HELB streamlines loan repayments for both local and overseas borrowers

Beneficiaries can now use the WorldRemit platform to settle their student loans from anywhere in the world.

Kenyans living abroad now have a simpler way to repay their HELB loans, thanks to a new digital channel introduced by the Higher Education Loans Board.

The board has announced that beneficiaries can now use the WorldRemit platform to settle their student loans from anywhere in the world.

More To Read

- Sh19 billion deficit, legal gaps lock out KMTC students from Helb loans

- Varsity students to receive up to Sh60,000 Helb upkeep as state disburses Sh3.32 billion

- Helb to disburse funds under old model as it awaits court appeal outcome

- UON students to hold peaceful protests over HELB delays on Friday

- Attorney General defends new university funding model as fair and effective

- Why MPs want HELB, bursaries and scholarships merged into single fund

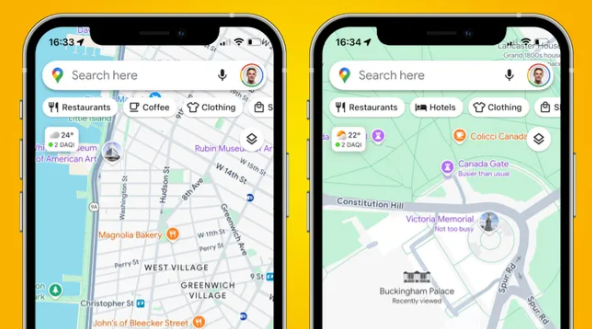

In its announcement on Thursday, HELB shared a full step-by-step guide explaining the process.

“Wherever in the world you may be, we have made it easier for you to make an impact back home. Here is how to pay your HELB loan via WorldRemit,” read the statement.

Process

The process starts by visiting www.worldremit.com and selecting the Bank Deposit option. Borrowers are required to choose between United States Dollars (USD) and Kenyan Shillings before proceeding.

Next, one must enter the preferred amount and use the Kenya Commercial Bank (KCB) account number 1103266314 as the recipient account.

Payments should be made using either a debit or credit card, and the borrower must include their national ID number as the payment reference.

After making the payment, the borrower is expected to send the confirmation email to HELB through either [email protected] or [email protected].

Back home, HELB has also made it easier for individuals and employers to pay their loans. The agency noted that repayments have shifted to the eCitizen platform, where users can settle their dues through a checkoff system.

For individuals, three different platforms are available: the HELB Mobile App, the HELB website portal, and the USSD code *642#.

These tools are meant to simplify the process and ensure convenient repayment.

Apart from digital tools, HELB has partnered with various banks and mobile money services to allow a wide range of payment options for those in Kenya.

These channels are designed to make it easier for borrowers to meet their obligations.

HELB also pointed out that it occasionally gives discounts on penalties for overdue payments, especially for borrowers who choose to pay off their loans in a lump sum. These offers provide relief to defaulters and encourage faster repayment.

By embracing digital platforms both locally and abroad, HELB aims to widen access to repayment services and improve its loan recovery efforts.

Top Stories Today