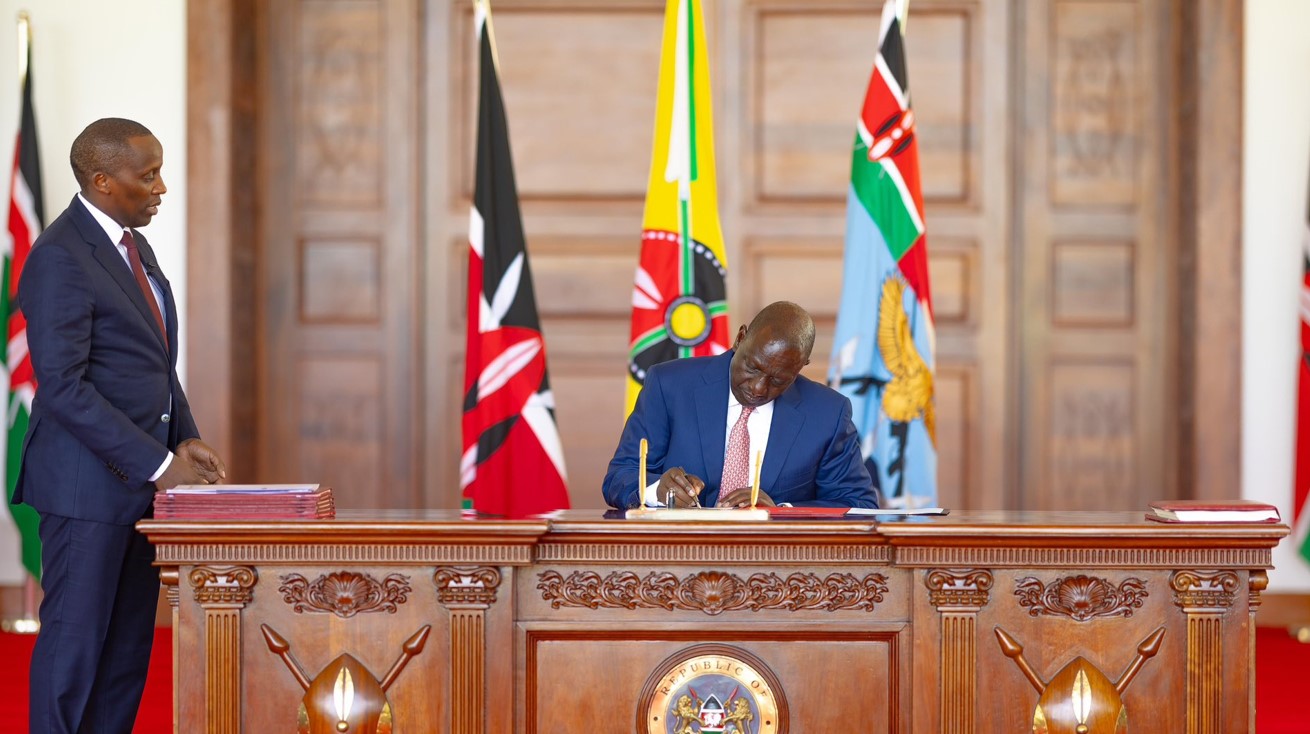

President Ruto assents to bill removing excise duty on imported transformers

The Kenya Power and Lighting Company (KPLC) will also be able to procure more transformers within its existing budget, thereby ensuring a consistent power supply while reducing the frequency and impact of outages.

President William Ruto has signed into law the Excise Duty (Amendment) Bill, 2025, effectively removing the 25 per cent tax on imported, fully assembled electric transformers and their parts — a move expected to lower electricity connection costs for consumers.

The Bill, which amends the Excise Duty Act, CAP 472, aims to make transformer infrastructure more affordable, enhance power connectivity, and reduce electricity tariffs by easing the cost burden of transformer imports and replacements.

More To Read

- Auditor General flags Kenya Power for missing 30 per cent tender quota for youth, women, and PWDs

- Kenya’s electricity demand hits all-time high of 2,439 MW, straining power generation capacity

- Kindiki unveils Sh1 billion plan to power 6,100 Marsabit homes

- How Trump–Ruto health deal fills the void left after USAID exit

- UNAIDS hails Kenya–US health framework as major boost for HIV response

- Kenya, US sign Sh208 billion health cooperation deal to transform to strengthen primary care, services

“This measure is expected to lower electricity connection costs for consumers by reducing the price of transformers, as every connection relies on transformer infrastructure. It will also help bring down electricity tariffs by cutting transformer replacement costs,” the Bill states.

The Kenya Power and Lighting Company (KPLC) will also be able to procure more transformers within its existing budget, thereby ensuring a consistent power supply while reducing the frequency and impact of outages.

The excise duty had initially been introduced through the Tax Laws (Amendment) Act, 2024, with the aim of supporting local assemblers. However, its effect proved counterproductive.

“The amendment has hurt the manufacture and supply of transformers by increasing the cost of importing parts,” the Bill notes.

“It is intended that this amendment will reduce the cost of electricity and enhance power connectivity through the increased manufacture and supply of transformers to the Kenya Power and Lighting Company.”

The MPs also anticipate that lifting the duty will attract more investment in the energy sector, enabling KPLC to expand its network with additional transformers and thereby improve electricity distribution across the country.

A statement from Parliament further underscored this expectation. “If enacted, this amendment is expected to lower electricity costs and improve power connectivity by facilitating increased manufacturing and supply of transformers to the KPLC.”

The timing of the President’s assent is critical, coming amid an ongoing transformer shortage that has stalled new connections. In April 2025, KPLC initiated an emergency procurement process to acquire 3,319 transformers within a 14-day window.

In addition to transformers, the Tax Laws (Amendment) Act, 2024, had also introduced excise duty on a range of imported goods, including: imported printing ink (excluding those originating from East African Community (EAC) member states that meet the Rules of Origin criteria), ceramic sanitary ware (5 per cent), polished glass (35 per cent of the customs value), coal (2.5 per cent), and certain types of polymers — including saturated polyester, vinyl acetate polymers, and styrene acrylic emulsions — which were subjected to a 20 per cent tax on their customs value.

With the new law in place, stakeholders in the electricity sector are expected to be among the biggest beneficiaries, as the tax relief makes essential components of power distribution more accessible, paving the way for faster installations and improved electricity access throughout Kenya.

Top Stories Today