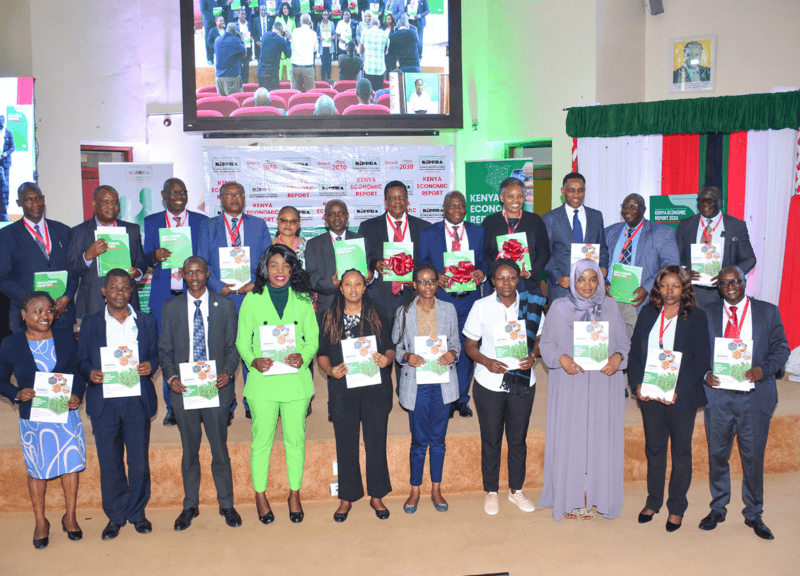

Foreign Investments offer minimal impact to Kenya’s industrialisation, study shows

The report recommends urgent policy reforms to make brownfield investment more attractive and sustainable in this sector, which has the potential to drive Kenya’s industrial ambitions.

Despite being a vital catalyst for economic transformation, Foreign Direct Investment (FDI) inflows into Kenya have had a minimal impact on the country’s overall industrialisation for over a decade.

This is according to a study by the state-owned research institute, the Kenya Institute for Public Policy Research and Analysis (KIPPRA), covering 15 years between 2007 and 2022.

More To Read

- KNBS data shows uneven food price shifts as inflation dips slightly

- World Bank upgrades Kenya’s growth outlook to 4.9 per cent, warns of elevated risks

- Africa presses global financiers for bigger, better capital flows to power growth

- Ruto: Under my reign the cost of living, inflation has gone down

- New KIPPRA report exposes the hidden weaknesses crippling Kenya’s forest industry

- CBK targets Sh40 billion in new Treasury bond auction

The comprehensive study, which examines FDI trends and their contributions to four core industrial sectors – mining, manufacturing, electricity, oil and gas, and construction – highlights a concerning disconnect between investment levels and industrial growth.

Ideally, FDI is generally expected to promote technology transfer, skills development and trade integration.

However, KIPPRA notes that these benefits have not been fully realised across most sectors of the Kenyan economy.

The sector-specific analysis presents a mixed picture.

The mining and quarrying sector shows the most consistent positive results, benefiting from both foreign and domestic investment.

Given its capital-intensive nature, foreign investment in mining is especially crucial. However, to optimise returns, the study recommends promoting joint ventures between foreign firms and local players to facilitate knowledge and technology transfer, thereby building domestic capacity.

In manufacturing, greenfield investments, those that create new production facilities, have helped improve technological capacity and output.

By contrast, brownfield investments, which involve acquiring or leasing existing facilities, have not delivered long-term benefits, largely due to regulatory constraints.

The report recommends urgent policy reforms to make brownfield investment more attractive and sustainable in this sector, which has the potential to drive Kenya’s industrial ambitions.

The electricity, oil and gas sectors have moderately benefited from greenfield FDI, which has enhanced productivity, while brownfield investments currently exert a negative impact.

Nevertheless, KIPPRA says there is long-term potential if regulatory and infrastructural challenges are addressed.

It therefore calls on the government to provide targeted incentives, such as tax holidays and reduced import duties on capital goods, to attract more greenfield investments in energy.

The construction sector has seen relatively better integration of both foreign and domestic investment, although domestic capital remains more influential.

Notably, both greenfield and brownfield FDIs have contributed positively; however, aligning these investments with Kenya’s infrastructure and housing priorities will be critical, according to the study.

Public-private partnerships (PPPs) are identified as another key mechanism to channel foreign capital into areas of national strategic interest.

All of this is unfolding against the backdrop of a continued decline in FDI inflows.

Data from the East African Community Secretariat shows that Kenya’s FDI inflows fell significantly in the recent past, dropping to $374.6 million (Sh48 billion) in 2023 from $710.21 million (Sh92 billion) in 2022, marking a 47.2 per cent decrease.

This decline was largely driven by the depreciating currency at the time, elevated interest rates, rising inflation, a dollar shortage and poor performance on the Nairobi Securities Exchange.

The downturn coincided with a 43 per cent reduction in the number of foreign investment projects, from 209 in 2022 to 146 in 2023.

Additionally, KIPPRA reports that the share of FDI contribution to the country’s GDP has remained below five per cent for over a decade.

“In the East African Community (EAC), Kenya’s FDI contribution to GDP has been declining since 2011,” the report notes.

While statistics show that Kenya led in FDI contribution to GDP among EAC countries in 2011, KIPPRA observes that the trend has since reversed, and other EAC members have overtaken Kenya.

“Consequently, the current trend indicates that there is a need for Kenya to re-evaluate its strategies for attracting and retaining FDI in the country to support industrialisation as envisioned in the Kenya Vision 2030 and BETA.”

To reverse this, the study recommends a review of Kenya’s National Industrial Policy with a sharper focus on foreign investment.

Creating a more transparent, predictable legal and regulatory environment is also deemed essential to regain investor confidence and improve the efficiency of investment flows.

Top Stories Today