CBK admits it lacks authority to shut illegal county bank accounts

This loophole has led to a sharp increase in county accounts at commercial banks. A recent report by Controller of Budget Margaret Nyakango revealed that by March 2025, counties had opened 1,763 new accounts over 12 months, pushing the total to 3,431.

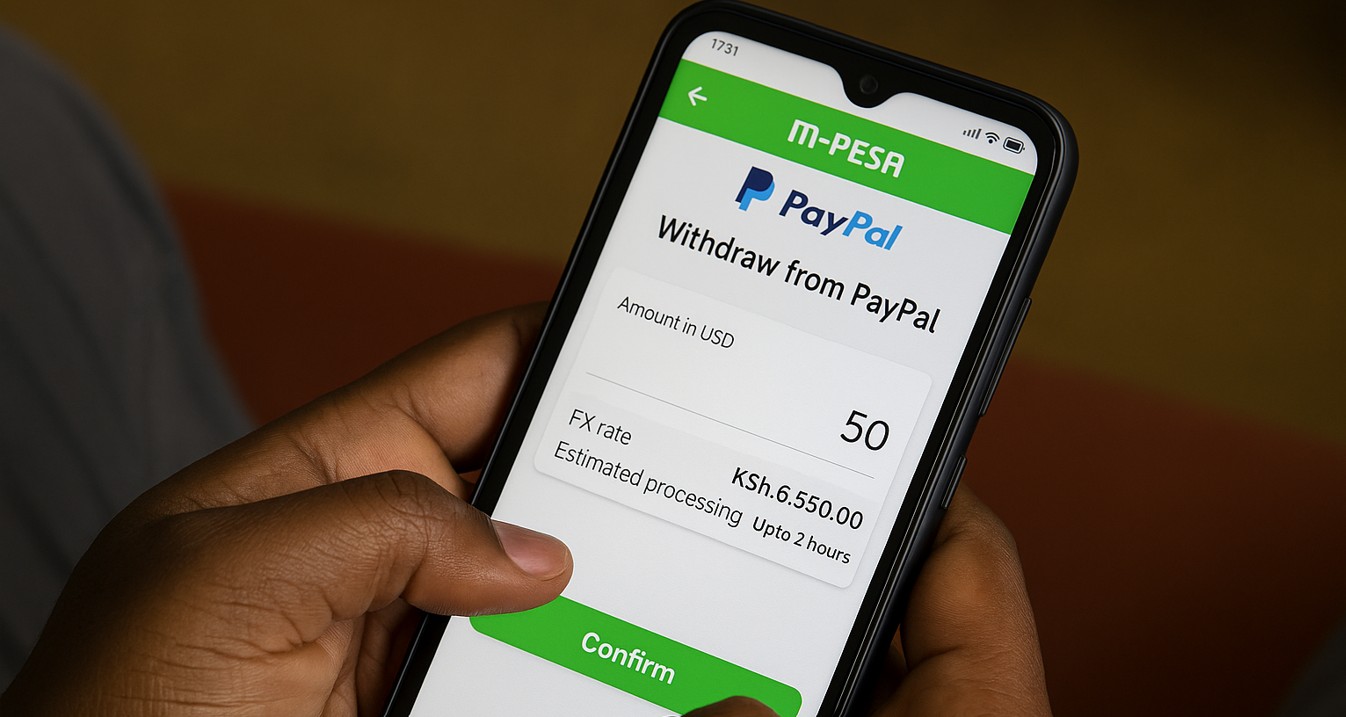

The Central Bank of Kenya has disclosed it cannot take action against counties operating unlawful bank accounts in commercial banks due to the lack of a clear legal mandate, exposing serious weaknesses in public finance oversight at the devolved level.

Appearing before the Senate Standing Committee on Devolution and Intergovernmental Relations on Thursday, CBK Governor Kamau Thugge said the bank is unable to enforce the closure of unauthorised accounts since the current law does not empower it to do so.

More To Read

- CBK set to monitor county transactions in real time to curb corruption

- Parliament to vet Pius Angasa for CBK board appointment after Ruto's nomination

- Governors, MCAs feud derails devolution, stall key projects

- Counties under pressure as Treasury moves to curb misuse of funds with new single account system

- Controller of Budget halts funds to counties over expired bursary, loan programmes

- Report reveals State House blew Sh1 billion on local travel in nine months

His remarks followed a question by vice chairperson Catherine Mumma, who had sought to understand CBK’s role in managing the growing concern over county accounts. Thugge pointed to regulatory loopholes that counties are now using to escape scrutiny.

“Just to identify some of the challenges that we face, one is the enforcement limitation that there is a lack of a direct mandate by CBK to compel county governments to close unauthorised accounts,” he told the committee.

While the 2015 County Government Public Finance Management regulations require that all county accounts, except petty cash (imprest) accounts, be held at the CBK, Thugge noted that counties have exploited unclear sections in the main Public Finance Management Act to justify opening accounts in commercial banks.

He said the law allows county treasuries to open accounts without indicating where they must be held.

“They are using that legal gap to open accounts wherever they wish. The regulations say one thing, but the law is not explicit on enforcement or limitations,” Thugge said during the session chaired by Senator Mohamed Abass.

This loophole has led to a sharp increase in county accounts at commercial banks. A recent report by Controller of Budget Margaret Nyakango revealed that by March 2025, counties had opened 1,763 new accounts over 12 months, pushing the total to 3,431.

Thugge warned that vague and conflicting provisions between the PFM Act and its regulations have allowed counties to continue bypassing the CBK, despite the regulations being clear on where funds should be kept.

He also cited operational challenges, saying the CBK’s limited physical presence makes it difficult for counties in far-flung areas to access its services.

He added that weak coordination between oversight institutions like the Office of the Auditor General and the Controller of Budget has further complicated efforts to hold counties accountable for how and where they manage public funds.

Top Stories Today