Treasury proposes stricter measures for tax defaulters, relief for compliant taxpayers

One of the key proposals is to expand the scope of agency notices to include non-resident persons, allowing the commissioner to recover unpaid taxes from them more effectively.

The government has proposed a series of changes to the Tax Procedures Act aimed at improving tax collection, easing enforcement, and addressing concerns from taxpayers and non-residents.

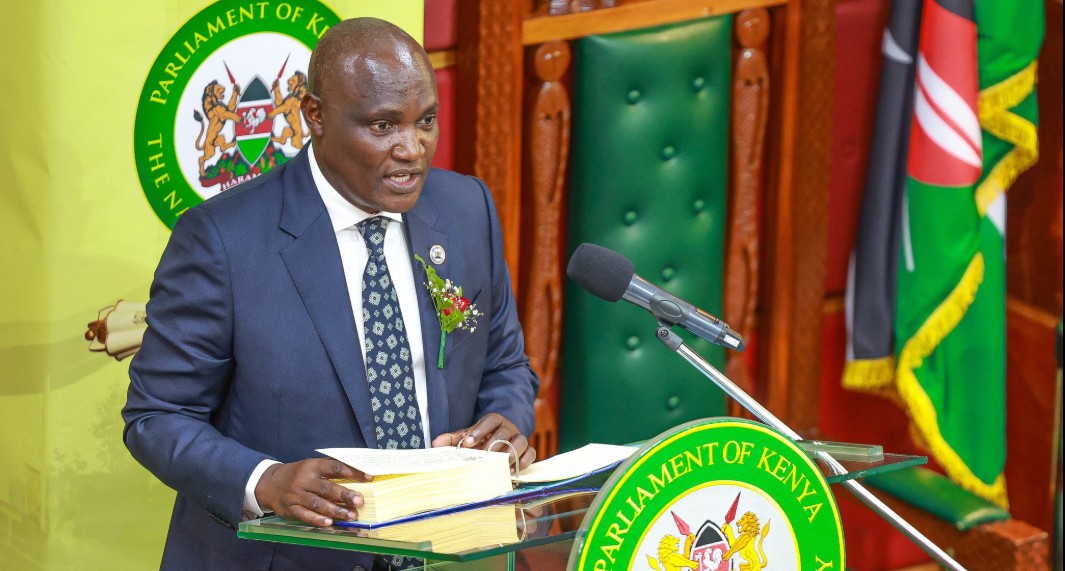

Treasury Cabinet Secretary John Mbadi said the proposed amendments are meant to close loopholes, remove barriers to the recovery of unpaid taxes, and make the tax system more transparent and fair.

More To Read

- Blow to governors as Treasury advances integrated revenue collection system

- Treasury, Senate threaten funding cuts over counties’ financial mismanagement

- CS Mbadi under fire for saying State can’t fully fund free education

- Kenya’s economy stable under Ruto, says Treasury CS Mbadi in response to Gachagua's claims

- Treasury CS John Mbadi faults parastatals for prioritising profits over public service

- Counties under pressure as Treasury moves to curb misuse of funds with new single account system

“These changes will improve compliance and help us collect revenue on time,” he said while presenting the budget statement for the Financial Year 2025/26.

One of the key proposals is to expand the scope of agency notices to include non-resident persons, allowing the commissioner to recover unpaid taxes from them more effectively.

To ensure faster collection of taxes after legal disputes, the Bill clarifies that once a judgment is made in favour of the Commissioner, enforcement will only be stopped if a court issues a stay order.

Exempt property transfers

Mbadi also proposed to exempt property transfers made by or to the commissioner during tax recovery from stamp duty, removing financial and legal barriers that may slow down the process.

Another amendment will require the commissioner to give reasons when sending amended tax assessments to taxpayers.

The Treasury CS said this will promote transparency and build public trust in the tax system.

To address complaints from taxpayers, the Bill also gives the Cabinet Secretary the power to waive penalties and interest caused by system delays or administrative errors, if recommended by the commissioner.

Top Stories Today

- From Kariokor Market to the world: Elizabeth Kioko’s beadwork legacy

- Ogam, Omija and McCarthy reflect on Harambee Stars crucial win over Morocco

- How to choose your first camera: Expert tips for beginners

- The power of 10 minutes: How morning sunlight enhances memory and mood

- Homemade kashata: A sweet treat made with only 3 ingredients

- Mali detains 20 soldiers suspected of coup plot against military junta