Prioritising today's needs over the future: The retirement dilemma facing Kenyan youths

Caught up in the daily struggles and pressures of life, most youth prioritise immediate needs over long-term financial security.

Many young people in Kenya see the retirement age of 60 through a distant lens, perceiving it as a milestone far beyond their current reality.

This perception often leads them to overlook the importance of planning for retirement, as it seems like a concern for the distant future.

More To Read

- Youth from Kenya, Uganda, Ethiopia, South Sudan urged to lead peace efforts in Karamoja

- High Court upholds 60-year mandatory retirement age, dismisses discrimination petition

- South Korean researchers to study Kenyan youth challenges amid protests

- Budget shortfall threatens Ruto’s Sh29.7 billion youth empowerment programme

- Youth reproductive health gains at risk from cultural, financial strains, lobby warns

- Why "soft life" is the new hustle – the Kenyan shift from struggle to self-care and smart living

Caught up in the daily struggles and pressures of life, they prioritise immediate needs over long-term financial security.

This mindset leaves many living paycheck to paycheck, hoping for a stroke of luck when retirement eventually arrives.

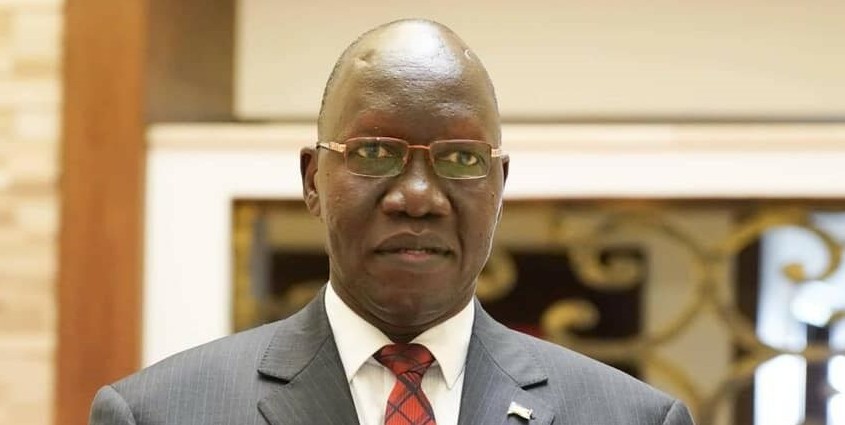

Victor Mugambi, a resident of Eastleigh in his early thirties, embodies this perspective. Mugambi, a "hustler" by nature, doesn't entertain the thought of retirement.

"I haven't planned for retirement," he admits. "My focus is on providing for my family and ensuring my children's needs are met."

Mugambi admits that the challenges of life are very pressing for him and his family.

"I haven't made any retirement plans because I have numerous immediate needs to address. Perhaps in the future, when those needs are taken care of, I might consider retirement. But for now, retirement isn't on my radar," he says.

Victor Mugambi, a resident of Eastleigh. (Photo: Charity Kilei/EV)

Victor Mugambi, a resident of Eastleigh. (Photo: Charity Kilei/EV)

Daily demands

For Mugambi and others like him, retirement feels like a luxury they can't afford to consider amidst the demands of daily life.

Lucy Akinyi from Majengo in Nairobi echoes Mugambi's sentiment. "With so many responsibilities, retirement isn't a priority," she explains.

"My focus is on the present, making sure my family is taken care of." Akinyi's attitude reflects the sentiment of many Kenyans who are too preoccupied with the challenges of today to think about tomorrow.

"It's not that I disregard concerns for the future, but rather, my current circumstances limit my options for planning," she adds.

The lack of foresight regarding retirement is further exacerbated by the financial constraints faced by many Kenyans.

Zachariah Kimani, another Eastleigh resident in his mid-thirties, acknowledges this reality.

"I haven't written a retirement plan," he confesses, "but I'm slowly setting money aside."

Kimani, like many others, recognises the importance of planning for retirement but finds it difficult to do so given his current financial situation.

Zachariah Kimani, a resident from Eastleigh. (Photo: Charity Kilei/EV)

Zachariah Kimani, a resident from Eastleigh. (Photo: Charity Kilei/EV)

Despite the challenges, there is a glimmer of hope for a more secure retirement future.

As data from the Kenya National Bureau of Statistics (KNBS) reveals, there were approximately 17.4 million people in the formal and informal sectors in 2020.

However, a staggering 13.9 million Kenyans had no retirement savings scheme in place, with the majority belonging to the informal sector.

This data underscores the urgent need for increased awareness and action regarding retirement planning in Kenya.

While retirement may seem like a distant concept to many young people, the reality is that the earlier one starts planning, the better prepared one will be for the future.

By prioritising financial literacy and encouraging savings initiatives, Kenya can work towards ensuring a more secure retirement for all its citizens.

Retirement planning in Kenya faces significant challenges, including a lack of awareness, financial constraints, and competing priorities.

However, by fostering a culture of saving and providing resources and support for retirement planning, Kenyans will be cushioned from the uncertainties of the future.

Top Stories Today