High lending rates expected to slow private sector credit growth - CBK survey

The survey found that high lending rates and tight credit underwriting are reducing the demand and uptake of new facilities.

The high lending rates in the market are expected to slow credit growth in the private sector in the year to December, a survey by the Central Bank of Kenya (CBK) has revealed.

Despite an expected rise in demand for short-term borrowing and requirements for working capital by large firms and small businesses, the survey indicates that high lending rates and tight credit underwriting will temper private sector credit growth.

More To Read

- CBK cuts lending rate to 9.00 per cent to boost business and household borrowing

- Kenya adopts Women Entrepreneurs Finance Code to close gender financing gap for women entrepreneurs

- CBK warns of rising debt distress, urges fiscal coordination

- Ruto: Under my reign the cost of living, inflation has gone down

- CBK data shows Sh344 billion decline in mobile money transactions, steepest drop in 18 years

- CS Mbadi tables new banking rules targeting non-compliance, unethical practices

The CBK Market Perceptions Survey for March 2024 revealed that 62 per cent of respondents anticipated a slowdown in private sector credit growth due to high lending rates and tight credit underwriting, which are reducing the demand and uptake of new facilities.

This is despite an expected rise in demand for short-term borrowing and working capital requirements by large firms and small businesses.

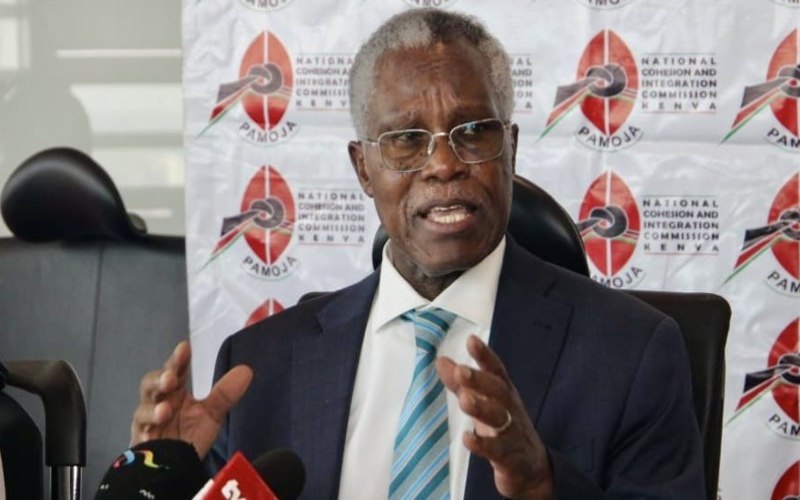

"The increases in NPLs [non-proft loans] were noted in the real estate, trade, personal and household, energy and water, and building and construction sectors," CBK Governor Kamau Thugge said in his post-Monetary Policy Committee briefing earlier this month, as the apex bank retained its base lending rate at 13 per cent.

Commercial banks are, however, lending by up to 23 per cent, depending on the risk profile of the borrower, as they continue to make adequate provisions for the NPLs.

Nevertheless, 70 per cent of the respondents expected support for private sector credit growth from a better economic performance in 2024 relative to 2023. This was due to favourable weather conditions, a favourable foreign exchange environment, positive sentiments in the economy, and lower inflation, which are likely to boost demand for working capital and term funding.

Growth in commercial bank lending to the private sector slowed to 10.3 per cent in February, compared to 13.8 per cent in January 2024. Credit growth in manufacturing was at 13.6 per cent, transport and communication at 7.5 per cent), trade at 10.7 per cent, and consumer durables at 7.4 per cent.

"The number of loan applications and approvals remained resilient, reflecting sustained demand, particularly for working capital requirements," Thugge said.

However, 82 per cent of respondents expected the high cost of credit due to high interest rates and prospects of increased interest rates, a relatively high inflation environment, and the high cost of doing business in the country to dampen credit appetite in the next two months.

The survey targeted chief executives and other senior officers of 354 private sector firms, comprising 38 commercial banks, 14 microfinance banks, and 302 non-bank private firms, including 84 hotels, through questionnaires administered online and via email and hard copies. The overall response rate to the March 2024 Survey was 73 per cent of the sampled institutions, according to CBK.

Respondents expect economic growth to be driven by enhanced agricultural production supported by more than-average rainfall across the country and government interventions in the sector.

A resilient private sector-led diversified economy, supported by healthy, albeit diminishing, consumer activities due to slowing incomes and a tourism sector recovery with increasing international travel, is also expected to drive growth.

However, the high cost of borrowing, constraining disposable incomes for consumption and investments by households and MSMEs, and high taxation remain risks to economic activities.

Top Stories Today