Draft Finance Bill, 2025 formally tabled in National Assembly following Cabinet approval

National Assembly Speaker Moses Wetang'ula confirmed its receipt along with the 2025/26 Budget Estimates, which include key revenue-raising measures for the upcoming fiscal year.

The draft Finance Bill, 2025, was officially tabled in Parliament on Tuesday, following Cabinet approval.

National Assembly Speaker Moses Wetang'ula confirmed its receipt along with the 2025/26 Budget Estimates, which include key revenue-raising measures for the upcoming fiscal year.

More To Read

- National Treasury officials fail to explain Sh73 billion budget gap

- Treasury projects Sh4.49 trillion budget for 2025/26 financial year

- Wasted billions: How President Ruto's administration spent Sh54bn of taxpayers' money

- MPs warn of disruption to Parliamentary functions after Sh3.7 billion budget cut

“Honourable members, I wish to inform the House that I have received the Draft Finance Bill 2025 from the Cabinet, which relates to the revenue-raising measures for the Budget submitted,” stated the Speaker.

The Bill will now be examined by various parliamentary committees before further debate.

Speaker Wetang’ula, in his communication to Parliament, emphasised that the National Assembly is required by the Constitution and the Public Finance Management Act to consider the estimates of revenue and expenditure for the national government, Parliament, and the judiciary.

"In accordance with Article 221 of the Constitution, together with Section 39 of the Public Finance Management Act 2012, it is the constitutional duty of the National Assembly to consider the revenue and expenditure estimates of the national government, Parliament, and the judiciary for each financial year,” said the speaker of the National Assembly.

Once approved, the estimates will form the foundation for the Annual Appropriation Act. He also clarified that the Finance Bill had been referred to the Departmental Committee on Finance and National Planning for public participation and further consideration.

"Honourable Members, as you may be aware, the estimates have now been submitted and tabled before the National Assembly in accordance with the law. Once approved, these estimates will form the basis of the Annual Appropriation Act. Pursuant to Standing Order 235, they now stand committed to the respective departmental committees and the Budget and Appropriations Committee for consideration."

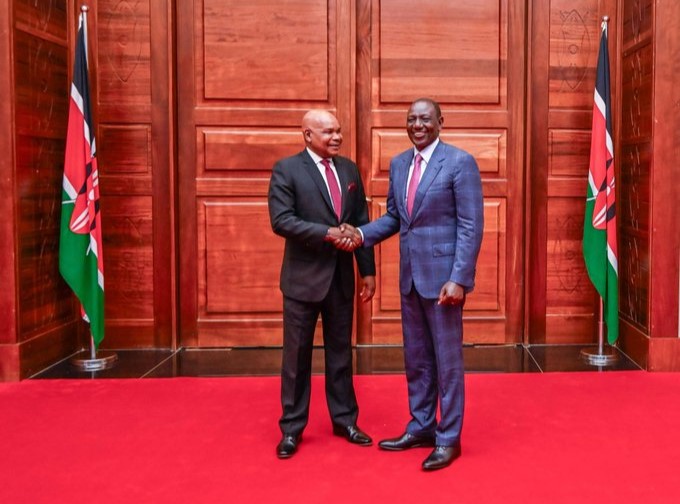

National Assembly Speaker Moses Wetang’ula during a past House session. (Photo: National Assembly)

National Assembly Speaker Moses Wetang’ula during a past House session. (Photo: National Assembly)

Minority Leader Junet Mohamed addressed the issue of public misinformation surrounding the Bill, following the circulation of unofficial versions over the past few months. He urged Kenyans to disregard any misleading claims or discussions that have been circulating in public forums.

He emphasised that the version of the Finance Bill now in Parliament is the official one, warning against the misrepresentation of its contents, particularly concerning any new taxation measures.

He called on all members of Parliament to refrain from spreading false information and instead focus on clarifying the Bill's contents for the public.

The Finance Bill, 2025, introduces key changes to streamline the tax system. It proposes amendments to the Income Tax Act, VAT Act, Excise Duty Act, and the Tax Procedures Act. These changes are aimed at addressing delays in revenue collection and cutting down on legal disputes related to taxation.

“Key provisions include streamlining tax refund processes, sealing legal gaps that delay revenue collection, and reducing tax disputes by amending the Income Tax Act, VAT Act, Excise Duty Act, and the Tax Procedures Act,” the cabinet despatch read.

Among the notable reforms is a move to improve the tax refund process, making it more efficient and reducing delays that have affected both individuals and businesses.

The government seeks to remove legal grey areas that have allowed prolonged disputes, which often delay the flow of revenue to the National Treasury.

To support small enterprises, the Bill, according to the cabinet, offers a major incentive by allowing them to fully deduct the cost of everyday tools and equipment in the year of purchase.

This will help eliminate the long waits currently experienced when applying for tax relief, enabling businesses to free up cash flow and focus on growth.

Additionally, the Bill provides a major win for retirees. All gratuity payments—whether from public service or private pension schemes—will now be fully exempt from taxation. This measure aims to secure financial dignity for retirees and ease the burden on senior citizens after years of service.

The Bill also introduces a mandatory requirement for employers to automatically apply all eligible tax reliefs and exemptions when calculating Pay As You Earn (PAYE) taxes. This change addresses the ongoing issue where many employees miss out on tax reliefs because employers fail to apply them, forcing workers to manually seek refunds from the Kenya Revenue Authority.

“Employers will also be required to automatically apply all eligible tax reliefs and exemptions when calculating Pay As You Earn (PAYE) taxes for employees. Currently, many employers omit these reliefs, forcing employees to seek refunds from the Kenya Revenue Authority,” reads the despatch.

According to the Cabinet, these reforms are aligned with the Bottom-Up Economic Transformation Agenda (BETA) and represent a firm step by the government to build a fairer and more inclusive economic system.

While the Bill does not propose new tax increases, it is designed to maximise the effectiveness of existing tax systems and ensure that every shilling due to the government is collected and used transparently. By plugging loopholes and boosting compliance, the government hopes to enhance fiscal responsibility and restore public confidence in the tax regime.

Top Stories Today