Finance Bill 2024: IMF denies involvement in Kenya’s failed tax proposals

The IMF's stance comes in the wake of public uproar over the proposed Finance Bill 2024, which many critics believed reflected the IMF’s influence.

The International Monetary Fund (IMF) has denied responsibility for the controversial tax measures in Kenya's failed Finance Bill 2024, stating that the government was entirely responsible for the design of the revenue policies.

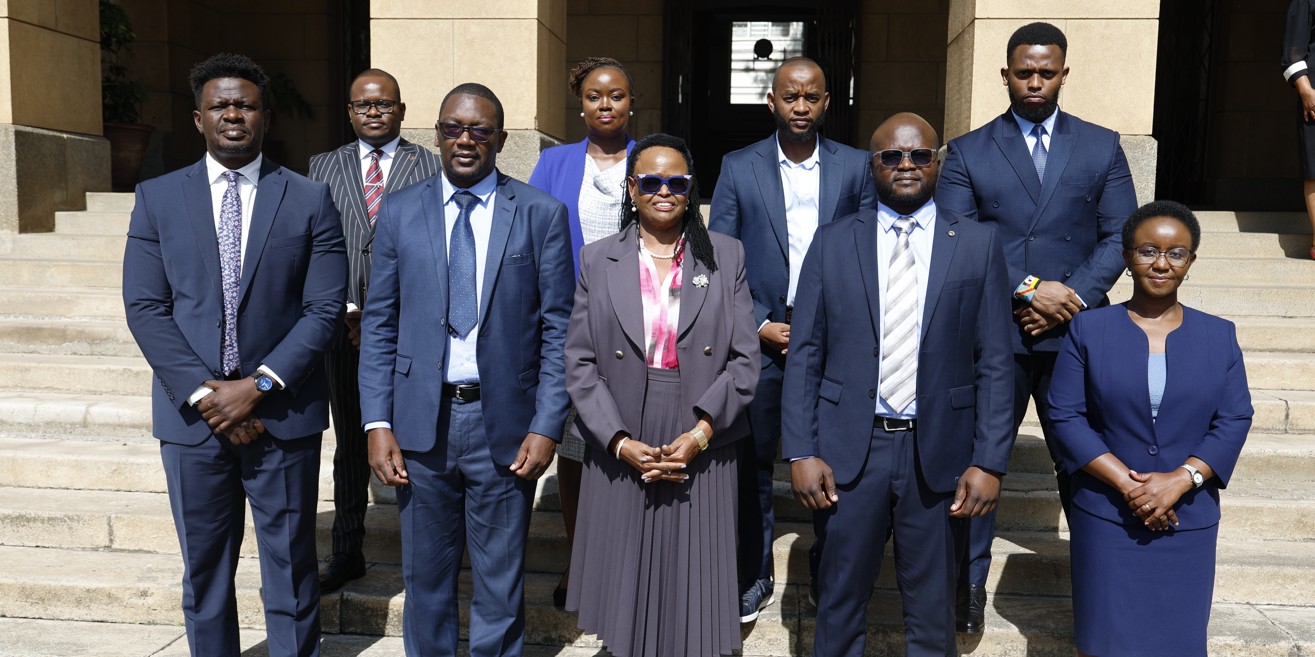

During his visit to Kenya, IMF Deputy Managing Director Nigel Clarke said the fund only offers advisory support on fiscal stability.

More To Read

- Maasai community sets aside 1 million acres to protect Amboseli ecosystem

- Ruto presides over historic handover of Amboseli National Park to Kajiado County

- World Bank urges shift to local currency loans in Africa

- Kenya moves to curb recruitment of its citizens in Russia-Ukraine war

- Treasury ordered to draft rules for on-lent loans amid oversight concerns

- Oburu’s DP position condition to Ruto unsettles Kindiki’s base

He noted that while the IMF had provided advice on how Kenya could achieve fiscal consolidation and macroeconomic stability, the design of specific tax policies was entirely the government’s decision.

"Specific revenue measures are not a design of the IMF. The choices made are totally in the purview of the government. I understand some of the misconceptions that exist. At the end of the day, specific policy choices, in particular revenue choices, are made by Kenyan authorities taking into consideration what is socially and politically feasible," Clarke said.

The IMF official also revealed that the fund would send a team to Kenya in 2025 to assist with governance reforms, a request made by the Kenyan authorities.

Clarke, who is on his first visit to Kenya since assuming his role as deputy managing director in October, has met with President William Ruto, Treasury Cabinet Secretary John Mbadi, and Central Bank Governor Kamau Thugge during his two-day stay.

The IMF's stance comes in the wake of public uproar over the proposed Finance Bill 2024, which many critics believed reflected the IMF’s influence.

The bill was shelved after violent protests, and President Ruto declined to assent to it. Clarke sought to dispel these views, affirming that the IMF’s role was limited to offering advice based on the economic environment, not dictating policy decisions.

"The IMF provides directional advice that is designed to assist in the attainment and maintenance of fiscal and external sustainability. In the process of providing advice, we always ensure a range of options is discussed and put on the table," he said.

Clarke also addressed the IMF’s recent decision to reduce its disbursement to Kenya, citing a decline in the country’s balance of payment needs following a successful Eurobond issuance earlier this year.

"Given that the government was successful in its Eurobond issuance early this year, the balance of payment needs declined and as a result, the amount of the disbursement was commensurately reduced," he said.

Further, the IMF cautioned the Kenyan government against excessive borrowing, stressing that any new loans should be part of a broader fiscal strategy aimed at reducing the country's debt vulnerability.

"Kenya’s budgetary arrangements are not built upon a foundation of continually increasing levels of debt," Clarke said.

Although the IMF agreed to conduct governance diagnostics in Kenya, it cautioned that the exercise would not be a quick fix for the country's governance issues. Instead, it would serve as a roadmap for potential reforms. Clarke also mentioned that discussions with various groups, including civil society, would help inform future engagements.

"The Kenyan programme is of extreme importance to the IMF, and it is one of our largest programmes anywhere in the world," he said.

The IMF and Kenya have been working together under a multi-year programme since April 2021, focusing on fiscal consolidation and structural reforms. The latest reviews, completed in November, saw the IMF disburse Sh78.3 billion ($606.1 million).

A ninth review is expected in April next year, with further discussions on the future of the programme to follow. However, the IMF has yet to commit to future programmes with Kenya.

"We have a number of means in supporting Kenya, whether in a programme or outside of it," Clarke said.

Top Stories Today

Reader Comments

Trending