Nairobi unveils bold compliance, digitisation drive to fund Sh44.6 billion budget without raising taxes

The county expects these measures to generate billions in revenue by unlocking dormant property value, enforcing timely payments, and broadening the tax base through enhanced data mapping.

Nairobi residents can expect a wave of compliance measures, digitised service platforms, and property regularisation reforms as the county unveils an ambitious strategy to fund its Sh44.6 billion 2025/2026 budget, without imposing any new taxes.

The county expects these measures to generate billions in revenue by unlocking dormant property value, enforcing timely payments, and broadening the tax base through enhanced data mapping.

More To Read

- Nairobi women caucus fault Ruto, Raila for scuttling Sakaja's impeachment

- Revealed: Mediated pact that halted Governor Johnson Sakaja’s impeachment

- Lobby calls for Nairobi County dissolution following audit revelations

- Legal experts warn top politicians against saving governors from impeachment

- Inside Raila Odinga’s bid to save Governor Johnson Sakaja from impeachment

- Raila summons ODM MCAs as Governor Johnson Sakaja faces impeachment threat

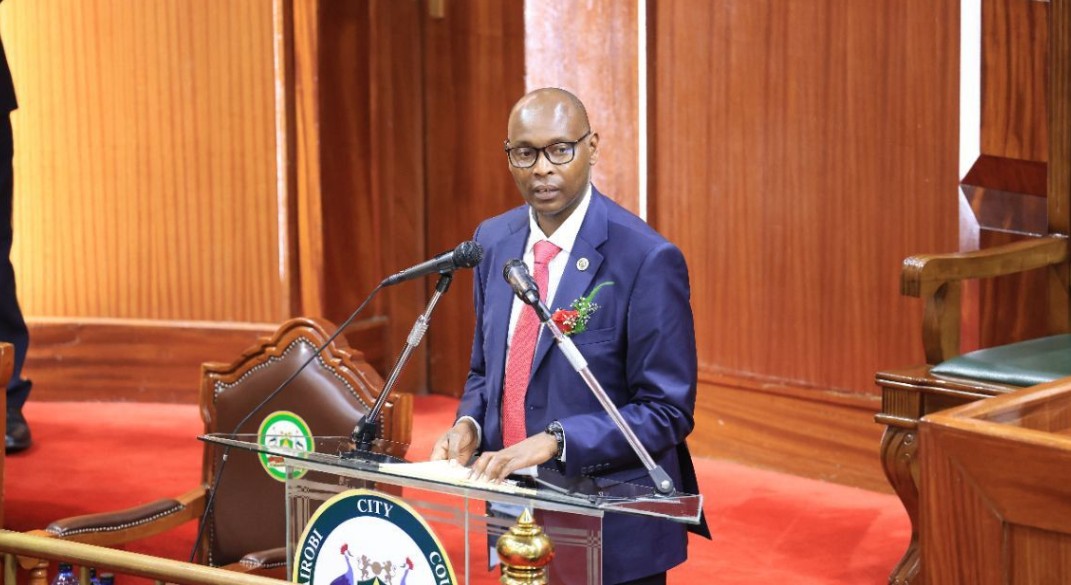

Nairobi’s Finance and Economic Planning CEC Charles Kerich, who presented the budget to the County Assembly, outlined the strategies that Governor Johnson Sakaja’s administration will implement to meet its revenue targets.

Kerich revealed that the county had recently collected Sh13.8 billion in revenue, its highest ever, without adjusting taxes or fees, a milestone that he said proves Nairobi can fund development through reforms rather than increased taxation.

A key pillar of the plan is the Regularisation of Illegal Developments Bill, recently passed by the County Assembly and now awaiting Governor Sakaja’s assent. The law offers a formal pathway for developers who constructed buildings without approval to legalise them and integrate them into the county’s official planning framework.

“This will provide a pathway for buildings already constructed to be approved and brought into the formal system. We expect to raise at least Sh5 billion through this,” Kerich said.

Sectional property titles

The county also plans to roll out sectional property titles in collaboration with the national government during the current financial year. The initiative aims to unlock dormant value in under-documented properties and encourage full legal ownership.

“This initiative will unlock property ownership and enhance compliance. From this, we expect revenue of not less than Sh2 billion,” he noted.

To promote accountability and service payment discipline, the county will introduce penalties for residents and businesses that delay payments.

Kerich clarified that while charges will not be increased, the penalties are meant to curb non-compliance and ensure services are paid for on time.

“We are not increasing the cost of services, but we will now introduce penalties for non-compliance. This ensures accountability without overburdening residents,” he explained.

The county is also launching a comprehensive data-mapping initiative to document all land parcels, buildings, and businesses across Nairobi. The goal is to expand the tax base by identifying more revenue sources and ensuring broader participation in the city's revenue system.

“This will help us bring more people into the revenue system and reduce reliance on a few compliant entities,” Kerich said.

Digital infrastructure

To support the reforms, the administration is investing in digital infrastructure that will allow Nairobians to access and pay for services more easily and transparently.

“We want to make it easier for residents and businesses to pay for services by investing in more open and accessible platforms. This will improve compliance and reduce the cost of doing business in Nairobi,” Kerich said.

Governor Sakaja’s administration is confident that the proposed reforms will strengthen revenue collection, plug wastage, and improve service delivery, without adding pressure to residents already coping with the high cost of living.

The budget includes Sh31.2 billion for recurrent expenditure and Sh13.4 billion for development.

The development allocation represents 30 per cent of the total budget, in line with the Public Finance Management Act, 2012, which requires counties to allocate at least 30 per cent of their budgets to development.

The county collected Sh13.7 billion in the 2024/2025 financial year, up from Sh12.8 billion in the previous year and Sh12.1 billion in 2022/2023. This reflects a steady rise from Sh10 billion collected in earlier years.

Top Stories Today