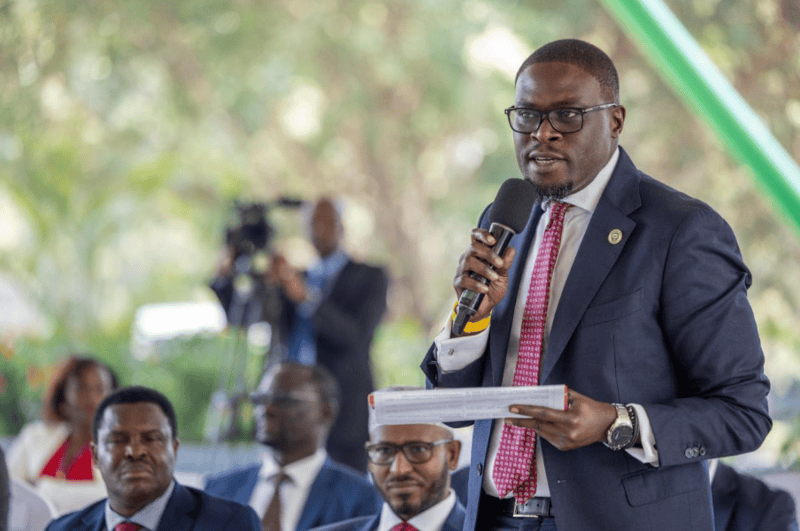

Ombudsman orders Nairobi County to prioritise pension debts in county budget

One of the key recommendations made by the Ombudsman was for Nairobi County to carry out a thorough joint verification of the pension debts.

Nairobi County is under increasing scrutiny following an urgent call from the Office of the Ombudsman to address long-overdue pension debts owed to former workers of the defunct Nairobi City Council.

In a statement issued on Monday, December 15, the Ombudsman urged Governor Johnson Sakaja’s administration to resolve the inherited pension obligations, emphasising that these are non-negotiable despite the administrative transition.

More To Read

- IPOA launches probe as family demands truth over boda boda rider’s death in Nairobi police cell

- Uhuru Park set for food, music and culture as three-day Nairobi Festival kicks off

- Nairobi orders staff to submit academic, professional records by January 15

- Ombudsman orders Agriculture ministry to release sugar mill leasing records or face prosecution

- City Hall opens six-month window to regularise non-compliant properties

- Governor Sakaja unveils six-borough structure to enhance service delivery

The Ombudsman stressed that these arrears must be treated as statutory pending bills and prioritised in the county's budget.

One of the key recommendations made by the Ombudsman was for Nairobi County to carry out a thorough joint verification of the pension debts.

It urged the county to engage with pension administrators, as well as the Office of the Auditor General and the National Treasury, to ensure an accurate and transparent reconciliation process.

Additionally, the Ombudsman proposed that the county adopt a comprehensive and gradual payment plan over multiple years to clear the outstanding arrears.

A clear, time-bound schedule was suggested to ensure that the debts are cleared in a structured manner.

Transparency was another area of concern, with the Ombudsman recommending that Nairobi County provide regular, detailed updates to pensioners about the status of their outstanding payments.

The county was urged to make progress reports publicly available through official channels to ensure that retirees are kept well-informed.

The Ombudsman firmly stated that pension obligations are continuous and do not dissolve due to changes in administrative structures, stressing that these liabilities “survive the restructuring of institutions.”

The recommendation follows complaints from retirees of the Nairobi City Water and Sewerage Company, who have claimed that their pension deductions have not been remitted for years, leaving them financially burdened.

According to the retirees, over Sh4 billion in unpaid pension contributions is owed to various schemes, putting significant strain on their livelihoods.

In response to such concerns, the Senate Select Committee on County Public Investments and Special Funds (CPISFC) formed a Multi-Agency Taskforce in November to investigate discrepancies in pension debt figures reported by counties versus those submitted by pension schemes.

The taskforce’s objective is to reconcile the amounts owed, including principal, interest, and penalties, in line with the legal frameworks that govern the schemes.

The Committee has tasked the taskforce with developing a payment formula that is mutually agreed upon by the National Treasury, the Council of Governors, and pension scheme administrators, so that retirees can finally receive the funds owed to them.

Top Stories Today