Auditor-General flags Sh179 million lying idle in pension fund for European widows

The Auditor-General also questioned why the idle funds were not invested in interest-earning accounts, estimating a missed opportunity to earn Sh21 million in interest.

The Office of the Auditor-General has raised concerns over Sh179 million lying idle at the Central Bank of Kenya (CBK) meant to support the widows and children of deceased European officers in the East African Service.

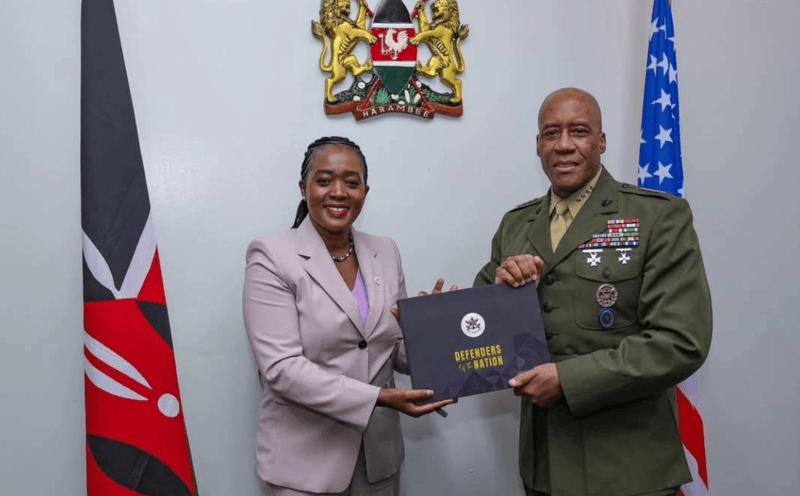

According to Auditor-General Nancy Gathungu, the National Treasury had retained this balance under the European Widows and Orphans Pension Fund by the end of the 2023-2024 financial year.

More To Read

- Government clears Sh118.3bn pending bills in Q1 2025 as Treasury pushes to cut arrears

- Sh46.5 billion equalisation fund shortfall denies marginalised counties critical services

- NPSC opposes MPs’ bid to redirect Sh833m from police insurance to settle idle hospital debt

- Sh876bn fiscal deficit leaves no room for extra spending in 2025/26 budget, MPs warn

- Treasury tightens PPP rules amid public outrage over secretive infrastructure deals

- Delayed payments cost taxpayers Sh4.3bn in avoidable interest, says Auditor-General

However, records show that only one surviving beneficiary received Sh54,264 during the period.

This has raised questions about why such a large sum remains allocated to a fund with just one beneficiary.

The Auditor-General also questioned why the idle funds were not invested in interest-earning accounts, estimating a missed opportunity to earn Sh21 million in interest.

Interestingly, Gathungu noted that the National Treasury had sought guidance from the CBK on potential investment avenues. However, the matter had not been resolved as of the November 2024 audit.

"Although management has indicated that the National Treasury had sought guidance from the Central Bank of Kenya on how to invest the funds, the matter had not been concluded as at the time of the audit in November 2024. the circumstances, the effective use of the funds held in the bank could not be confirmed," the report reads.

The Auditor-General also raised concerns about the Asian Officers Family Pensions Fund, which has been operating for years without a board of trustees, in violation of the law.

This fund was established to provide pensions for the families of Asian officers who served in the Kenyan government.

In addition, the audit revealed that Sh1 billion meant for provident funds remains unused at the CBK.

The report indicates that no payments were made in the last financial year, as there were no surviving members or beneficiaries as of June 30, 2024.

A provident fund is designed to provide financial support to employees upon retirement or to their dependents in case of death.

The Auditor-General questioned why these funds were not invested in interest-bearing instruments, estimating a potential loss of Sh122 million, based on the CBK's average interest rate of 11.875 per cent.

These revelations come at a time when Kenya is grappling with fiscal challenges due to debt-financed projects and investments.

The country's public debt ratio has surged from 41 per cent of GDP in 2014 to 69 per cent in 2024.

Top Stories Today