Kenya Airways blames grounded fleet, weak demand for Sh12.15 billion half-year loss

According to the airline’s financial disclosures, the drop was driven by a 14 per cent decline in passenger numbers and reduced capacity, which cut into revenues.

Kenya Airways blames grounded fleet, weak demand for Sh12.15 billion half-year loss

Kenya’s national carrier, Kenya Airways, has sunk back into loss-making territory, recording a Sh12.15 billion half-year loss to June 2025, a sharp contrast to the profit it registered in the same period last year.

More To Read

- Comesa watchdog probes airlines for withholding refunds on cancelled flights during Covid-19 pandemic

- Kenya Airways to restore Dreamliner service from July 22, 2025, easing international travel strain

- New Kenya–Qatar deal to introduce Mombasa–Doha route, third daily flight to Nairobi

- MPs question Treasury over repayment of KQ’s Sh58 billion loan amid profit report

- Tanzania-bound KQ flight ordered back to JKIA over suspected hazardous leak

- Trader threatens to sue KQ over dispute in unexplained reduction in shares

According to the airline’s financial disclosures, the drop was driven by a 14 per cent decline in passenger numbers and reduced capacity, which cut into revenues.

The airline’s net margin slumped to negative 16.3 per cent, down from a 0.6 per cent profit margin in 2024. This compares with a Sh513 million profit recorded in the first half of last year.

Kenya Airways’ total income for the six months ended June 2025 declined by 19 per cent to Sh74.5 billion, from Sh91.5 billion posted over the same period in 2024, reflecting weaker demand and a reduction in available capacity.

Passenger numbers also dropped from 2.54 million to 2.2 million, while available seat kilometres (ASKs) decreased 16 per cent to 6.72 billion. Revenue passenger kilometres (RPKs) also fell by 19 per cent, mirroring the revenue slump.

As a result, the airline recorded an operating loss of Sh6.24 billion, compared to an operating profit of Sh1.3 billion last year. This translated to a negative operating margin of 8.4 per cent, down from 1.4 per cent in 2024.

While total operating costs eased slightly to Sh80.7 billion from Sh90.2 billion, a reduction of Sh9.45 billion year-on-year, other costs soared to Sh5.97 billion from Sh687 million, placing additional strain on the balance sheet. Interest income rose marginally to Sh35 million, up from Sh23 million, but remained insufficient to offset ballooning expenses.

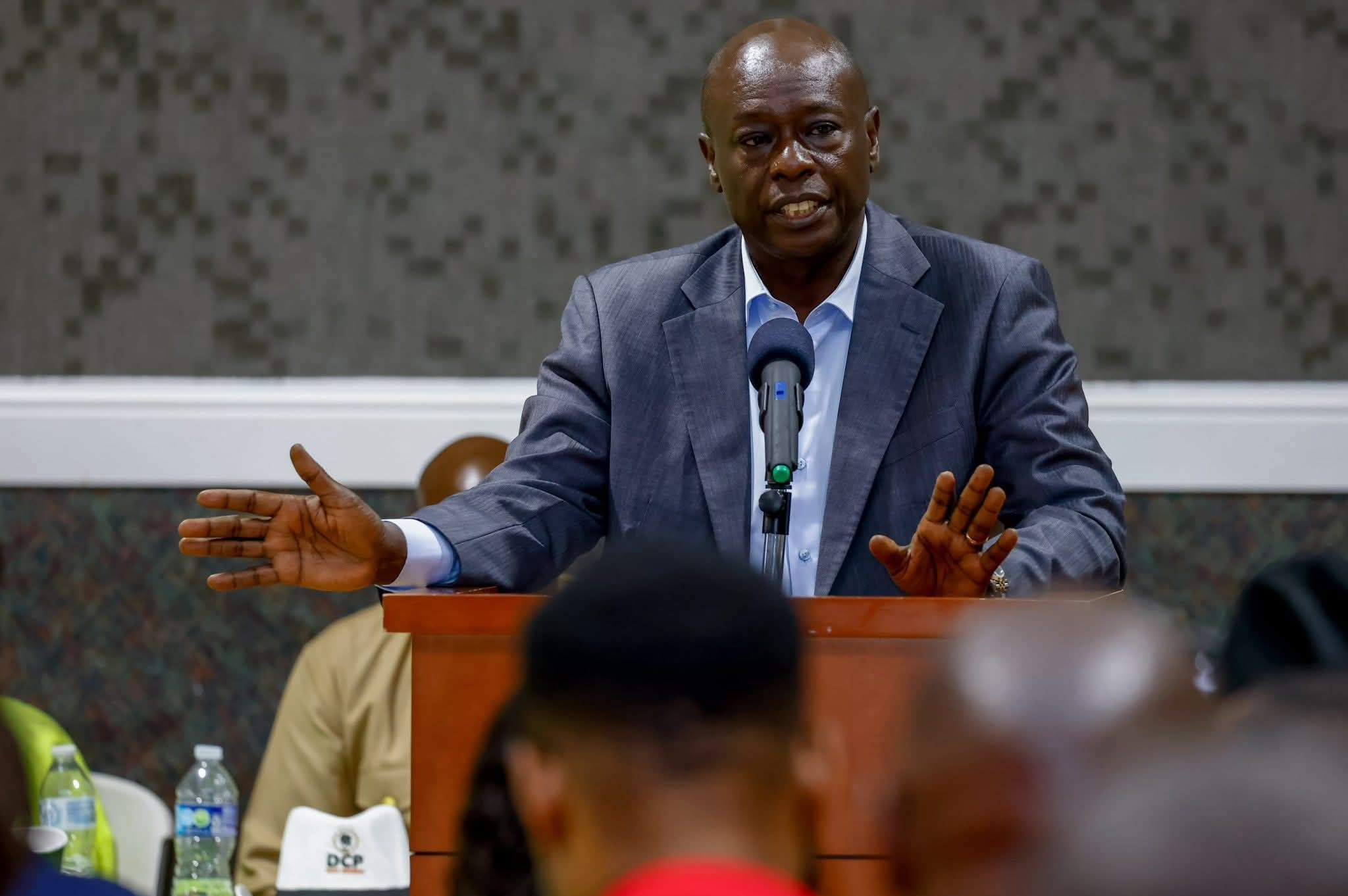

Kenya Airways has attributed part of the setback to the grounding of three Boeing 787-8 Dreamliners for maintenance. Chief Executive Officer Allan Kilavuka said one of the aircraft resumed service in July, and the airline is working to have its full fleet operational by next year.

“We’ve said the minimum that we are gunning for is about half a billion dollars, which we believe is a minimum. That will address the fleet expansions that we’re looking for,” Kilavuka said on Tuesday.

He confirmed that the airline intends to raise at least $500 million (Sh64.5 billion) in extra capital to expand and improve its fleet, with shareholder approval expected by the first quarter of 2026.

The latest results come after Kenya Airways ended 2024 with a Sh5.4 billion profit, the first in more than a decade, compared to a Sh22.6 billion loss in 2023.

The performance was driven by a six per cent revenue growth to Sh188.5 billion, stronger passenger demand, a 25 per cent rise in cargo tonnage, and a foreign-exchange gain of Sh10.55 billion following a stronger shilling.

Despite the relapse into losses, the airline said it is working to address capacity constraints, stabilise operations and improve efficiency to return to a growth path in the second half of the year.

Kenya Airways has been in the red since 2013, sliding into insolvency in 2018 after an aggressive expansion strategy left it with heavy debt. The collapse of global travel during the COVID-19 pandemic, combined with currency depreciation and high interest rates, worsened its financial challenges.

The government has stepped in on several occasions to support the airline, including paying off a $150 million (Sh19.35 billion) loan in January that Kenya Airways owed local banks.

Top Stories Today