Government clears Sh118.3bn pending bills in Q1 2025 as Treasury pushes to cut arrears

According to Treasury data, the reduction is partly attributed to the ongoing settlements in the infrastructure docket.

The government cleared Sh118.3 billion in pending bills during the first quarter of 2025, stepping up efforts to address long-standing arrears across major ministries and state departments.

Data from the National Treasury shows that the total outstanding debt fell from Sh539.9 billion at the end of 2024 to Sh421.6 billion by the end of March this year.

More To Read

- MPs push for urgent funding boost for Auditor General’s office

- Government road repairs fall to six-year low as funding cuts bite

- Judiciary faces Sh576.6 million pending bills amid budget review

- Treasury under fire for using Sh2.67 trillion in domestic loans on recurrent spending

- National Treasury secures Sh437.8 billion loan to plug budget deficit

- MPs raise alarm over alleged misappropriation of College of Insurance land

The drop follows a renewed push by the Exchequer to settle verified arrears, with ministries and state departments receiving approval to begin payments. Arrears related to the roads sector are paid separately through proceeds of a bond to be floated by the Kenya Roads Board (KRB).

According to Treasury data, the reduction is partly attributed to the ongoing settlements in the infrastructure docket.

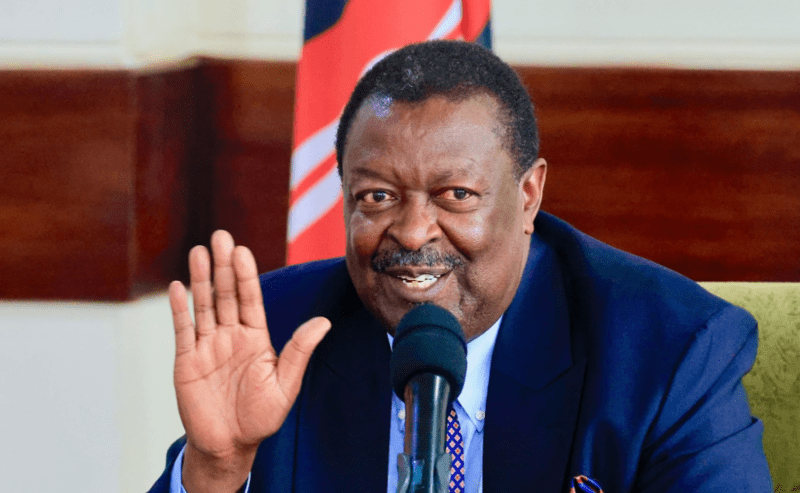

Treasury Cabinet Secretary John Mbadi confirmed that the state had begun clearing Sh80 billion worth of approved road-related bills, using proceeds from the road maintenance levy.

“About Sh80 billion of the approved bills relate to the road sector, and we have started settling those bills using the securitisation of the Sh7 per litre road maintenance levy,” Mbadi said.

“Pending bills are coming down partly because of the road sector settlements. For the balance of Sh148 billion, we are working to make a proposal to the Cabinet to settle the bills. By the time we get the approval, the committee will be done with the verification, and we can add approved pending bills to the balance to be settled.”

Cleared to begin payments

Mbadi added that ministries and departments, particularly those handling sensitive portfolios such as the Ministry of Defence, have already been cleared to begin payments.

The latest report from the Pending Bills Verification Committee shows that Sh578 billion out of the submitted Sh663 billion had been verified as of March. However, only Sh229 billion was certified for payment, which includes the Sh80 billion earmarked for the road sector.

The national government’s pending bills had hit a peak of Sh630.6 billion in September 2023, before starting to decline in subsequent months. The Sh421.6 billion pending as of March 2025 comprises Sh162 billion in recurrent expenditure and Sh259.7 billion in development-related obligations. These include amounts owed to contractors and suppliers, unremitted statutory deductions, and pension arrears owed to the Local Authorities Pension Trust.

Historical arrears

According to the Treasury, the largest portion of state corporations’ pending bills is linked to contractors and suppliers. In contrast, ministries, departments and agencies (MDAs) are largely dealing with historical arrears.

To further address the pending bills in the roads sector, the KRB has been cleared to issue a Sh135 billion bond. Proceeds from the bond will go directly toward settling infrastructure-related arrears.

Investors in the bond will be compensated through the Roads Maintenance Levy Fund, which was increased in July 2024 from Sh18 to Sh25 per litre. While the pricing of the bond is still under discussion, Treasury officials have indicated that it may be set at around 1.5 percentage points above the prevailing 91-day Treasury bill rate.

Other Topics To Read

- National

- National Treasury

- John Mbadi

- pending bills

- Road Maintenance Levy

- Treasury Cabinet Secretary

- Pending Bills Verification Committee

- Roads Maintenance Levy Fund

- Trade and Development Bank

- outstanding national debt

- Government clears Sh118.3bn pending bills in Q1 2025 as Treasury pushes to cut arrears

- Headlines

The proposed bond is part of a broader plan by the Kenya Kwanza administration to address the growing backlog of pending bills.

In its manifesto, the government pledged to hire a transaction advisor to guide the securitisation of verified arrears, aiming to ease pressure on the annual budget through off-budget settlements.

The regional development finance institution, the Trade and Development Bank, is arranging the bond.

Top Stories Today