SMEs sound alarm over rising failure rates amid investment gaps

Entrepreneurs lament that despite their critical role in job creation and local value chains, they still struggle to attract meaningful financing or form partnerships that would allow them to scale.

Small and medium-sized enterprises (SMEs) have raised concerns over slowed investments and limited collaboration in the counties.

They reckon that these two constraints continue to hold back their growth prospects, especially this year.

More To Read

- Grade 10 textbook supply at risk as Sh11 billion debt stalls printing

- KAM CEO Tobias Alando warns instability in Tanzania threatens regional trade

- Nairobi’s 'pencil man': Ignatius Otieno story of resilience, unique hustle

- Kagwe and Oparanya push for digital coffee auction, target triple production

- Treasury disburses Sh2.6 billion to boost recovery of MSMEs

- Oparanya: Hustler Fund loan defaulters to be locked out of bank, SACCO loans

Speaking during this year's national Business Ecosystem Summit in Kisumu, entrepreneurs at the forum said that despite their critical role in job creation and local value chains, they still struggle to attract meaningful financing or form partnerships that would allow them to scale.

Their concerns come amid mounting evidence that Kenya’s startup landscape remains one of the toughest in the region.

Recent reports show that a majority of local and small enterprises fail to achieve full transition into medium or large companies, an outcome heavily tied to financing gaps, policy bottlenecks and fragmented support structures.

Insights published by the Kenya Association of Manufacturers (KAM) SME Hub in April revealed that only 2 per cent of startups born in Kenya manage to grow through the full cycle, compared to a five per cent global average.

The fragility of Kenyan enterprises is further underscored by data from the Communications Authority of Kenya (CA), which shows that nearly 80 per cent of startups collapse within their first year, and only three to five per cent survive beyond that period.

For SMEs gathered in Kisumu, these statistics illustrate the consequences of underinvestment and the lack of structured collaboration, issues they say must be urgently addressed if small businesses are to realise their economic potential.

The summit convener and CEO of The IMC People, Jeanette Oromo, echoed the concerns raised by SMEs, calling for rapid deployment of capital into the sector.

“The momentum we are witnessing at the 2025 Business Ecosystems Summit must translate into tangible investments and partnerships. It is time to move beyond rhetoric and actively deploy capital into MSMEs,” Oromo said.

She added that access to financing remains the biggest obstacle for millions of enterprises operating across the country, noting that unlocking SME growth will require innovative financing models, patient capital and inclusive value chains.

Other business heads emphasised that counties must play a more active role in improving the business environment through predictable regulation and investment-friendly policies.

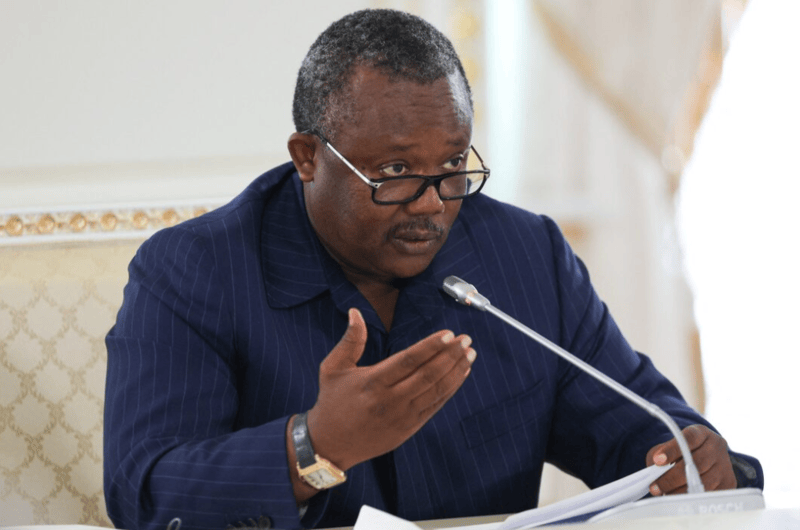

Kisumu Governor Peter Anyang’ Nyong’o said the return of major business gatherings, such as the Business Ecosystem Summit and other regional events, signals that devolved units can help attract partnerships if they demonstrate readiness.

“This demonstrates that Kisumu and the Lake region are open, competitive and strategic for business,” Nyong’o said.

As the summit enters its final sessions today, SME owners are calling for the collaboration and investment commitments made in Kisumu to be matched with concrete action throughout the coming years.

They insist that sustained platforms for market access, financing and industry collaboration are essential if Kenyan enterprises are to break the cycle of stagnation and high failure rates.

Top Stories Today