung’u Muigai over bribery allegations

The legal team emphasised that the loss of Sh211 billion in revenue due to the invalidation would have long-term consequences, including worsening the country's sovereign debt rating.

“The primary function of the government is to deliver services to its citizens, but this becomes impossible in the absence of enabling legislation,” the lawyers decried.

An affidavit from former Treasury CS Njuguna Ndung’u was presented to the court, highlighting that the government stood to lose Sh211 billion following the Act's nullification.

“These funds cannot be recovered from taxpayers,” read the affidavit.

Prof. Muigai noted the potential harm of a government default on its debt obligations, stating, “Failure to raise adequate revenue through taxation could result in a default on government debts, which would immediately damage Kenya’s sovereign debt rating.”

He added that a downgrade in the country’s rating would increase the cost of borrowing on the international market, subsequently raising the cost of servicing foreign debts.

Nyamodi further informed the court that the Sh211 billion revenue shortfall could halt essential services, including the disbursement of Sh10 billion in loans from the Higher Education Loans Board (HELB), the provision of Sh4 billion for free primary education, as well as funds for critical illness programs and pension payouts.

Additionally, advocate Issa Mansour, representing the National Assembly and its Speaker, defended the public participation process that preceded the Act’s passage.

He noted that over 1,000 memoranda were submitted, with 300 representations made, and each proposal was carefully considered by Parliament.

“The appellate court had a duty to evaluate how many of these proposals were accepted or rejected,” Mansour argued.

He insisted that the Court of Appeal erred in its judgment by not taking this into account.

He maintained that Parliament is not obligated to provide reasons for accepting or rejecting public proposals during the legislative process, as no such requirement exists.

Kenya Revenue Authority (KRA), represented by advocate Gaya Ochieng, warned of the far-reaching economic implications of the nullification.

"The blanket declaration of unconstitutionality by the Court of Appeal is excessive. Systems like electronic tax invoice management systems (eTIMS) were implemented to enhance tax compliance and combat fraud,” Ochieng said.

The hearing follows the Supreme Court’s earlier suspension of the Court of Appeal’s decision to invalidate the Finance Act, pending the outcome of the appeal.

The nullification had posed a significant challenge to the national treasury’s ability to raise revenue, coming only months after the government faced a Sh346 billion shortfall due to the rejection of the Finance Bill 2024 following widespread protests in July.

Should the Supreme Court uphold the nullification, the government has urged the court to issue orders that would allow continued public service delivery while enabling the government to rectify any issues in subsequent amendments to the Act.

The hearings are set to continue on Wednesday, September 11, 2024.

Top Stories Today