Ndindi Nyoro questions government’s decision to sell 15 per cent Safaricom stake

Kiharu MP Ndindi Nyoro has challenged the government’s plan to sell a 15% Safaricom stake to Vodacom, alleging undervaluation and lack of open bidding, as Treasury defends the deal as a funding strategy.

Kiharu MP Ndindi Nyoro has demanded a full explanation from the government on its decision to sell a 15 per cent stake in Safaricom to Vodacom Group, calling the process opaque and unfair to Kenyan taxpayers.

Speaking at a press briefing in Nairobi on Thursday, Nyoro said the move risks shortchanging the public and equated it to “mortgaging the country”.

More To Read

- Government cuts funding to merged, dissolved state corporations

- MPs push for urgent funding boost for Auditor General’s office

- Safaricom rolls out Daraja 3.0 in major M-Pesa API redesign

- Treasury under fire for using Sh2.67 trillion in domestic loans on recurrent spending

- National Treasury secures Sh437.8 billion loan to plug budget deficit

- MPs raise alarm over alleged misappropriation of College of Insurance land

He questioned the absence of open competition, asking, “There was no competitive bidding. How did they set the price, and how did they pick Vodacom as the buyer?”

The sale would give Vodacom a controlling 55 per cent stake in Kenya’s largest telecom company, reducing the government’s holding to 25 per cent.

The transaction comes shortly after Kalahari Cement, owned by Tanzanian businessman Edhah Abdallah Munif, acquired a 27 per cent stake in East African Portland Cement from the National Social Security Fund for Sh1.6 billion, handing the firm majority control.

Nyoro claimed that the government is selling Safaricom at an artificially low price, estimating that the Sh34 per share offer undervalues the company by about 25 per cent.

He noted that the telecom was trading at Sh45 per share in 2021, and its expansion into Ethiopia should have increased its worth.

“Kenyans have been over-subscribing Treasury bonds. Why were they not given a chance to buy Safaricom competitively and discover the market price?” he posed.

According to the MP, Safaricom’s current value exceeds Sh2.5 trillion, based on a 2021 valuation of Sh1.8 trillion.

“We cannot sell a share at Sh34 unless there has been a deliberate suppression of the valuation. The government is underselling the stake at the detriment of Kenyans,” he added, accusing officials of undervaluing one of the country’s most critical assets.

Recent Safaricom financial results underscore the company’s growth. For the six months ending September, net income rose to Sh42.8 billion, a 52 per cent increase, driven by strong performance from M-Pesa, data services, and smaller losses in Ethiopia.

Revenue climbed to Sh199.9 billion from Sh179.9 billion in the same period last year, reflecting 11.1 per cent growth.

“Either the people at the National Treasury are putting their interests first, are just incompetent or both,” Nyoro said.

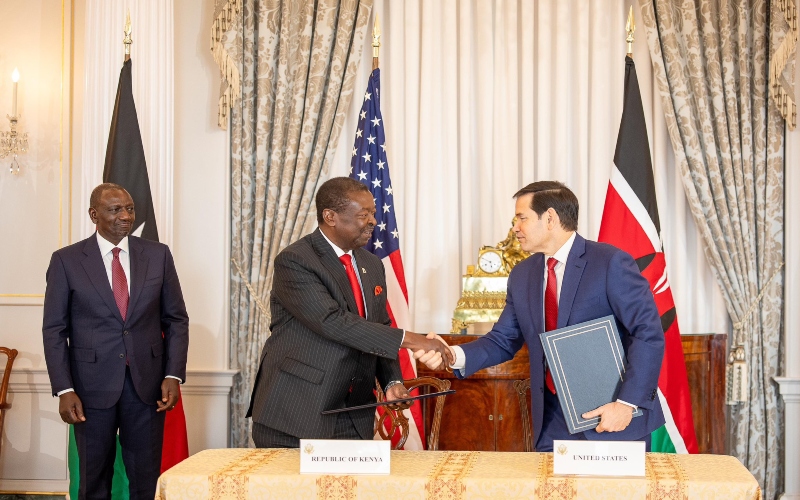

Treasury Cabinet Secretary John Mbadi defended the sale, describing it as part of President William Ruto’s plan to mobilise funds without raising taxes or national debt.

“Safaricom has been, and continues to be, a key strategic investment for us, as we are retaining a 20 per cent stake as well as board representation,” he said.

The company has also been a major source of government revenue, contributing Sh1.57 trillion in taxes, licence fees, and duties as of September.

This is the second major move by the government to cash in on Safaricom since it sold 25 per cent of its shares to the public in 2008 through an IPO that raised Sh51 billion.

Nyoro suggested that Safaricom should have been separated into telecommunications, financial services, and tower divisions before its valuation and sale, to ensure a fair market price.

The proposed deal would see the government receive Sh204.3 billion for its shares, along with Sh40.2 billion in upfront dividends on its remaining 20 per cent stake.

Following the sale, shareholding would be Vodacom 35 per cent, Vodafone five per cent, NSE shareholders 25 per cent, and the government 25 per cent.

Top Stories Today