Salaried workers to bear high PAYE burden as Treasury shelves tax relief plan

Mbadi said the Treasury was also considering a reduction in corporate tax rates from 30 per cent to 28 per cent, but this too was shelved due to similar revenue concerns.

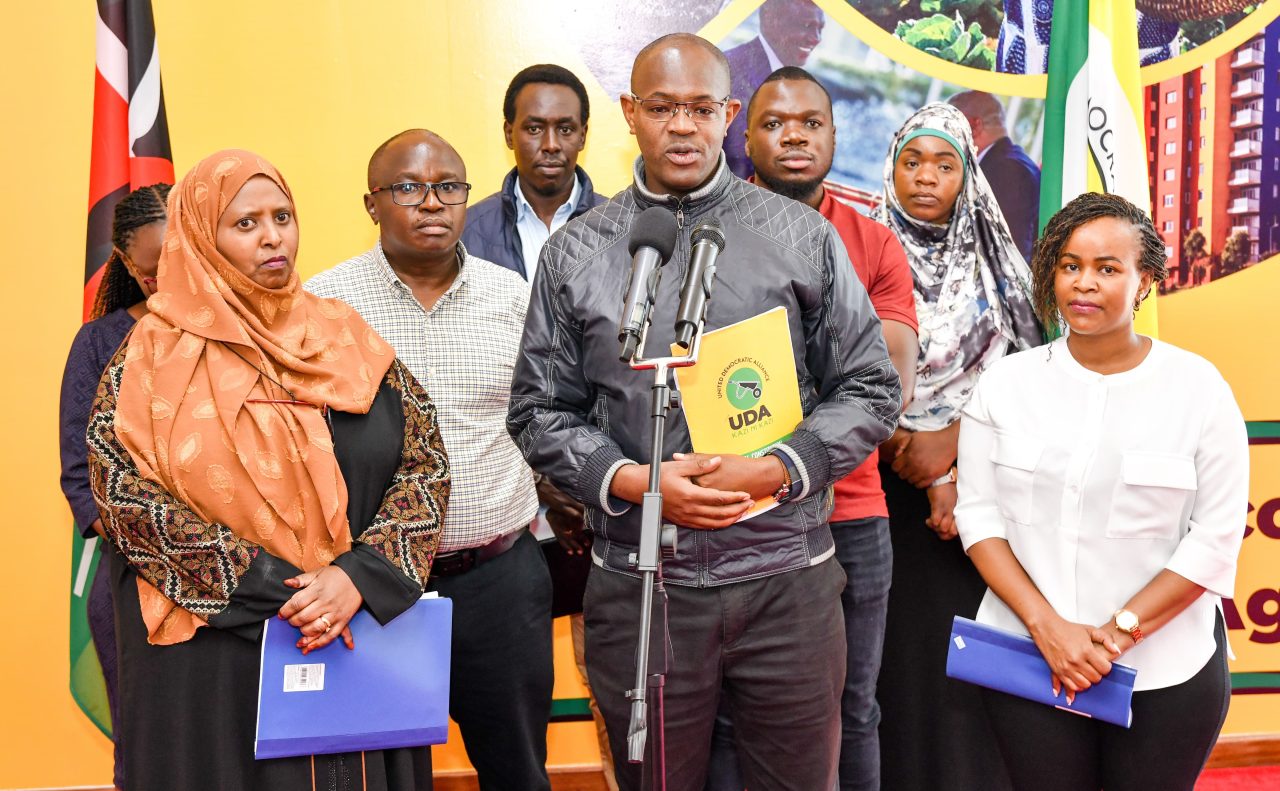

Kenyan workers will continue to face steep Pay As You Earn (PAYE) deductions after Treasury Cabinet Secretary John Mbadi announced that a proposed tax relief measure was scrapped from the 2025 Finance Bill due to the Kenya Revenue Authority’s failure to meet its revenue targets.

Speaking during a plenary session in the Senate on Wednesday, Mbadi said the government had conducted simulations to explore ways of easing the tax burden on salaried workers, but the failure by the Kenya Revenue Authority (KRA) to meet its revenue collection targets made it unfeasible.

More To Read

- MPs raise alarm over missing Sh4.2 billion earned from housing levy investments

- Lobby group Okoa Uchumi warns 2025 budget will raise costs, deepen inequality in Kenya

- CS Mbadi defends Treasury over unequal VAT policy on tea, sugarcane

- “Think before you vote” – Rose Njeri tells Kenyans as she slams State over her arrest

- Court releases Rose Njeri on bond amidst controversy over crackdown on digital dissent

- Ruto proposes law to allow housing levy contributors access Sh5 million loans

“When we were preparing the Finance Bill, we also did some simulation on how to reduce PAYE, but what stopped us from implementing it with this Finance Bill alongside the corporate tax was the failure by KRA to meet its revenue targets,” Mbadi told Senators.

Initially, KRA had projected to collect Sh2.787 trillion in revenue for the financial year ending June 30, 2024. However, this target was later revised downwards to Sh2.537 trillion.

Despite the adjustment, KRA still fell short, collecting Sh2.407 trillion, translating to a shortfall of Sh130 billion, or 95.5 per cent of the revised target.

However, the CS noted that KRA’s collections had grown by 11.1 per cent compared to the previous financial year’s total of Sh2.166 trillion.

Adverse macroeconomic factors

The Treasury attributed the shortfall to a combination of adverse macroeconomic factors, including the depreciation of the Kenyan shilling against the US dollar, rising bank lending rates, and persistent global supply chain disruptions caused by international conflicts.

Mbadi assured senators that the government remains committed to easing the tax burden on salaried workers and is optimistic that current reforms at KRA, particularly in automation and systems efficiency, will create room for such relief in future.

“We thought that as we carry out reforms at KRA, we should not be doing many things at the same time. First, let us see what the reforms at KRA are doing for us in terms of automation, then we can move to the next step,” he said.

Mbadi said the Treasury was also considering a reduction in corporate tax rates from 30 per cent to 28 per cent, but this too was shelved due to similar revenue concerns.

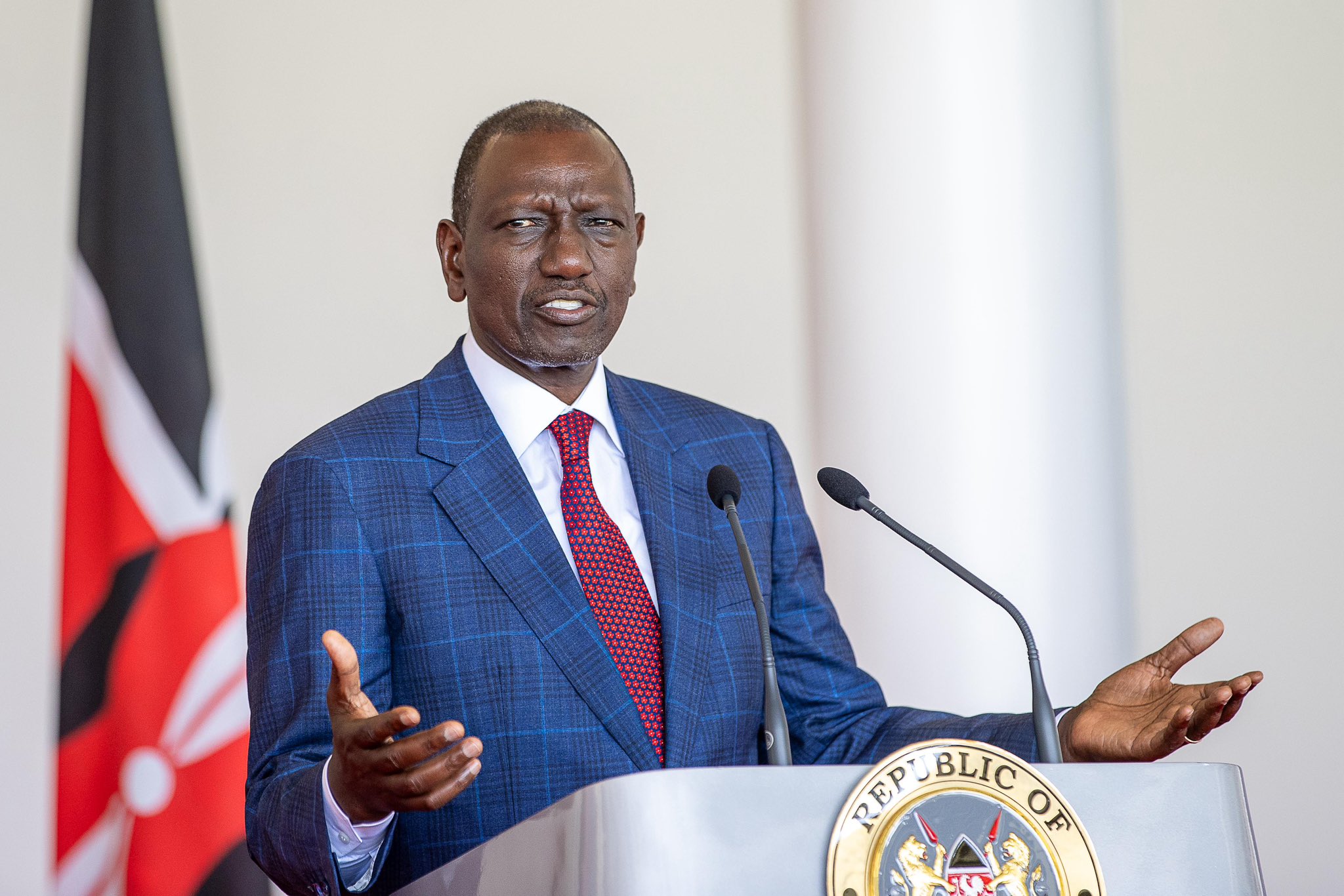

He added that the government is not solely responding to last year’s mass youth-led protests, which played a significant role in the withdrawal of the 2024 Finance Bill. He was responding to remarks by Nairobi Senator Edwin Sifuna, who attributed the policy reversal to pressure from Gen Z demonstrators.

Disposable income

“It is true that we have not made major changes in taxes that will disadvantage the taxpayer in terms of reducing their disposable income. Yes, I know Senator Sifuna is attributing it exclusively to Gen Z, partly true, partly not true. Honourable Senator Sifuna very well knows my stand on taxes, even before I joined the Cabinet. I am one person who does not believe that higher taxes lead to more revenue. That is my stand,” he said.

“Maybe we share that idea with Gen Zs, but it cannot exclusively be Gen Z’s idea. I think the government is also sold on the idea that, now that we have reached, we cannot go further to reduce disposable income.”

In addition to PAYE, Mbadi revealed that the government is undertaking a review of the controversial Housing Levy, which has drawn widespread criticism from formal sector workers. Currently set at 1.5 per cent of monthly salaries, the levy is a key pillar of the government’s affordable housing programme.

“On the Housing Levy, I think there is a discussion around seeing how to restructure it because again, it has serious benefits, in my view, as quite a number of projects are coming up,” Mbadi said.

“But at the same time, individual employees, those with payslips, have complaints which you cannot ignore. So a lot of restructuring is going on, and I am sure more pronouncements will come in due course.”

Mandatory deductions

Workers have voiced frustrations over the mandatory deductions, citing a lack of transparency in housing allocations and questioning the policy’s relevance to individuals who already own homes. Many argue that the deductions are unfair and fail to account for their unique housing situations.

The Federation of Kenya Employers (FKE) has been among the vocal stakeholders calling for changes to the levy. FKE has proposed a reduction of the Housing Levy from 1.5 per cent to 0.5 per cent, arguing that it would ease the financial burden on workers and enhance business competitiveness.

“These steps, if adopted, would ease the cost of living, increase the disposable income of the lowest-paid employees, and make Kenyan businesses more competitive,” FKE CEO Jacqueline Mugo said.

Top Stories Today