Kenya adopts Women Entrepreneurs Finance Code to close gender financing gap for women entrepreneurs

Kenya has adopted the WE Finance Code, a global framework to expand credit for women-led businesses, aiming to close gender financing gaps and support data-driven financial inclusion reforms.

Kenya has intensified efforts to close the gender financing gap for women-led businesses after formally adopting and signing the Women Entrepreneurs (WE) Finance Code.

The code, developed by the Women Entrepreneurs Finance Initiative (We-Fi) and housed at the World Bank, is a global framework designed to expand access to credit for women-owned micro, small and medium enterprises (WMSMEs).

More To Read

- Ruto terms Hustler Fund largest financial inclusion programme since independence

- CBK data shows Sh344 billion decline in mobile money transactions, steepest drop in 18 years

- Diamond Trust Bank lands in Garissa, ignites push for financial inclusion in northern Kenya

- CS Mbadi tables new banking rules targeting non-compliance, unethical practices

- Kenya’s exports to EAC partners grow as diaspora sends Sh1 trillion home

- CBK targets Sh40 billion in new Treasury bond auction

Under the code, participating institutions are required to adopt gender-responsive policies, strengthen data collection on women borrowers, design tailored financial products, and commit to transparent reporting on financing outcomes for women-led enterprises.

For Kenya, the initiative is expected to accelerate progress in reducing gender disparities in entrepreneurship, formal lending, and participation in the digital economy. The move places the country among more than 30 nations that have committed to structured, data-driven reforms aimed at improving financial access for women entrepreneurs.

Decisive step

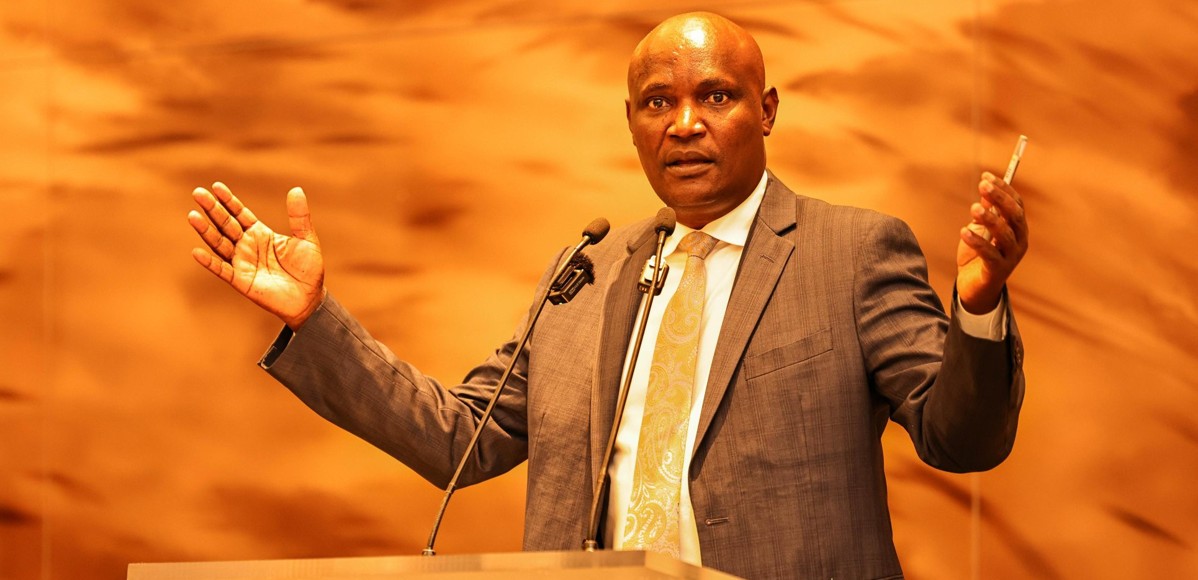

Treasury Cabinet Secretary John Mbadi said Kenya’s adoption of the WE Finance Code marks a decisive step towards placing women at the centre of economic decision-making, innovation and national growth.

“This noble idea provides a platform to which all women of this country are placed at the centre of economic conversations, innovation and decision-making,” Mbadi said.

He commended the Central Bank of Kenya (CBK), the State Department for Gender and Affirmative Action, FSD Kenya and the Kenya Bankers Association for championing the initiative.

Mbadi noted that the code is backed by evidence of strong performance among women-led enterprises.

“Those entities that are led by women outpace those which are led by men in all aspects, including profitability. Women are more careful in everything they do,” he observed.

Significant financing gaps

Despite this, significant financing gaps persist. Only 27 per cent of women-owned businesses can access formal banking services, compared with 45 per cent of male-owned firms. According to the CS, this forces many women to turn to informal lenders and short-term credit, often leaving them vulnerable to exploitative practices.

“It is unacceptable that while women-led MSMEs contribute significantly to our economy and employ millions of people, only 27 per cent of the women-owned businesses can easily access banking services.”

He urged more financial institutions to sign up to the Code.

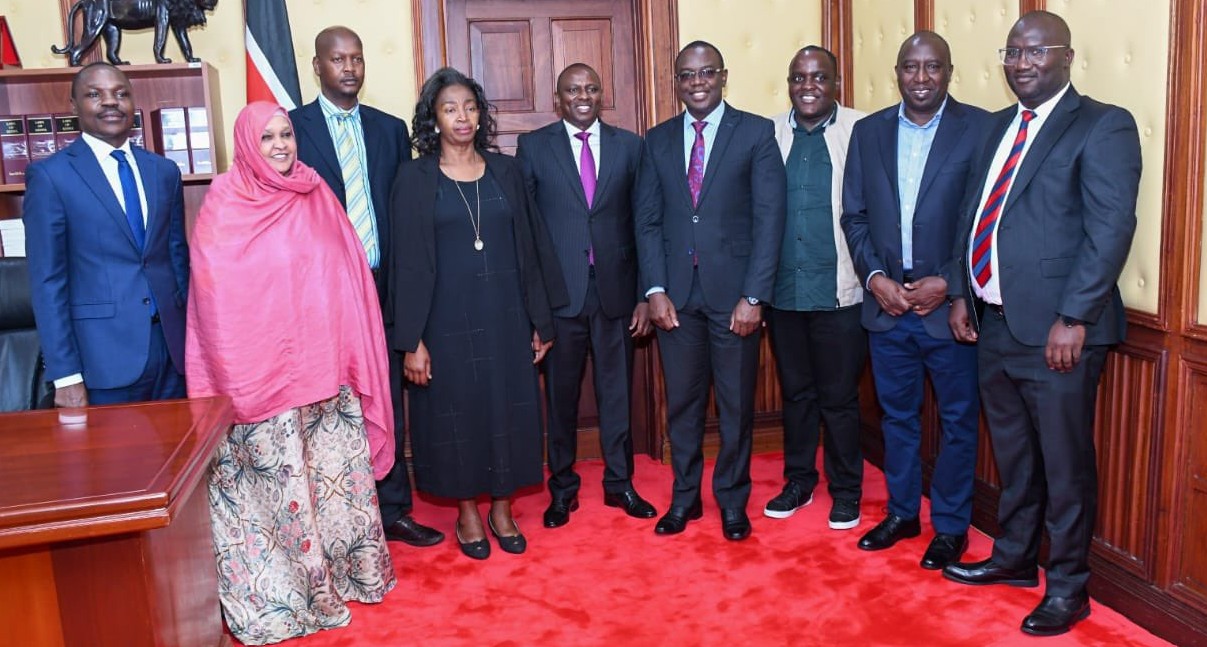

Mbadi spoke in Nairobi on Thursday during the signing of the instrument, presided over by the Central Bank of Kenya. The ceremony also marked the launch of the first National Financial Inclusion Strategy (NFIS) 2025–2028 and the Fourth Medium Term Plan 2023–2027 for the financial sector.

Coordinated framework

The inclusion strategy outlines a coordinated framework for expanding access to financial services. It provides a tool for closer collaboration among stakeholders to minimise duplication and ensure efficient use of resources in implementing financial inclusion initiatives, innovations and policies.

The strategy also sets out a roadmap for expanding equitable access to and usage of quality financial products and services — including payments, credit, insurance, pensions, savings and investments — delivered sustainably to meet consumer needs and promote financial wellbeing.

The NFIS is driven by the need to improve overall financial health for individuals and businesses through a multi-stakeholder, data-driven and innovation-led approach.

Top Stories Today