Government says Hustler loans recovery efforts will respect data privacy

This comes after the government declared plans to recover Sh7 billion from 13 million loan defaulters by targeting their M-Pesa accounts and airtime balances.

The Ministry of Cooperatives and Micro, Small, and Medium Enterprises (MSMEs) Development has announced that Hustler Fund loan recovery efforts will comply with data protection laws.

This comes after the government declared plans to recover Sh7 billion from 13 million loan defaulters by targeting their M-Pesa accounts and airtime balances.

More To Read

- Ruto terms Hustler Fund largest financial inclusion programme since independence

- Hustler Fund faces scrutiny as MPs demand answers on missing Sh14 billion, beneficiary records

- Tertiary students ineligible for NYOTA programme, PS Susan Mang’eni clarifies

- Hustler Fund defaulters to lose access to SHA 'Lipa Pole Pole' initiative

- Court trims interested parties in Hustler Fund’s legality case

- Oparanya: Hustler Fund loan defaulters to be locked out of bank, SACCO loans

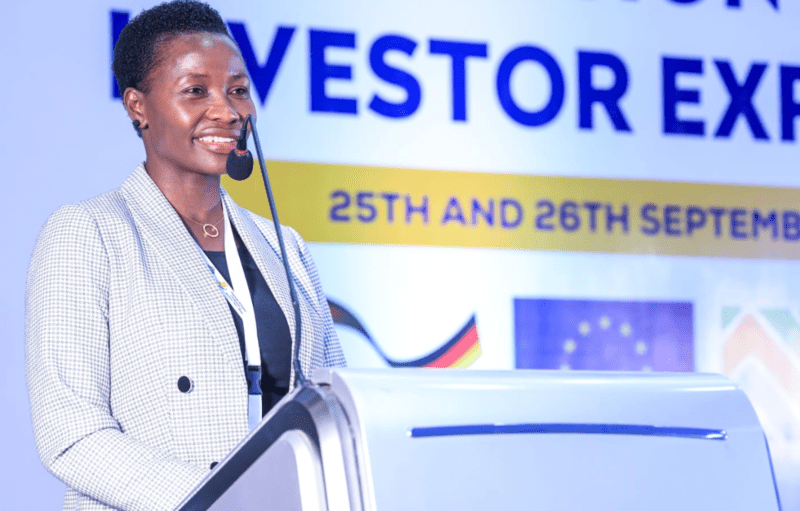

In a statement on Wednesday, MSMEs Development Principal Secretary Susan Mang’eni assured the public that any recovery measures would strictly adhere to national data protection laws, adding that the role of service providers is purely technological, with no involvement in customers’ financial portfolios.

“The Hustler Fund Service providers partners' role remains the provision of technology. We wish to assure Kenyans that the government remains committed to the adherence of data protection laws and the default recovery measures will be within the law,” she said.

Mang’eni also clarified that Hustler Fund is separate from the banks and mobile money wallets And the funds are not offered as part of the intermediaries' financial product portfolio but rather offered as a service from the intermediaries to the Fund.

“The Hustler Fund is fully government-owned and operates within the framework of Kenyan law. It is not part of the financial products offered by the intermediaries but rather a service provided by them to the Fund,” she said.

She further said loans amounting to over Sh57.8 billion have been disbursed, with Sh45.5 billion already repaid.

The PS further encouraged Kenyans to repay their loans on time to build their credit score for higher loan limit access.

“We remain dedicated to ensuring that the Fund grows, and deepens financial inclusion at the Bottom of the Economic pyramid,” she said.

The clarification follows comments from Hustler Fund Acting CEO Elizabeth Nkuku, who suggested that the government is considering legal avenues to recover the debts, including accessing M-Pesa accounts and deducting from airtime balances.

Appearing before the National Assembly's Special Funds Committee, Nkuku said many defaulters have the financial capacity to repay their loans, based on their regular M-Pesa transactions.

She highlighted that the defaulters were largely borrowers who took loans during the first two months after the launch of the Hustler Fund.

“It’s not that they cannot pay. They are people who just don’t want to pay,” she told the committee.

She noted that two million borrowers currently maintain good financial credit, while five per cent of every loan borrowed is retained as savings for the borrowers. The savings have accumulated to Sh3.5 billion.

She further said that the eight per cent interest rate charged on the loans is distributed among mobile operators, banks, the secretariat, and the Fund's growth initiatives.

Top Stories Today