New Sh3.9 billion fund to make insurance affordable for millions in Africa

Recent studies highlight the fragile state of Africa’s insurance sector, with penetration rates below three per cent in most countries, leaving households, small businesses, and vulnerable communities exposed to financial shocks.

Insurers and regulators across Africa have received a major boost in efforts to close the continent’s vast protection gap, currently estimated at about 85 per cent.

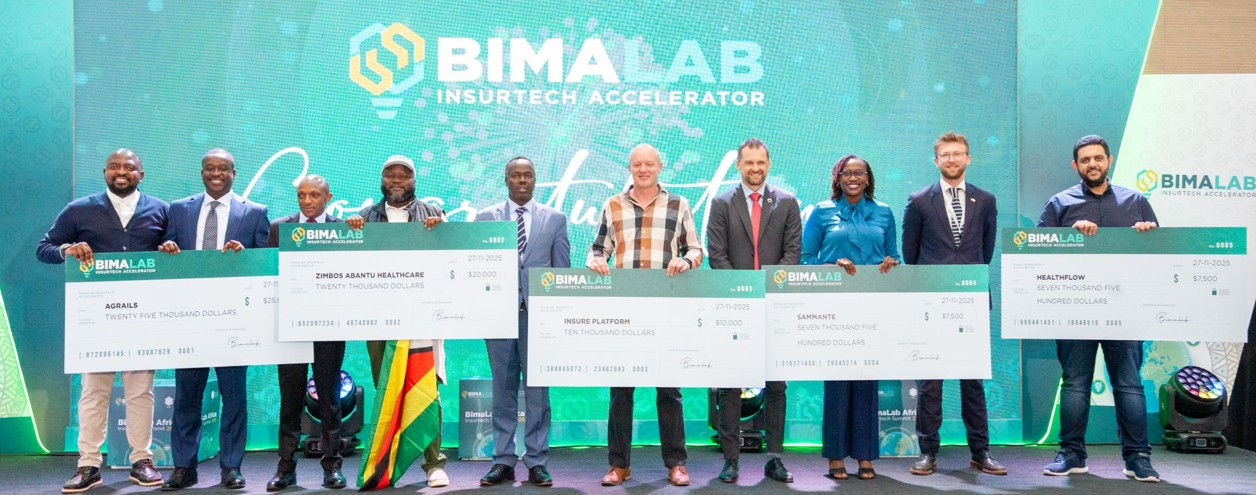

This comes with the unveiling of a $30 million (Sh3.9 billion) funding package at the 2025 BimaLab Africa Insurtech Summit in Nairobi.

The capital injection aims to accelerate innovation in the insurance sector and attract more private investment into insurtech, strengthening the ecosystem and expanding access to affordable, relevant insurance solutions across African markets.

The fund, provided by specialist finance firm FSD Africa and named the Inclusive Insurtech Investment Fund (3iF), is set to become a key driver of private-sector participation in insurance technology.

Targeting early-stage startups, the venture capital vehicle will focus on widening insurance access, affordability, and awareness, with special emphasis on climate resilience, health, and financial inclusion for underserved populations.

3iF builds on the BimaLab Accelerator Programme, which has supported more than 135 startups across 28 countries. By bridging the financing gap that often prevents promising tech-enabled insurance solutions from scaling, the fund is expected to play a crucial role in addressing Africa’s long-standing challenge in insurance protection.

Blended financing structure

With a blended financing structure, the fund is scheduled to launch in January 2026, providing growth capital to BimaLab graduates and other high-potential ventures.

Commenting on the initiative, Kelvin Massingham, Director of Adaptation and Resilience at FSD Africa, said the launch of the 3i Fund opens “an exciting new chapter for insurance innovation in Africa.”

“By investing in the next generation of insurtech pioneers, we are unlocking opportunities to expand access, affordability, and resilience for millions across the continent,” Massingham said.

“Our goal is to empower visionary startups to transform how insurance works for everyone, driving inclusive growth, climate resilience, and financial security for Africa’s future.”

Alongside the fund, a new regulatory assessment toolkit was unveiled at the two-day summit (November 26–27). The toolkit is designed to help African insurance regulators evaluate the potential impact of new insurtech innovations, streamline assessment processes, and lower barriers for startups seeking approval to pilot new models.

The initiative aims to expand access to affordable risk protection for low-income households, rural communities, informal workers, and smallholder farmers.

Commenting on the toolkit, Insurance Regulatory Authority (IRA) CEO and Commissioner Godfrey Kiptum said that strengthening the regulatory environment is laying the foundation for a more resilient and inclusive insurance ecosystem in Africa.

“Building regulatory readiness for innovation is key, and BimaLab’s new toolkit will be an invaluable resource not only for us here in Kenya, but for African regulators across the continent,” Kiptum said.

Recent studies highlight the fragile state of Africa’s insurance sector, with penetration rates below three per cent in most countries, leaving households, small businesses, and vulnerable communities exposed to financial shocks.

In 2022, around 80 per cent of economic losses from natural disasters went uninsured, up from 58 per cent the previous year.

Top Stories Today