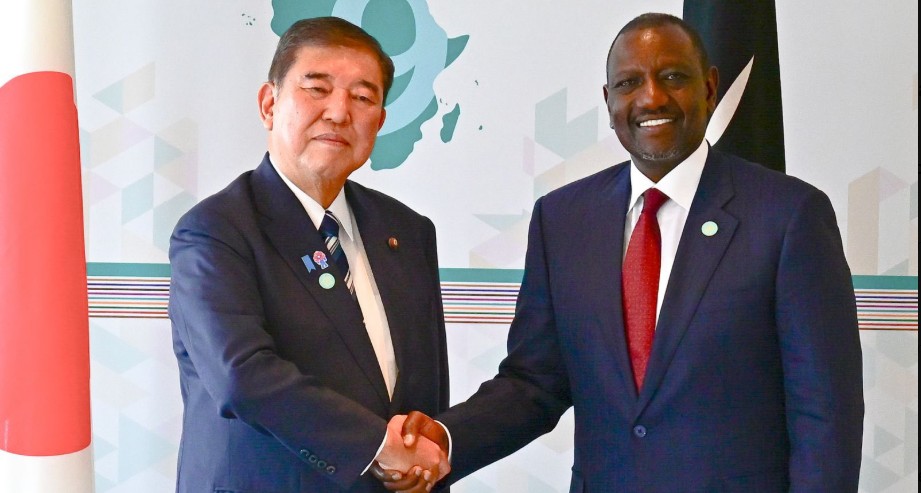

Kenya and Japan sign yen-denominated loan deal to boost development, cut borrowing costs

According to Reuters, while the loan’s pricing and terms were not disclosed, the deal builds on a February 2024 agreement between Kenya and NEXI to deepen financial cooperation.

Kenya and Japan on Wednesday signed a yen-denominated loan agreement during the Tokyo International Conference on African Development (TICAD) summit in Yokohama.

The facility is intended to support Nairobi’s development projects while lowering borrowing costs through insurance provided by Japan’s Nippon Export and Investment Insurance (NEXI).

More To Read

- President Ruto courts Japan, seeks balance in uneven trade

- Kenya and Uganda sign 8 new MoUs to boost trade, infrastructure and regional integration

- Extreme weather affects mental health: What vulnerable women in Kenya told us

- Japan sets new internet speed record at 1.02 petabits/second

- Kenya seals Sh258 billion de-risking deal, healthcare, infrastructure MoUs at UK investment forum

- 25 youths join IGAD’s inaugural leadership training cohort

According to Reuters, the specific pricing and terms of the loan were not disclosed. However, the deal builds on a February 2024 agreement between Kenya and NEXI aimed at strengthening financial cooperation.

NEXI’s guarantee is expected to reduce investment risks, thereby making sovereign borrowing more affordable.

“Japan is the third largest source of official development assistance to Kenya, having provided our country with more than $5 billion (Sh650 billion) in the past 60 years of our strong and mutually beneficial relationship,” President Ruto said in a statement on X after the signing.

At the summit, President Ruto also announced that Kenya’s economy is projected to grow by 5.6 per cent this year, up from 4.7 per cent in 2023. The forecast surpasses earlier projections of 5.3 per cent by the Treasury and 5.2 per cent by the Central Bank.

“GDP is expected to grow 5.6 per cent this year, despite global domestic headwinds arising from escalating tariffs and trade disruptions affecting many economies,” Ruto told the conference.

In a subsequent statement on X, President Ruto invited Japanese investors to take advantage of Kenya’s stable economic outlook, major infrastructure projects, and ongoing investment-friendly reforms.

Kenya has increasingly sought diversified funding sources to sustain infrastructure and development projects amid global uncertainties.

“120 Japanese companies have invested in Kenya, leveraging on our strategic location, the gateway to Eastern Africa and indeed the entire continent, expanding infrastructure and fibre optic network, and vibrant financial and capital markets,” Ruto noted.

“As Kenya’s economy expands and grows, our country offers many opportunities for the private sector in Japan, including digitisation, provision of medical equipment for our universal health coverage, precision farming, e-vehicle manufacturing and green energy industrialisation, among others.”

Top Stories Today