Government refutes claims of road levy securitisation, attributes fuel hikes to global prices

The Ministry of Energy and Petroleum said fuel prices are computed transparently based on global import costs and legally set tax structures.

The government has refuted claims that the recent fuel price hikes are linked to the securitisation of the road maintenance levy, maintaining that the increases are driven by higher international prices and tax adjustments.

In a statement on Wednesday, the Ministry of Energy and Petroleum said fuel prices are computed transparently based on global import costs and legally set tax structures.

More To Read

- Three-week drop in benchmark crude sets up Kenyans for further fuel price relief

- High Court blocks 10 per cent crude oil duty, slams government for bypassing public input

- Fuel prices remain unchanged in November EPRA review

- MPs reject plan to regulate cooking gas imports via open tender system

- Fuel prices remain unchanged across Kenya in latest EPRA monthly review

- EPRA shuts 12 filling stations for selling adulterated and export-bound fuel

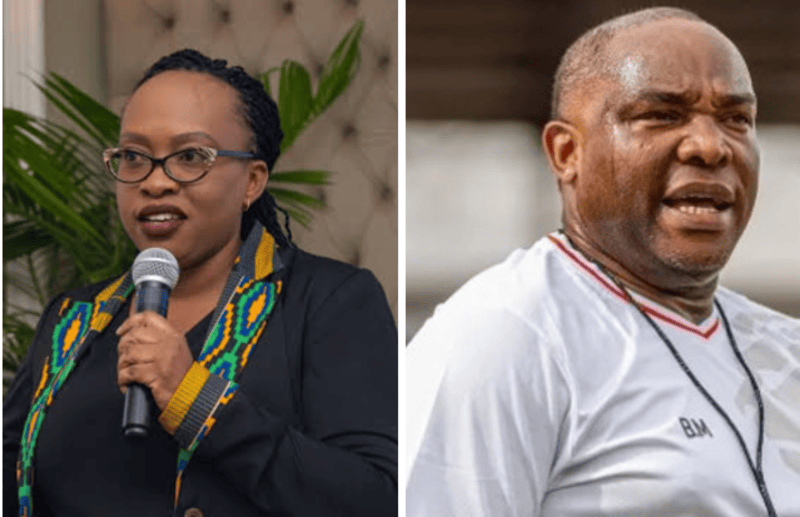

The Ministry’s response followed sharp criticism from Kiharu Member of Parliament Ndindi Nyoro, who accused the government of masking domestic failures behind global trends. Nyoro insisted that excessive domestic taxation and the securitisation of fuel levies are the real drivers of the fuel cost crisis.

“Global oil prices peaked last year, not this year,” Nyoro said, claiming that the government was using misleading narratives to justify high pump prices.

“Out of the total cost per litre, more than Sh80 for petrol and Sh76 for other fuels go directly into taxes and levies.”

In response, the Ministry explained that the computation of petroleum pump prices follows the Petroleum (Pricing) Regulations, 2022 (Legal Notice No. 192 of 2022), and considers four key cost components: the landed cost of imports, storage and distribution costs, gross margins, and applicable taxes and levies.

In the latest review covering July 15 to August 14, 2025, the Ministry noted that two cargoes of super petrol, two cargoes of diesel, and one cargo of jet fuel were considered. The shipments were then delivered between June 10 and July 9, 2025.

According to the Ministry, global prices referenced through S&P Global Platts showed notable increases between May and June 2025. Super petrol rose from $671.79 to $716.94 per metric tonne, diesel increased from $563.84 to $616.47, and kerosene prices rose from $598.43 to $647.20. It noted that this reflected percentage increases of 6.72 per cent, 9.33 per cent and 8.15 per cent, respectively.

Nyoro had also argued that for a country with domestic oil production, tax policy remains the most effective shield against volatile global fuel prices, yet this potential is being misused.

He further disclosed that in 2023, the government quietly imposed an additional Sh7 per litre levy at a time when global oil prices were dropping, effectively denying Kenyans the relief expected from falling international prices.

More alarmingly, Nyoro accused the government of secretly borrowing Sh175 billion against the fuel levy without parliamentary consent or public disclosure.

“This borrowing is not captured in official debt records, and Parliament was never consulted. That raises grave concerns about transparency, legality, and long-term fiscal sustainability,” he warned.

The legislator questioned the identities of the lenders, the interest rates involved, and the broader implications of such borrowing for Kenya’s future.

“We are essentially spending money today that belongs to future budgets. This undermines financial planning for coming administrations and risks mortgaging the country’s revenue streams,” Nyoro said.

“If public levies can be used as collateral for debt without oversight, what stops future governments from pledging VAT, PAYE, or even NHIF contributions? This sets a dangerous precedent that threatens Kenya’s financial sovereignty.”

But in response, the Ministry clarified that the road maintenance levy was last reviewed in July 2024, rising from Sh18 to Sh25 per litre for super petrol and diesel after parliamentary approval to support the expanding road network.

Since then, it said no revision of this levy has occurred, contrary to public claims. It added that ad valorem taxes such as the Railway Development Levy (RDL) and Import Declaration Fee (IDF) fluctuate based on the CIF value of imported products.

“It also suffices to note that the Government has in previous pricing cycles intervened in the market and applied stabilization to cushion consumers by keeping pump prices lower than the actual prices in times where the published prices would otherwise have been higher,” the Ministry added, terming it “mischievous and factually incorrect” to link the recent pump price increases to the securitisation of the road maintenance levy.

Top Stories Today