30 Saccos flagged over capital gaps by regulator

Among those affected, Metropolitan National, Shoppers, Jitegemee, Jumuika, Lamu Teachers, and Ndosha Saccos have been singled out for having core capital to total assets ratios of less than five per cent half the required minimum.

Thirty regulated savings and credit cooperative societies (Saccos) have been placed on notice for failing to meet the required capital adequacy standards, raising concerns about their financial stability.

The Savings and Credit Cooperative Societies Regulatory Authority (Sasra) has flagged these institutions, warning that their inability to maintain sufficient core capital could expose them to risks.

More To Read

- SACCO lending surges to Sh131.8 billion as demand for land, school fees, farm credit rises

- Sacco auditors face lifetime ban for failing to submit mandatory reports, regulator warns

- More SACCOs register with FRC to fight money laundering, terrorism financing

- SASRA on the spot over alleged mismanagement, wrangles at Nandi Teachers Sacco

- Thousands at risk of loan defaults as employers fail to remit Sh4.2 billion to Saccos

- SACCO members hit by 4 per cent payout cuts in wake of Sh13.3 billion KUSCCO heist

Sasra requires all regulated Saccos to maintain a minimum core capital of Sh10 million. In addition, Saccos must have a core capital to total assets ratio of at least 10 per cent and a core capital to total deposits ratio of at least eight per cent.

The regulator said some Saccos are also not sharing adequate financial information with it and credit reference bureaus, which raises further concerns.

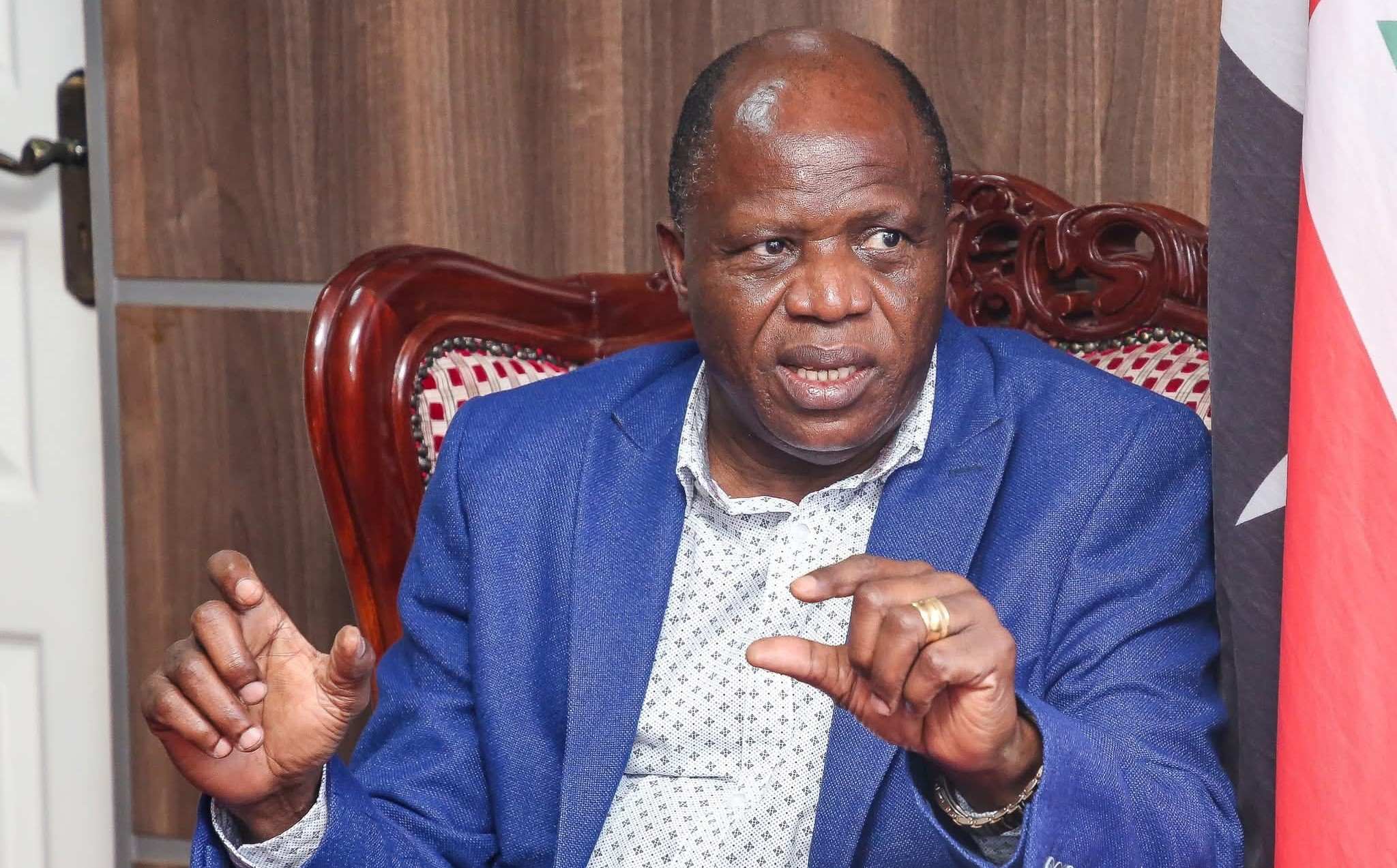

“Out of 355 Saccos we regulate, we have 30 institutions that we have put on heightened supervision for failing to meet the minimum capital requirements, primarily when capital is being eroded you’ll find there are other issues, including the credit risk among others,” said SASRA Chief Executive Officer (CEO) Peter Njuguna.

Among those affected, Metropolitan National, Shoppers, Jitegemee, Jumuika, Lamu Teachers, and Ndosha Saccos have been singled out for having core capital to total assets ratios of less than five per cent half the required minimum.

Their core capital also falls below the Sh10 million threshold, raising further doubts about their financial viability.

Sasra's latest report shows that deposit-taking Saccos experienced a slight drop in capital adequacy ratios in 2023.

Core capital to total assets fell from 16.36 per cent in 2022 to 16.07 per cent in 2023, while core capital to total deposits dropped from 23.90 per cent to 23.26 per cent.

“The foregoing marginal drops showed that Saccos grew their total assets and deposits at faster rates than the rate at which they grew their core capital,” Sasra noted in its report.

The regulator has advised Saccos to adopt strategies that not only boost revenue but also increase retained earnings to safeguard against future financial shocks.

Other Topics To Read

Top Stories Today