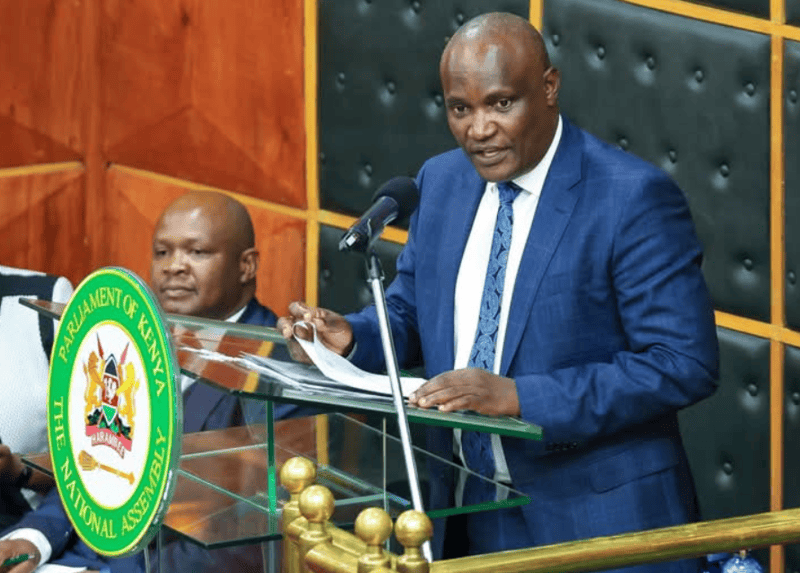

Treasury targets foreign firms in public tenders with fresh tax proposal

According to the Treasury, the move is aimed at tightening tax compliance and ensuring that foreign firms contributing to large public contracts also meet their tax obligations in Kenya.

A new proposal in the Draft Finance Bill, 2025, could see foreign businesses supplying government tenders and scrap metal dealers subjected to withholding tax on their earnings, adding to the existing 16 per cent value-added tax they already pay.

According to the Treasury, the move is aimed at tightening tax compliance and ensuring that foreign firms contributing to large public contracts also meet their tax obligations in Kenya.

More To Read

- Kenya lost over Sh500 billion to tax waivers and corruption- report

- Bill proposes new tax regulations for freelancers, gig workers

- KRA misses revenue target by Sh163 billion in first half of FY 2024-2025

- Kenyans brace for higher taxes as new levies take effect

- Finance Committee concludes public hearings on proposed tax amendment bills

- Public hearings begin on Tax Laws Amendment Bill, 2024

If passed by Members of Parliament, the proposal will expand the tax base to include non-resident suppliers and dealers in imported scrap metal who have previously operated without paying withholding tax. The payments will now be taxed at the source, with the buyer deducting the tax before remitting the remainder to the supplier.

The Finance Bill 2025 specifically proposes to amend the Income Tax Act to include payments for the supply of goods to public entities and the sale of scrap metal as items subject to withholding tax.

“Section 10 of the Income Tax Act is amended in subsection (1), by adding the following new paragraphs immediately after paragraph (k)–(l) supply of goods to a public entity and (m) sale of scrap,” reads the Bill tabled in Parliament last Wednesday.

Under current tax law, a five per cent withholding tax applies to income from professional or management services, royalties, interest, winnings, rent, commission, or other inconsistent income. However, the supply of goods and scrap sales by foreign entities has not previously fallen within this scope.

Tax burden

Foreign suppliers to public agencies already pay VAT at 16 per cent on goods and services rendered, meaning the new withholding tax will significantly increase their overall tax burden.

The Treasury says the amendment is necessary to enhance fairness and accountability in tax collection from firms operating in Kenya’s market, even if they are not based in the country.

The law requires that any person or entity earning income, wholly or partially, from activities in Kenya is liable for tax. However, enforcement has been a challenge, particularly with non-resident companies that often under-report their earnings

Last year, Auditor-General Nancy Gathungu disclosed that over Sh150 billion in taxes had been lost due to companies under-declaring their revenues, highlighting the urgency of stronger compliance mechanisms.

To combat this, the Treasury has been rolling out stricter enforcement measures, such as making it mandatory for all tax-deductible expenses to be supported by an eTIMS receipt, an electronic tax invoice generated by the seller.

The proposed law will now compel buyers of scrap metal and State procuring entities to deduct a withholding tax of five per cent and remit it to KRA before paying suppliers. For foreign suppliers and scrap dealers, this tax will be treated as final, given they are non-resident and have no further tax obligations locally.

This means the KRA will not have another opportunity to audit or scrutinise the operations of these foreign entities once the withholding tax is remitted.

By targeting suppliers who operate from outside the country but profit from lucrative public contracts, the Treasury hopes to close tax loopholes and enhance fairness in tax contributions from all businesses operating in Kenya’s economic space.

Top Stories Today