Relief for Kenyans as KRA announces new tax amnesty programme

The initiative is expected to alleviate financial challenges faced by taxpayers while promoting compliance with tax laws. It represents a critical step in the government's efforts to create a fair and efficient tax environment.

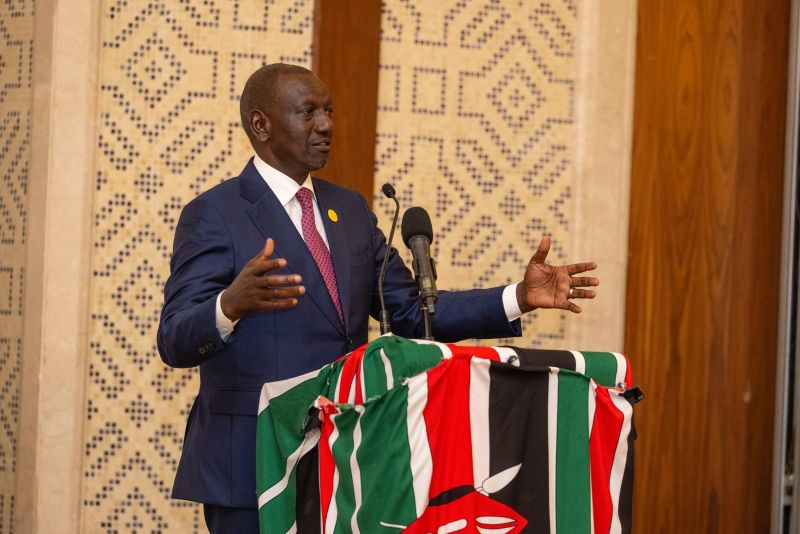

The Kenya Revenue Authority (KRA) on Friday issued a public notice informing Kenyans about the tax amnesty programme made possible by the Tax Procedures (Amendment) Act, 2024 which was signed into law by President William Ruto early this month.

The initiative aimed at easing financial burdens for taxpayers with interest and penalties accrued up to the end of 2023, will run from December 27, 2024, to June 30, 2025.

More To Read

- Oburu’s DP position condition to Ruto unsettles Kindiki’s base

- Ruto admits Kenya is rationing electricity, says at least Sh1.2 trillion needed to boost capacity

- Ruto amplifies Africa’s voice, calls for justice and inclusion at Doha summit

- President Ruto urges global unity to fight poverty, inequality at Doha summit

- Kenyans to replace lost IDs for free as Government gazettes six-month waiver on fees charged

- KRA’s official X account hacked, public warned against fraudulent posts

Under the programme, taxpayers who have fully paid all principal taxes due by the end of 2023 will automatically receive a waiver on related penalties and interest. No formal application will be required for this category, ensuring a seamless process for eligible individuals.

An application will, however, be required for those who have not settled their principal taxes for the eligible period.

"A person who has not paid all the principal taxes accrued up to December 31, 2023, and is unable to make a one-off payment for the outstanding principal taxes will be required to apply to the Commissioner for the amnesty and propose a payment plan for any outstanding principal taxes, which should be paid by June 30, 2025," read part of the notice from the Commissioner for Domestic Taxes Rispah Simiyu.

The initiative is expected to alleviate financial challenges faced by taxpayers while promoting compliance with tax laws. It represents a critical step in the government's efforts to create a fair and efficient tax environment.

Taxpayers seeking clarification or assistance with the amnesty programme are encouraged to visit their nearest Tax Service Office or reach the authority through the contacts listed on their website.

Top Stories Today