IMF vows to support Kenya despite recent wave of deadly protests

In January this year, the IMF granted Kenya a new loan of more than $941 million (Sh121.9 billion) to help reinforce Kenya's finances.

The International Monetary Fund has pledged to continue supporting Kenya to overcome its economic challenges, despite the recent wave of deadly protests.

In a statement on Wednesday, IMF Director of Communications Julie Kozack said they were committed to working with Kenya to chart a course towards robust, sustainable, and inclusive growth.

More To Read

- Kenya and IMF agree to start formal talks on new lending programme

- Kenya to defer Sh88.1 billion IMF funding to next year

- CBK's foreign reserves hit four-year high after IMF boost

- IMF concerned over Kenya's budget shortfall despite proposed new taxes

- IMF warns Kenya over further interest rate cuts, citing risks to economic stability

- Kenya seeks Sh37.6 billion IMF funds cut citing lower financing pressures

"Our main goal in supporting Kenya is to help it overcome the difficult economic challenges it faces and improve its economic prospects and the wellbeing of its people," reads the statement.

IMF also said it was closely monitoring the situation in Kenya and was deeply concerned about the tragic happenings.

"We are deeply concerned about the tragic events in Kenya in recent days and saddened by the loss of lives and the many injuries. Our thoughts are with all the people affected by the turmoil in the country," reads the statement further.

Data from the Police Reforms Working Group (PRWG) released on Wednesday revealed that at least 53 deaths occurred on Tuesday during the anti-Finance Bill, 2024 protests in Nairobi

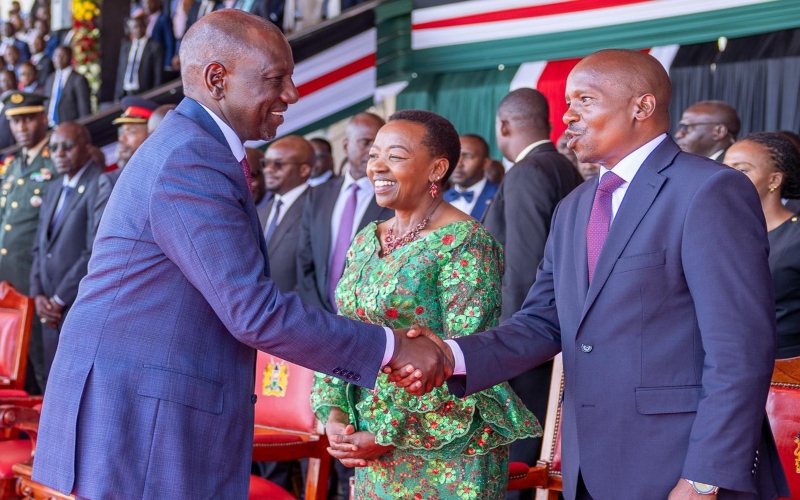

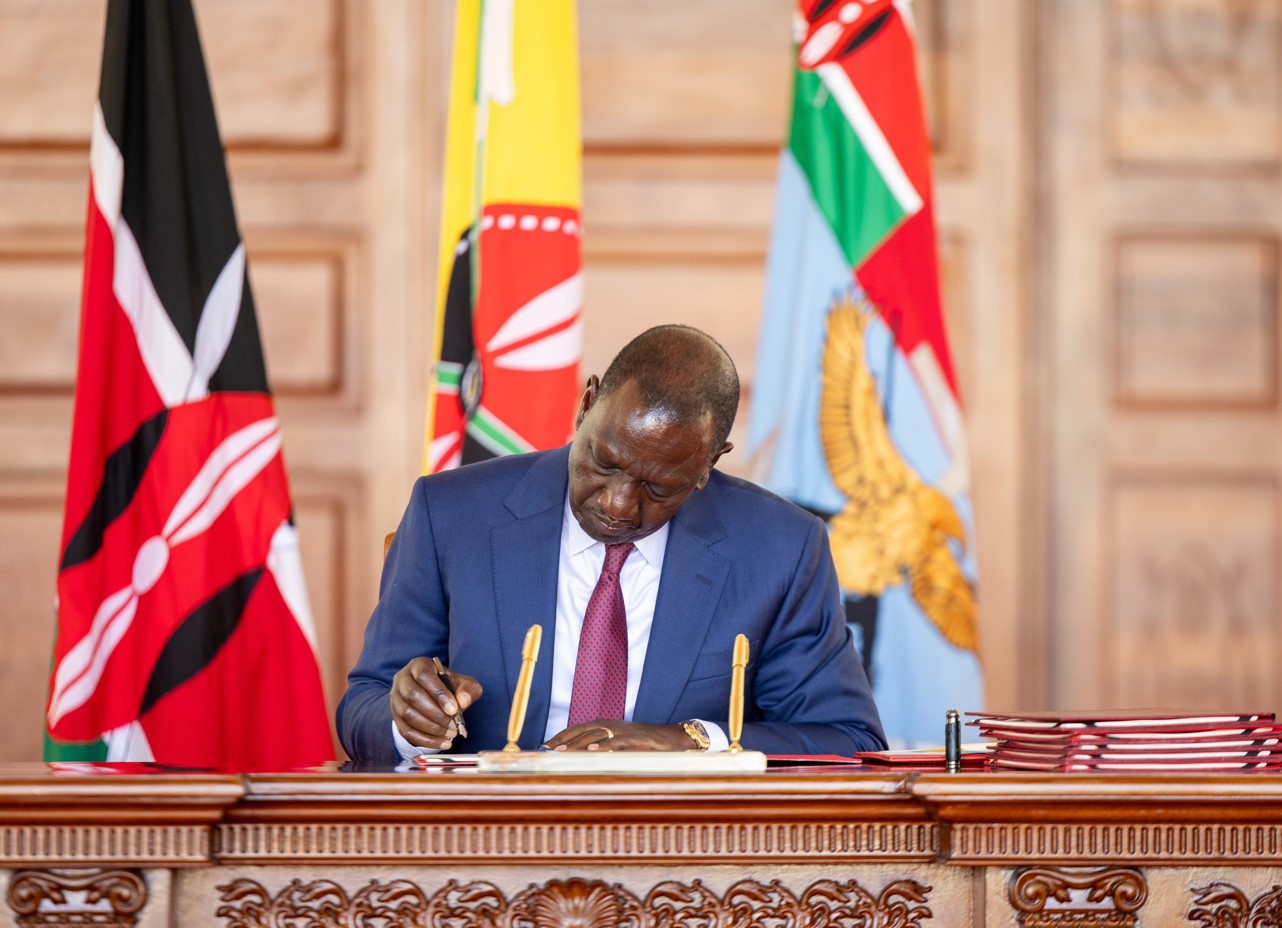

In November 2022, President William Ruto announced he would work with the IMF to ensure sustainable economic growth after holding talks with IMF managing director Kristalina Georgieva in Sharm El-Sheikh, Egypt.

Ruto then said Kenya welcomes the support of the IMF towards building the resilience of the Kenyan economy and ensuring sustainable economic growth.

"We will work with the IMF to help overcome the effects of climate change," he said.

New loan

In January this year, the IMF granted Kenya a new loan of more than $941 million (Sh121.9 billion) to help reinforce its finances.

The Washington-based agency said it forecast Kenya's economic growth at around 5 per cent this year, from an estimated 5.1 per cent in 2023.

"Kenya's growth remained resilient in the face of increasing external and domestic challenges," Antoinette Sayeh, IMF deputy managing director and acting chair, said in the statement.

Kenya has been grappling with acute liquidity challenges amid uncertainty over its ability to access funding from financial markets before a $2 billion (Sh257 billion) Eurobond matures this month.

Last week, Kenya cleared the remaining $556.97 million (Sh71.5 billion) of the $2 billion (Sh257 billion) Eurobond that was due by June 24, 2024.

Figures by the National Treasury's Public Debt Management Office said that the outstanding note was settled on Friday, June 21, three days ahead of the maturity date.

The repayment saw Kenya's National Reserves move above the four-month statutory requirement for the first time in five months.

Top Stories Today