Tax relief boost as KRA slashes fringe benefits rate for workers

Fringe benefits tax applies to employees, directors, or their relatives who receive welfare perks such as low-interest loans from their employers. The tax is charged on the difference between the actual interest paid and the prevailing market interest rate.

Workers receiving additional job benefits, such as subsidised loans, will pay less tax for the next three months after the Kenya Revenue Authority slashed the fringe benefits tax rate to a three-year low.

This comes as a response to the latest cut in the Central Bank of Kenya's (CBK) lending rate aimed at supporting economic recovery.

More To Read

- KIPPRA flags job creation as key concern despite Kenya’s economic growth

- Economic hardships, not just high interest rates, driving digital loan defaults among Kenyan youth

- Kenya enforces mandatory certificate of origin for all imports under new 2025 tax law

- Mang’eni urges Kenyan MSMEs to embrace technology, formalise for global growth

- Sugar prices set to rise as new levy takes effect

- Banks pocket Sh13 billion more from MSMEs driven by higher interest rates – CBK

In a review released on Thursday, the KRA announced the fringe benefits tax will stand at 8 per cent from July to September 2025.

The move follows the CBK’s sixth consecutive rate reduction last month, which brought the base lending rate down from 10 per cent to 9.75 per cent.

Since August 2024, the regulator has lowered the rate by a total of 3.25 percentage points, placing it at the lowest level since June 2023.

Fringe benefits tax applies to employees, directors, or their relatives who receive welfare perks such as low-interest loans from their employers. The tax is charged on the difference between the actual interest paid and the prevailing market interest rate.

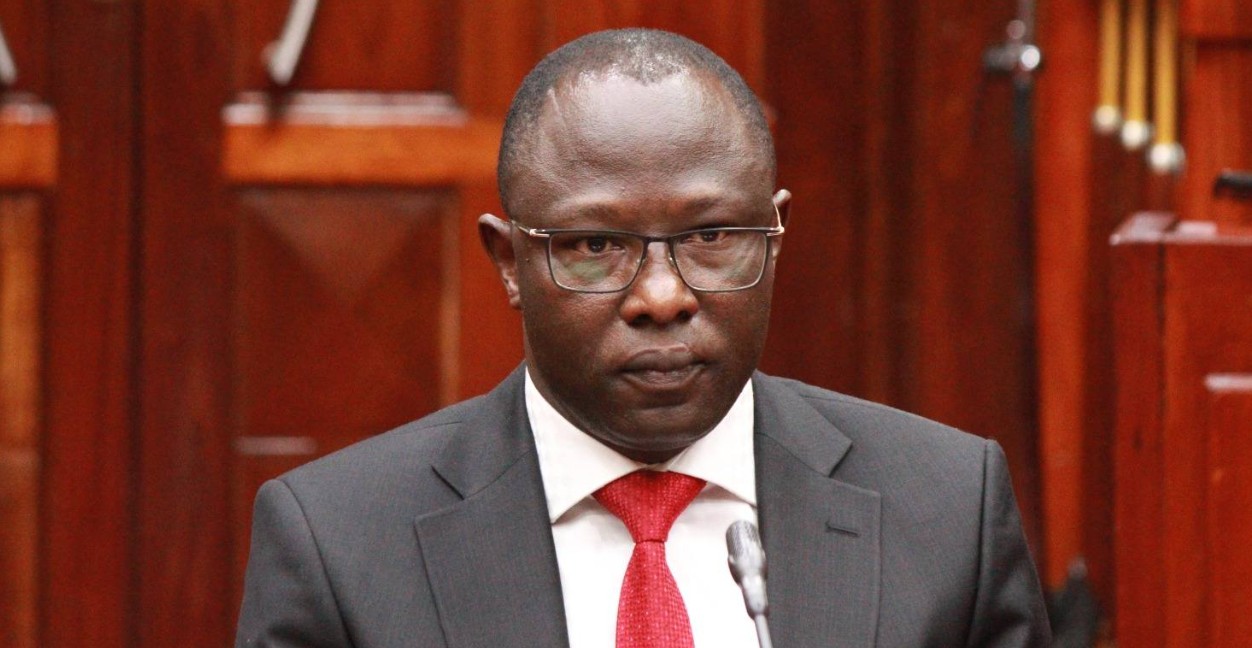

“For the purposes of Section 12B of the Income Tax Act, the Market Interest Rate is eight per cent. This rate shall be applicable for the three months of July, August, and September 2025,” said Rispah Simiyu, the Commissioner for Domestic Taxes at KRA, in a public notice.

The last revision in April had lowered the rate to 9 per cent, which was already a two-year low, down from the 13 per cent that was in place at the beginning of the year.

Under the law, fringe benefits tax is part of an employee’s taxable income, which also includes wages, salaries, and bonuses. The tax must be paid by the employer on or before the 9th of the month following the month the benefit is offered.

In cases where the loan extends beyond the employee's exit from the company, the tax still applies until the loan is cleared. The Commissioner is expected to prescribe the market lending rate every quarter, based on current lending conditions.

The recent tax cut is closely linked to the CBK's efforts to stimulate lending in the private sector and promote broader economic growth. The CBK Monetary Policy Committee last month reduced the base lending rate for the sixth time, citing improved macroeconomic stability.

“The MPC observed that overall inflation was expected to remain below the midpoint of the five plus or minus 2.5 per cent target range in the near term, supported by stability in food and energy prices and continued exchange rate stability,” said CBK Governor Kamau Thugge following the review.

KRA’s decision is likely to ease pressure on employers who offer extra perks and boost disposable income for workers benefiting from employer-backed loans.

Top Stories Today