Kenya faces more debt pressure as Ruto plans to borrow Sh1tr to fund budget

Ideally, the government opts for borrowing, both externally and internally, to cater to the fiscal gap in every financial year.

President William Ruto has announced that his administration will have to borrow close to Sh1 trillion in the current 2024/25 Financial Year, a move that could pile more pressure on Kenya’s debt burden.

The new borrowing estimate is almost double the initial projection of Sh597 billion contained in the initial budget statement.

More To Read

- The impact of the recent Finance Bill on different sectors

- Parastatals’ unchecked borrowing fuelliing Sh2.9 billion debt, Auditor General warns

- Kenyan shilling holds steady at 129 against the dollar for a year

- Nyoro warns Sh44.8 billion Talanta loan could cost Kenyans over Sh100 billion

- Debt financing dominates East Africa’s private capital transactions in Q2 - report

- World Bank assures Kenya’s debt sustainable if properly managed

Speaking during a roundtable TV interview on Sunday, Ruto said the government had found itself between a rock and a hard place following the withdrawal of the Finance Bill 2024 that sought to raise additional revenue of Sh346 billion.

He regretted that Kenya now has to borrow more, which will mean further debt pressure.

“If we want to become a better economy, then we must have a prudent debt environment, and to manage the current debt while at the same time managing our expenditures, there are only two ways we can go; increasing our taxes or borrowing. It's unfortunate we have to resort to borrowing now that the additional tax route is no more,” Ruto said

The National Treasury had budgeted to borrow Sh333.8 billion externally and Sh263.2 billion domestically to cater for the Sh597 deficit. These figures are, however, likely to double once the president’s announcement comes into effect.

Economist Ken Gichinga of Mentoria Consulting told The Eastleigh Voice that this will have a substantive effect on the country’s fiscal environment in terms of debt, effectively breaching the statutory debt ceiling of Sh10 trillion which was set in June 2022 for the 2022/2023 financial year.

Kenya has been grappling with a high debt burden in the past decade, hitting a high of Sh11.1 trillion in December last year.

Year-on-year from December 2021 to December 2023, the debt has risen by about 36 per cent from Sh8.2 trillion to Sh11.1 trillion, on the back of increasing interest charges on both external and internal loans.

The latest data by the Kenya National Bureau of Statistics (KNBS) shows the external debt service charge as a percentage of GDP at prevailing market prices has been on the rise since 2019, increasing from 2.2 per cent then, to 5.6 per cent in 2023.

“Borrowing from the external market now is even much costlier compared to years back, thus the only scenario we will be looking at is more debt pressure,” Gichinga said.

He added that the forex exchange volatility will also add to the burden of high interest rates on external loans which are dollar-denominated, as the shilling continues to rally below the pre-2020 high against the US dollar.

President Ruto also reckoned that a huge chunk of the taxes collected every year has been going into debt servicing, specifically the interest charges.

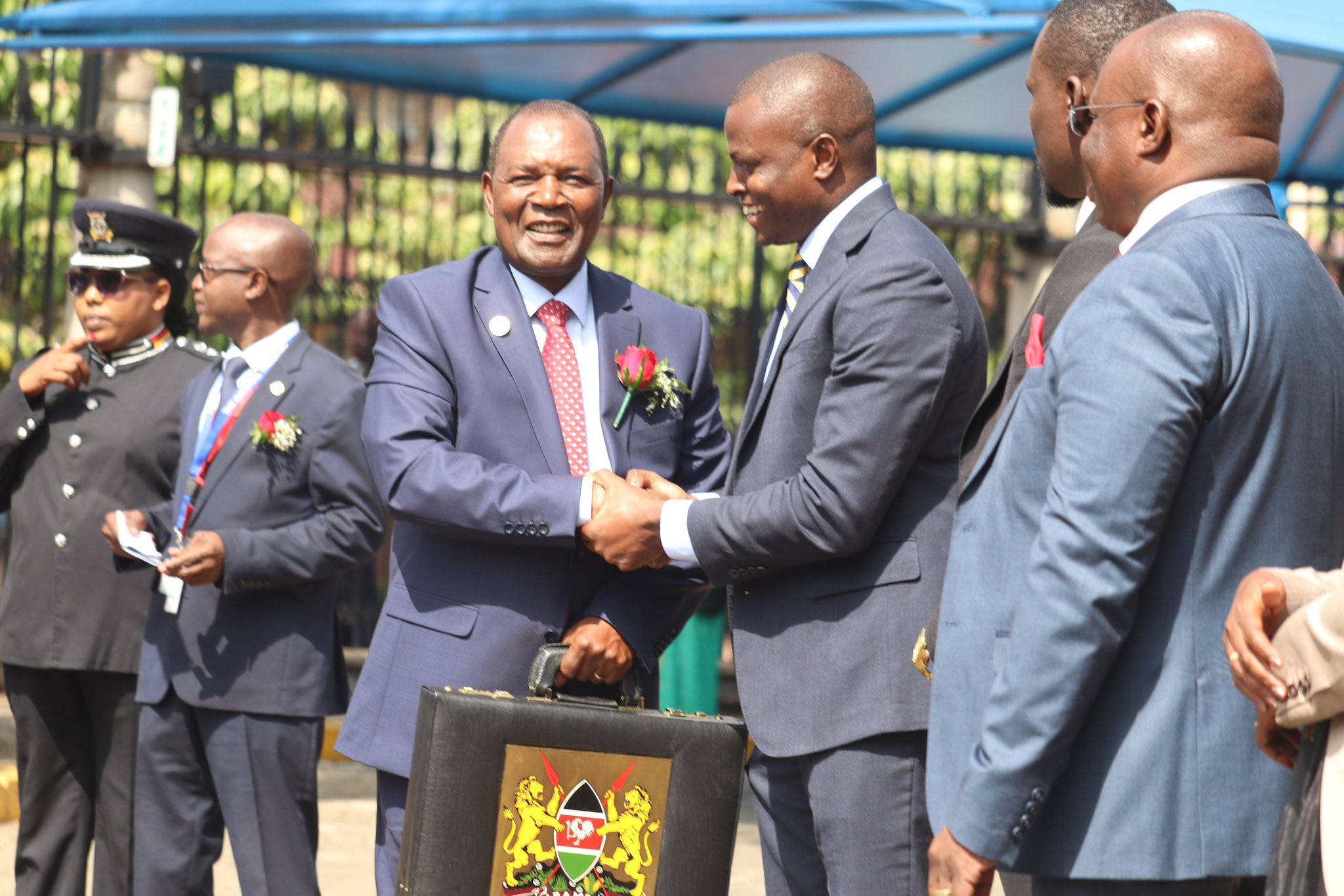

Treasury CS Njuguna Ndung'ú received by the Chair of the Budget & Appropriations Committee Ndindi Nyoro, Deputy Leader of Majority Owen Baya, Clerk of the National AssemblySamuel Njoroge, among other leaders during the budget presentation in June 2024. (Photo: Treasury)

Treasury CS Njuguna Ndung'ú received by the Chair of the Budget & Appropriations Committee Ndindi Nyoro, Deputy Leader of Majority Owen Baya, Clerk of the National AssemblySamuel Njoroge, among other leaders during the budget presentation in June 2024. (Photo: Treasury)Treasury CS Njuguna Ndung'ú received by the Chair of the Budget & Appropriations Committee Ndindi Nyoro, Deputy Leader of Majority Owen Baya, Clerk of the National Assembly Samuel Njoroge, among other leaders.

“Out of the Sh2.17 trillion we collected in 2023 for instance, about Sh1.3 trillion went to service debt,” Ruto said.

Early this year, he also decried the country’s debt burden, saying out of every Sh10 the taxman collects, Sh7 goes to debt servicing.

Even if the government resorts to more domestic borrowing, experts have warned of the historically high interest rates on domestic loans for the government, terming it bad for the economy.

“Heavy reliance on domestic private sector debt is likely to spur inequalities in tax, budget, and development policies in the country. Domestic loans now often come at higher interest rates compared to external concessional loans, and they mature faster, piling pressure on repayment obligations,” says Okoa Uchumi, a debt justice activist civil society initiative that seeks to ensure accountability in Kenya's public debt management.

It adds that the proceeds from the current taxation will mostly be used to service debt instead of funding vital public services. This means expenditures on pro-poor sectors such as health, education, agriculture, and social protection will be limited, denying a majority of citizens access to quality and affordable services.

The lobby group reiterates that private sector debt is costlier to finance, while the average interest rates on external loan commitments have been modest.

Domestically, interest rates for the 91-day T-bills, for instance, ranged between 15 and 16 per cent between 2023 and this year.

Days after the president withdrew the Finance Bill 2024, he assented to the Appropriations Bill 2024. He directed the Treasury to prepare supplementary estimates, reducing the country’s expenditure by Sh346 billion. The reduction will be shared equally between national and county governments, translating to almost a Sh173.35 billion hit on each level of government.

The signing of the spending Bill into law also meant the total revenue target for 2024/25 now stands at Sh3.059 trillion, down by about 10.17 percent.

On the other hand, the fiscal deficit for the year 2024/25 now grows by 52.54 per cent to Sh1.006 trillion, just about 6.07 per cent of the country’s GDP.

Ideally, the government opts for borrowing to cater to the fiscal gap in every financial year.

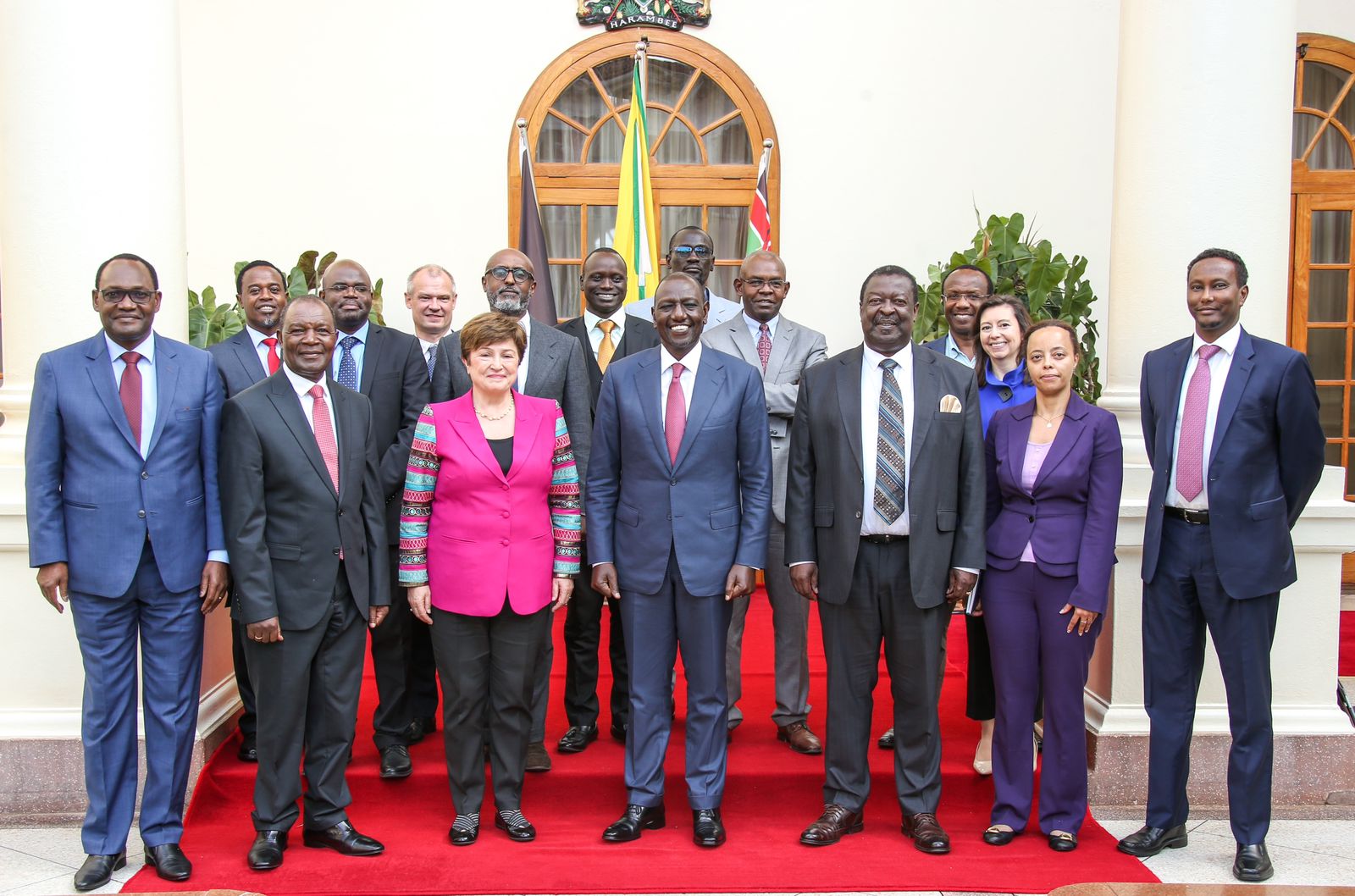

Considering the IMF programme target of a fiscal deficit of 4.0 per cent in 2024/25, this presents a challenge, especially now that the ongoing programme has its sunset date within 2024/25.

The country could thus be looking at possible adjustments to the $3.6 billion (Sh464.4 billion) programme, following the latest developments.

President William Ruto (centre), Prime Cabinet Secretary Musalia Mudavadi (third right) and Treasury CS Njuguna Ndung'u (second left) pose for a photo with the Managing Director of the International Monetary Fund (IMF) Kristalina Georgieva at State House, Nairobi in May 2023. (Photo: PCS)

President William Ruto (centre), Prime Cabinet Secretary Musalia Mudavadi (third right) and Treasury CS Njuguna Ndung'u (second left) pose for a photo with the Managing Director of the International Monetary Fund (IMF) Kristalina Georgieva at State House, Nairobi in May 2023. (Photo: PCS)President William Ruto (centre), Prime Cabinet Secretary Musalia Mudavadi (third right) and Treasury CS Njuguna Ndung'u (second left) pose for a photo with the Managing Director of the International Monetary Fund (IMF) Kristalina Georgieva at State House, Nairobi in May 2023. (Photo: PCS)

Top Stories Today