Uwezo Fund disburses Sh2.2 million to 14 community groups in Kamukunji

The Uwezo Fund has disbursed Sh2.2 million to 14 groups in Kamukunji, piloting a fully digitised application and repayment system aimed at boosting transparency, accountability and community empowerment.

The Uwezo Fund has released Sh2.2 million to 14 community groups in Kamukunji Constituency, marking a significant milestone in the government’s ongoing effort to digitise public services.

The event, held at the California Resource Centre, brought together youth, women, men, elderly groups and persons with disabilities from Pumwani, California, Eastleigh North and Eastleigh South wards.

More To Read

- Government cuts funding to merged, dissolved state corporations

- Senate targets KEMSA in plan to turn devolved institutions into executive agencies

- Museums go fully digital as National Museums of Kenya unveils new ticketing system

- Safaricom rolls out Daraja 3.0 in major M-Pesa API redesign

- AG advises Treasury CS to halt Sh50 e-Citizen convenience fee following High Court order

- Blow to State as court declares eCitizen Sh50 charge illegal, halts mandatory school fee payment via platform

During the event, nine first-time applicant groups each received Sh100,000 while four groups that had completed their previous loan cycle were issued Sh200,000 each. One long-standing group, now in its fourth cycle and with a strong repayment record, received Sh500,000, a testament to the Fund’s policy of rewarding accountability and financial discipline.

Kamukunji was selected as one of three pilot constituencies, alongside Roysambu and Dagoretti, to test the new fully digitised Uwezo Fund system. Under this arrangement, all applications are now submitted through e-Citizen, and repayment funds are transferred directly via M-Pesa, and not through the bank as previously done.

This shift aligns with the government’s digital Initiative and the Bottom-Up Economic Transformation Agenda (BETA).

Despite several groups being eligible in the constituency, only 14 qualified for this year's funding cycle. According to officials, many delayed registration or lacked awareness of the new digital procedures. Early requirements, such as KRA compliance, also discouraged applicants before the government later scrapped the requirement.

Speaking during the event, Kamukunji MP Yusuf Hassan, emphasised that the fund is intended to uplift and empower both groups and individuals. He noted that the Uwezo Fund plays a vital role in the government’s broader efforts to support community development.

Yusuf acknowledged that although the project was substantial, many beneficiaries failed to repay their loans in its initial stage, while others misused the funds.

However, he encouraged the community to improve, highlighting successful groups, such as Murata Mwega, that have borrowed multiple times, repaid consistently, and grown stronger.

“The more you borrow and repay responsibly, the more opportunities you create for yourself and your community,” he stressed.

The MP also highlighted the tangible development progress within the constituency, noting that Kamukunji once faced significant challenges, but today, many children can access bursaries for secondary school.

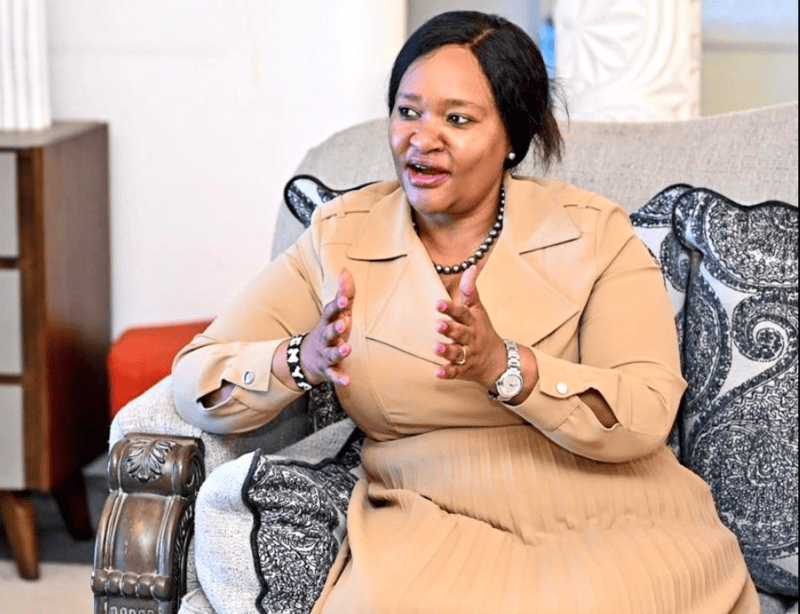

Kamukunji MP Yusuf Hassan speaks during the disbursement of Uwezo Fund to community groups at the California Resource Centre in Eastleigh, Nairobi. (Photo: Ahmed Shafat)

Kamukunji MP Yusuf Hassan speaks during the disbursement of Uwezo Fund to community groups at the California Resource Centre in Eastleigh, Nairobi. (Photo: Ahmed Shafat)

He assured residents that bursaries will continue to be available.

Additionally, from December 15 to December 16, a new crash program will be introduced to empower youth through short technical courses aimed at equipping them with practical, employable skills.

Committee Chairperson Jackson Muturi, based at the Kamukunji MP’s Office, explained that the purpose of the Uwezo Fund is to gradually evolve and take up the role previously played by the Youth Fund, ensuring that resources are accessed directly through constituency offices under the legislature.

Muturi noted that the Fund’s structure has undergone several adjustments to align it with modern government systems.

“The whole idea is to modernise the Fund so that it truly reaches the people through their constituency offices. We are building a structure that is transparent, accountable and accessible,” Muturi said.

According to the Chairperson, the entire process was previously conducted manually, but under the current administration, all operations have now been digitised. Kamukunji was selected as one of three constituencies, alongside Dagoretti and Roysambu, to pilot this new digital model.

He added that the process has involved thorough shortlisting, vetting and compliance checks to match the requirements of the digitisation phase. After one and a half years of testing, he said the pilot has been successful and will now be rolled out nationwide.

Muturi explained that the application process is open to youth groups whose members are aged below 35 and have been active for at least six months with an income-generating activity. Women’s groups, on the other hand, have no age limit but must be registered and active.

For first-time applicants, the maximum amount available is Sh100,000. Groups that meet their goals and repay their loans are eligible for refinancing, with each cycle increasing by Sh100,000 until they reach the maximum of Sh500,000. After this, they can apply for a refinancing amount of Sh200,000.

He confirmed that the Kamukunji office has successfully disbursed Sh2.2 million, and he hopes the beneficiaries will use the funds responsibly.

Muturi acknowledged that digitisation initially posed challenges, particularly the early requirement for KRA compliance, which discouraged many groups. At one instance, only five groups had applied, but once the government removed the KRA requirement, applications increased significantly.

“Digitisation scared many groups at first, but once they understood it, they embraced it. These 14 groups took the bold step, and now we want to see how well they repay and grow,” he added.

He emphasised that all groups must be registered and enrolled on e-Citizen for the process to work. Although the new system is unfamiliar to some community members, he said the pilot groups demonstrated that it is possible and effective.

A section of beneficiaries during the disbursement of Uwezo Fund at the California Resource Centre in Eastleigh, Nairobi. (Photo: Ahmed Shafat)

A section of beneficiaries during the disbursement of Uwezo Fund at the California Resource Centre in Eastleigh, Nairobi. (Photo: Ahmed Shafat)

Muturi stressed that all payments must be processed through e-Citizen and that the entire exercise is transparent, free of corruption and free of favouritism.

He also pointed out that Airbase Ward had no representation in this cycle, while Eastleigh North and California each had two groups. Pumwani contributed nine groups, accounting for nearly 60 per cent of the beneficiaries.

“Repayment is everything. If groups don’t repay, they automatically lock themselves out of future opportunities,” he said.

Muratha Mwega Self-Help Group, formed in 2013, was among the groups that received Sh500,000. Chairperson Stephen Kariongo Murata said the group has grown steadily due to discipline and table banking.

“We started with Sh100,000, then Sh200,000, then Sh250,000. Our table banking has enabled us to buy a plot and grow our assets. We hope to reach Sh1 million next year,” he said.

He praised the MP’s support, adding, “Government money helps. There’s no interest; you return exactly what you were given. God willing, we repay in a year and apply for more.”

Another beneficiary, Clinton Ndegwa, Vice Chair of Brix CBO, said his two-year-old group received Sh100,000 as first-time applicants.

“We had dormant projects like a car wash. With this money, we are reviving them. People should form groups, get certificates and seek help. The support is there,” he said.

Beneficiaries included youth groups, elderly women’s groups, groups of persons with disabilities, Somali youth groups and several newly registered men’s groups.

Joseph Munguti, representing the OCS, encouraged residents to report crime anonymously to help security agencies curb gang activities and drug circulation.

Poor repayment trends from earlier beneficiaries were also highlighted as a challenge that affected sustainability. “Uwezo Fund is a loan, not a grant. Repayment is the only way the fund continues helping others,” officials reminded the participants.

The Uwezo Fund was officially established under Legal Notice No. 21 on 21 February 2014 and was launched by the President on 8 September 2013.

Since its inception, the fund has disbursed over Sh7.2 billion, directly benefiting approximately 1,124,221 people, of whom about 69 per cent are female and 31 per cent male. According to a 2023 report, the fund had disbursed around Sh7.5 billion to approximately 82,246 groups across the country.

Top Stories Today