SHA system glitches force hospitals to demand cash payments from patients

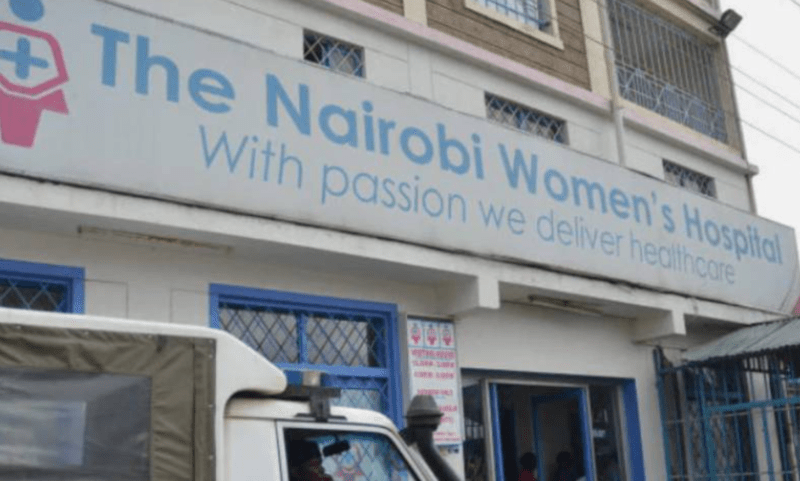

The Nairobi Women’s Hospital has announced that effective immediately, only cash payments will be accepted due to unresolved issues with the SHA system.

Hospitals across the country have raised concerns over the rollout of the Social Health Authority (SHA), citing system failures and unclear debt settlement processes. This has forced many patients to pay for services out of pocket.

The Nairobi Women’s Hospital has announced that effective immediately, only cash payments will be accepted due to unresolved issues with the SHA system.

More To Read

- KNCHR says Kenyans still locked out of healthcare despite Sh138 billion SHA boost

- MPs ditch SHA, the public health scheme they once praised, and opt for private cover

- How Trump–Ruto health deal fills the void left after USAID exit

- MPs demand SHA clears Sh10 billion in pending NHIF bills within three months

- TSC confirms shift to SHA cover for teachers from December 1

- SHA transition sparks tension as teachers cite lack of consultation, legal violations

In a statement issued on Thursday, Barbara Kiugu, Group Finance and Strategy Officer said that as of October 1, 2024, they will no longer be providing services under the National Hospital Insurance Fund (NHIF). The SHA was officially rolled out on the same date.

“During this transition period, we regret to inform you that our institution is not yet able to process claims or offer services under the new SHA system. Unfortunately, the SHA claiming system is not fully functional, preventing healthcare providers from verifying member status, notifying patients for treatment, requesting approvals, or submitting claims,” she said.

The hospital said that the healthcare providers have not been assigned active accounts for the new SHA Electronic Providers Portal and necessary user credentials for accessing the SHA Portal had not yet been issued thus hindering service provision.

"Required biometric devices for patient verification are also unavailable, and the previous NHIF devices are incompatible with the SHA system. Member details, including benefits and the active/inactive status of members, are currently unavailable in the portal, making it impossible to validate patients, the hospital stated.

Concerns over SHA rollout

Various hospitals have raised concerns regarding the rollout of the SHA. The Kenya Renal Association, representing kidney doctors, nurses, and other healthcare practitioners, has warned of the failure to remit claims amounting to close to Sh10 billion, with no clear reimbursement pathway in the now dysfunctional NHIF.

“With the rollout of SHA, we had hoped for improvements in dialysis service delivery and reimbursement,” the association stated.

They noted that they have offered several recommendations to SHA regarding healthcare improvements, including prevention of kidney disease, non-dialysis management of chronic diseases, and the expansion of transplant services.

Other organisations, including faith-based groups, have also raised alarms over the rollout, citing unclear debt settlement processes.

Faith-based medical facilities and the Rural and Urban Private Hospitals Association of Kenya (RUPHA) have rejected the new SHA contracts, citing unresolved concerns over unpaid dues and unfair contractual terms.

Through their Secretary-General, the faith-based organisations' facilities argue that the government has failed to address the payment of over Sh21 billion owed to them by the now-defunct NHIF.

KMPDU Secretary-General Davji Atellah claimed the government's move aimed to benefit private insurers.

"SHIF is a capsizing ship! There is too much bilge water for it to sail. We have repudiated the Act from November 2023, with one message: 'It will deny Kenyans access to healthcare.' NHIF was superior to all other private-sector insurance plans, and the stoppage seems designed to benefit private insurance companies," he stated.

Top Stories Today