Police, prison officers to get new insurance deal amid senate probe

The insurer will cover group life, work injury, group personal accidents, and Last Expense cover.

Police officers and their prison counterparts will, from April 1, be insured by Britam Life Assurance Company, Kenya Limited.

This follows the signing of a three-year contract with the company, a move that ends the previous contract with a private insurer that is at the heart of a Senate probe following claims of inefficiency and delayed processing of medical insurance claims.

More To Read

- Plumber ordered to pay Sh30 million over flood damage to Muthaiga home

- Rights groups welcome moving of Baby Pendo's case to Kisumu, push for speady prosecution

- Activists demand IPOA probe into mysterious death at Mombasa police station

- DCI orders release of journalist Collins Kweyu from Central Police Station

- Students at risk as 85 per cent of schools lack insurance - AKI report

- Fear and mistrust keep police abuse victims silent, report finds

A memo by the National Police Service accounting officer Bernice Lemedeket to the Director of Criminal Investigations, Internal Affairs Unit, and the two Deputy Inspector Generals of Police in charge of the police service and the administration service asked that police officers be informed of the change.

The insurer will cover group life, work injury, group personal accidents and Last Expense cover.

The termination of the previous insurer's contract comes after police officers accused Medical Administrators Kenya Limited (MAKL) of being inefficient.

They accused the insurer of widespread frustrations, including denial of medical services when seeking treatment.

The medical insurance scheme was mentioned as a source of pain and discontent among many NPS officers, as it was subjecting them and their families to bureaucratic delays in the approval of treatment or performance of urgent medical procedures

At the same time, junior officers reported delays in payment of the Last Expense Benefits to bereaved families, especially when officers had died on duty.

Some officers, for instance, linked similar frustrations to the death of an officer based at Lamu Central Police Station who died after he could not get treatment in the nearest facility because the provisions of the cover excluded access to that facility.

Others linked the death of the Officer Commanding Kibra Police Station, Chief Inspector Samuel Chiro to the firm's frustrations. The officer succumbed last Sunday while undergoing treatment.

Affected officers say they would look for alternatives elsewhere despite their insurance having been paid in full by the government.

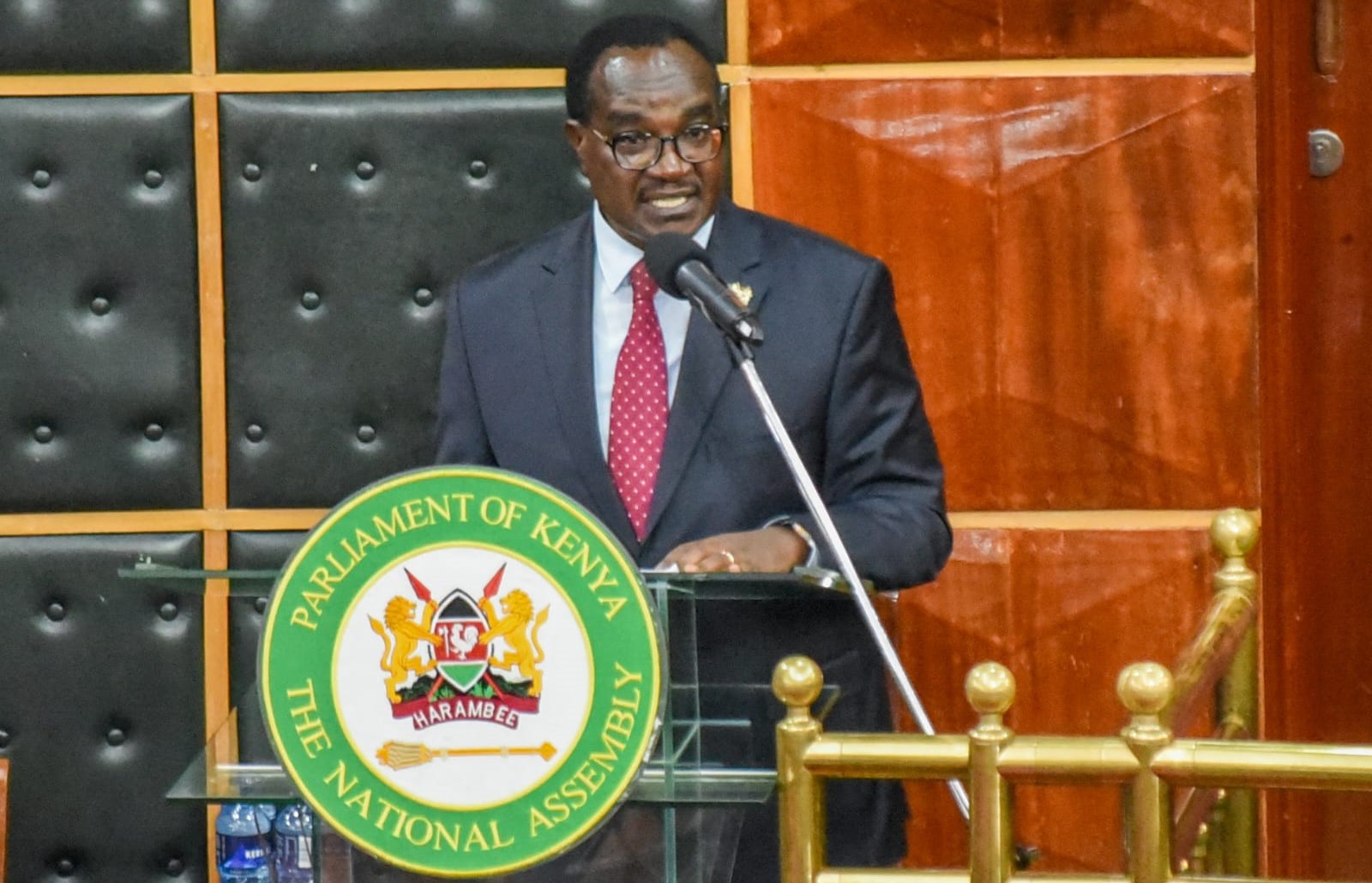

Last year, Nominated Senator Raphael Chimera asked the Health Committee to investigate delays in processing medical insurance claims and payments to hospitals subcontracted to the insurance firm.

As a follow-up to the request for the probe, the Senate wrote a letter to the National Police Service Commission (NPSC), asking the insurer to explain the cause of the delays and its procedure for processing claims.

"The committee should therefore report on the criteria for processing claims at MAKL, explaining the delays reported by the police officers in the processing of medical insurance claims and treatment in the MAKL contracted hospitals," the letter reads in part.

Officials say the insurer received more than S10 billion to insure police and prison officers but was last year owing a number of hospitals, including the Nairobi West Hospital, money for rendered services.

The Senate probe revolves around over Sh176.1 billion allocated by the government to MAKL for the last nine years in medical covers for teachers, the police and prison officials.

The government contracted a consortium of underwriters comprising CIC, Old Mutual, and Britam, to provide comprehensive cover for members of the Service between January 1, 2023, and December 31, 2023.

MAKL had been contracted by two members of the consortium to tender as the capitation administrator.

Top Stories Today