State eyes Sh70 billion in private funds for 2025/26 infrastructure projects

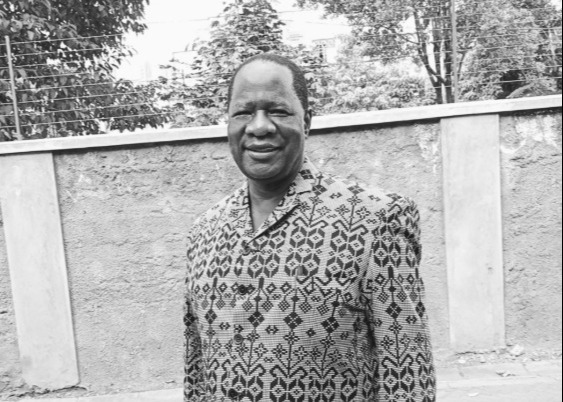

Treasury Cabinet Secretary John Mbadi on Thursday said the government has embraced PPPs to build roads, dams, electricity transmission lines and other critical infrastructure while reducing pressure on public debt.

Kenya is pushing forward with plans to raise Sh70 billion for infrastructure development in the upcoming financial year, through 32 new Public Private Partnership (PPP) projects. This follows the scrapping of previous deals with Adani Group that were criticised for a lack of transparency and value for money.

Treasury Cabinet Secretary John Mbadi on Thursday said the government has embraced PPPs to build roads, dams, electricity transmission lines and other critical infrastructure while reducing pressure on public debt.

More To Read

- Kenya deviates from debt plan, risks debt trap amid soaring interest payments – CoB

- State agencies owe Sh6 billion in unpaid statutory deductions, Treasury warns

- 1,420 public agencies now on government’s e-procurement platform

- Counties not against e-procurement, just need a functional system - CoG Chair Ahmed Abdullahi

- Angola’s TAAG Airline launches Nairobi flights as AirAsia exits Kenya

- Kenya losing over Sh600 billion in stalled public projects, says PMI

His comments came during the presentation of the 2025/26 budget, where he outlined the government’s shift in financing strategy.

“Currently, there are 32 PPP projects at various stages which are targeted to mobilise Sh70 billion in the Financial Year 2025/26 through private investments in priority sectors like energy, water, housing, health and transport,” Mbadi said.

This push comes after Kenya last year cancelled deals that had been awarded to Adani Group for the upgrade of Jomo Kenyatta International Airport (JKIA) and the construction of electricity transmission lines.

The cancellation followed sharp criticism over transparency and concerns about value for money. The government’s decision was also influenced by the indictment of Adani in the United States in November 2024.

Under the new plan, the Treasury had earlier outlined 33 projects at different stages of the PPP cycle, with 15 undergoing feasibility studies as of April and five at the proposal phase.

A key focus is on four major transmission lines worth $245.93 million (Sh31.8 billion), including the 220kV Kiambere–Maua–Isiolo, 220kV Kwale–Shimoni (Kibuyuni), 132kV Meru–Maua, and 132kV Kipevu–Mbaraki lines.

The projects also include several major dams, among them Ndarugu 2, Galana and Londiani, that are to be constructed through the PPP model. These are expected to boost water supply and support development in multiple regions.

The PPP approach allows private financiers to undertake projects and recoup their investments through mechanisms such as tolls, leases or long-term usage agreements.

It also aligns with calls from development partners, including the International Monetary Fund, for Kenya to adopt transparent and accountable financing frameworks amid rising debt levels caused by five years of increased borrowing.

The government is banking on this renewed model to fund infrastructure without relying heavily on loans or taxes, especially after controversy derailed previous plans involving Adani’s energy subsidiary.

Top Stories Today

Reader Comments

Trending