IMF to consider Kenya's economic plan at end of August - Mudavadi

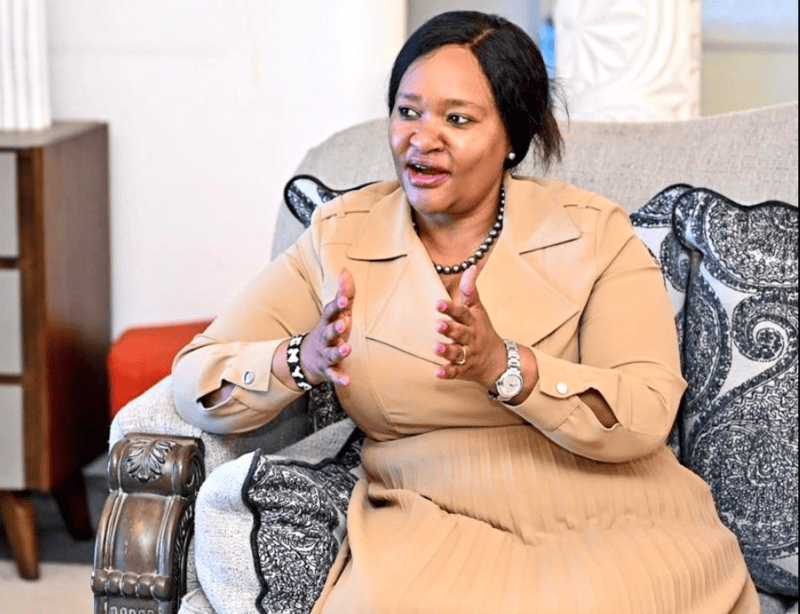

Prime Cabinet Secretary Musalia Mudavadi said that the Treasury "has had a very robust engagement with the International Monetary Fund" despite the tax-hike setback.

Kenya has submitted an economic repair plan to the International Monetary Fund and it expects the fund's board to review it for approval at the end of August, the country's chief minister told a parliamentary panel.

Kenya had to rapidly draw up new spending cuts after widespread youth-led protests against tax hikes previously put forward by President William Ruto's government left at least 50 people dead.

More To Read

- Ruto backs IMF partnership as key to Kenya’s debt, economic reforms

- World Bank upgrades Kenya’s growth outlook to 4.9 per cent, warns of elevated risks

- Africa’s share of global extreme poverty rose by 30 per cent in 10 years - World Bank

- Revenue raise, prudent debt key to Africa’s 2026 upgraded growth prospects - IMF

- World Bank urges shift to local currency loans in Africa

- Kenya ranked 10th in Africa’s most attractive investment destinations

Prime Cabinet Secretary Musalia Mudavadi said that the Treasury "has had a very robust engagement with the International Monetary Fund" despite the tax-hike setback.

"It is our desire and hope that Kenya's proposition will receive favourable consideration so that we can move beyond the challenges that we are facing," Mudavadi told the parliamentary budget committee in remarks seen by Reuters on Tuesday.

The IMF did not immediately comment. The East African nation has a $3.6 billion IMF programme, and the Fund had reached a staff-level agreement on the seventh review of Kenya's programme in early June.

But its board had not signed off on the review when Ruto scrapped the tax hikes that were a core part of its plan to meet IMF targets, and investors said the political turmoil would make getting IMF cash trickier.

Even at the review, Kenya had sought IMF waivers after failing to meet two targets on balancing the budget and tax collection.

Mudavadi said that under the revised spending plan for the 2024/25 financial year, the budget deficit is projected to rise to 4.2 per cent of gross domestic product, up from 3.3% before the withdrawal of the finance bill.

"The revision to the deficit barely a week after the initial plan underlines the herculean task faced by the authorities to achieve their fiscal consolidation goals," Ayodeji Dawodu, head of Africa research and strategy with boutique investment banking group BancTrust & Co said in a note.

Other Topics To Read

Top Stories Today