Treasury disburses Sh2.6 billion to boost recovery of MSMEs

The five-year Sh7.1 billion initiative was designed to fill financing gaps in the MSME sector, gaps that widened during the Covid-19 pandemic.

The National Treasury has released Sh2.63 billion to micro, small, and medium enterprises (MSMEs) over the past year, aiming to strengthen their recovery and long-term resilience.

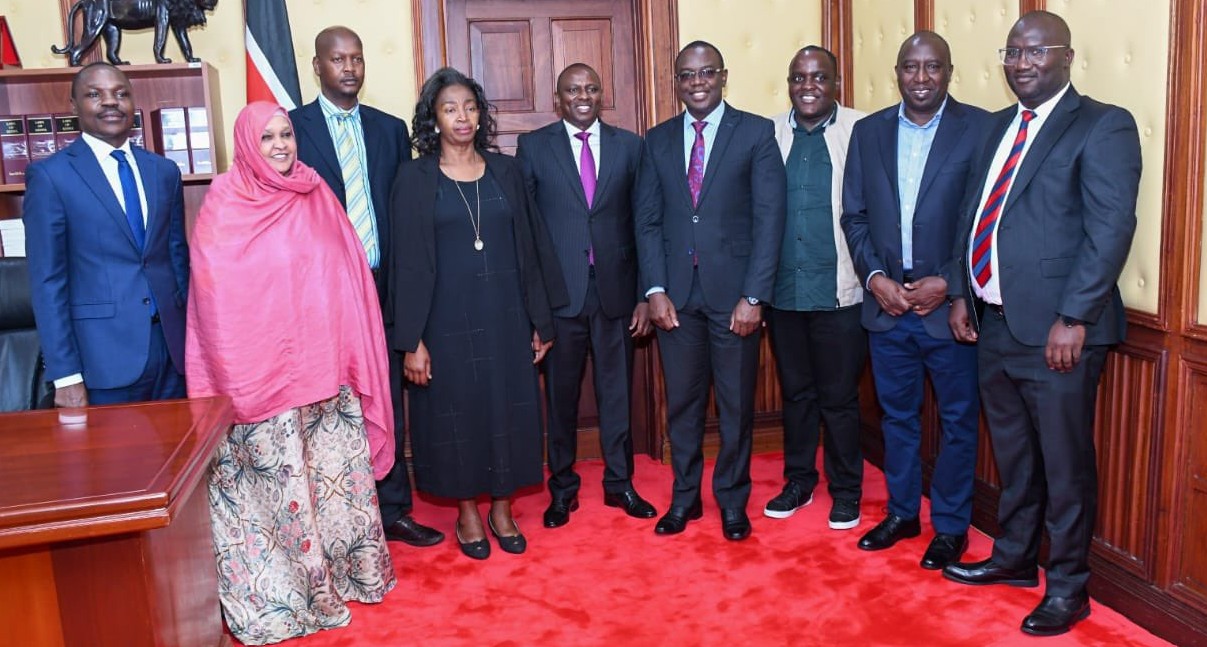

The funds, distributed through the Supporting Access to Finance and Enterprise Recovery (SAFER) Project, have benefited 36,990 businesses across 32 counties.

More To Read

- Government, miners form joint committees to curb exploitation, protect communities

- MPs push for urgent funding boost for Auditor General’s office

- SMEs sound alarm over rising failure rates amid investment gaps

- Treasury’s plan to abolish six development authorities raises fears over 423 projects, 1,500 jobs

- Treasury under fire for using Sh2.67 trillion in domestic loans on recurrent spending

- National Treasury secures Sh437.8 billion loan to plug budget deficit

The five-year Sh7.1 billion initiative was designed to fill financing gaps in the MSME sector, gaps that widened during the Covid-19 pandemic.

The program, implemented by the Treasury’s Project Implementation Unit in partnership with the Kenya Development Corporation (KDC), targets enterprises struggling to secure formal financing.

“Of these, 12,221 are women, with 28.8 per cent of loans extended to women-owned enterprises. About 9.7 per cent of the total financing has gone into green economy and climate-smart projects,” the KDC said in a statement.

Officials note that SAFER is also embedding Environmental, Social, and Governance (ESG) practices into lending.

Participating financial institutions are required to carry out environmental and social risk assessments to ensure the sustainability of projects funded under the program.

This week, a four-day technical assistance session is taking place in Nairobi, bringing together stakeholders to improve the operational capacity of participating financial institutions.

Regulators, including the Sacco Societies Regulatory Authority (SASRA), are discussing better compliance monitoring, financial reporting, and data-sharing to increase accountability.

The next stage of the SAFER Project will integrate the Digital Lending Window, which is expected to make credit more affordable and expand access for underserved businesses.

Kenya has about 7.4 million MSMEs, employing 14.4 million to 14.9 million people and contributing up to 40 per cent of GDP, according to the Kenya National Bureau of Statistics (KNBS).

Yet only around 16 per cent of these businesses, roughly 1.1 million, can access formal financial services, leaving the remaining 84 per cent reliant on informal sources.

Analysts say the main barriers preventing small businesses from getting loans include a lack of collateral, informal operations, and weak credit histories.

While the total demand for MSME credit is estimated at Sh4 trillion, formal lenders provide only Sh700 billion, leaving a gap of roughly Sh3.3 trillion ($30 billion), a shortfall that continues to limit the sector’s growth potential.

Top Stories Today