How debt and taxes conspired to rob Nairobi’s slum-dwelling youth of the promise of a better life

Walking back the tax bill hasn’t solved Kenya’s problems, and on Aug. 19, Kenya’s new finance minister said that some of the proposed taxes would be introduced as the country looks to service its foreign debt.

Throughout the summer of 2024, young Kenyans have taken to the streets of the capital, Nairobi, in a series of anti-government demonstrations.

Dubbed the “Gen Z” protests, the unrest was sparked by the introduction of an unpopular finance bill in mid-June. A month later, the bill was withdrawn, but protests have persisted and at least 50 people were killed in the subsequent police crackdown on demonstrators.

More To Read

- Court rejects bid to charge police over death of protester Beasley Kamau

- Gachagua alleges deadly plot to kill protesters, warns youth to shun June 25 demos

- Kenya’s police brutality victims trapped in endless cycle of political promises and no justice

- Inquest told plainclothes police fired live bullets at protesters before Rex Masai’s death

- Gen Z-led protests, floods dent Kenya's economic growth in 2024 to 4.7 per cent

- BBC documentary "Blood Parliament" to be screened in Kayole despite government pressure

But the roots of the protests predate this summer; Kenyans have been dissatisfied with the country’s economy since at least mid-2023 when initial protests began. And while the catalyst for these latest demonstrations may have been a series of tax increases proposed in the finance bill, the problems that young Kenyans face extend far beyond that issue.

For more than a decade, I have been researching slums in Nairobi and speaking with low-income residents in the capital. I’ve watched Gen Zers grow up since 2010 when some were just 5 years old. That same year, Kenya adopted a new constitution that guaranteed protected rights for all Kenyans, including adequate and affordable housing, clean water, health, equality, freedom of assembly, freedom from violence, and children’s rights to basic education. In short, poor Gen Zers were promised a pathway toward a decent life.

The failure of the Kenyan government to deliver on that pledge provides the backdrop to the deep-rooted grievances among Kenya’s poor that have manifested in widespread protests this summer.

Hardship and promises

The epicentre of the current protests is Nairobi, a city in which around 70% of residents live in slums – informal settlements with poor infrastructure.

Most residents of Nairobi’s slums live in extreme poverty, meaning they exist on just a couple of dollars a day. With such meagre earnings, the increasing cost of living in recent years has made life intolerable for many, directly undercutting the promise of the 2010 constitution.

Kenyan governments have failed to deliver on promises for many reasons, but mostly for economic and institutional reasons. Money was made available to reform health care and housing, resulting in an increase in the National Health Insurance Fund and new homes around the city. However, health care and permanent housing remain unaffordable for the majority of residents who live in Nairobi’s slums. Funds for clean drinking water resulted in more public taps, but not enough to shorten the average slum dweller’s daily trek. Meanwhile, increased access to textbooks does not help those who cannot afford them, and improved sanitation in Kenya has been marginal.

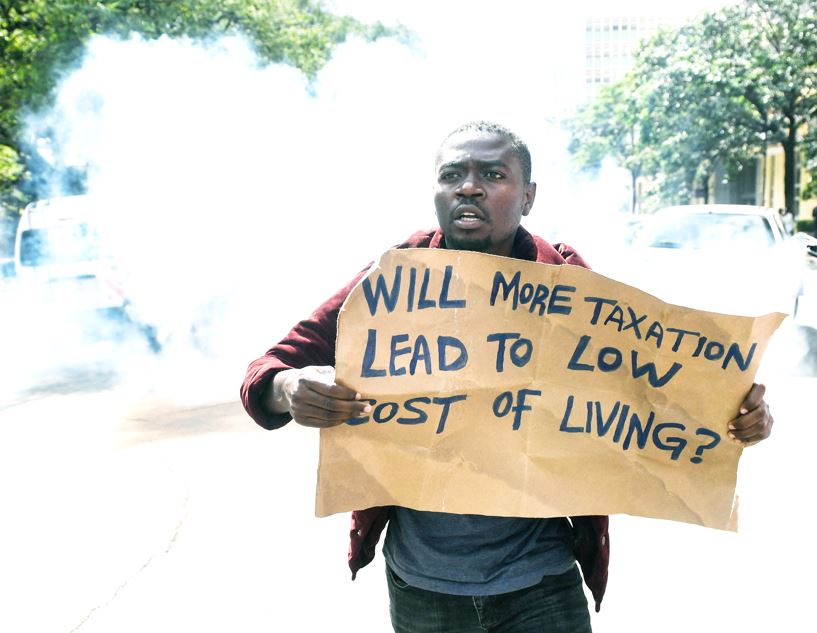

A protester is seen amid tear gas, during a demonstration over police killings of people protesting against Kenya's proposed finance bill 2024/2025, in Nairobi, Kenya, June 27, 2024. REUTERS

A protester is seen amid tear gas, during a demonstration over police killings of people protesting against Kenya's proposed finance bill 2024/2025, in Nairobi, Kenya, June 27, 2024. REUTERS

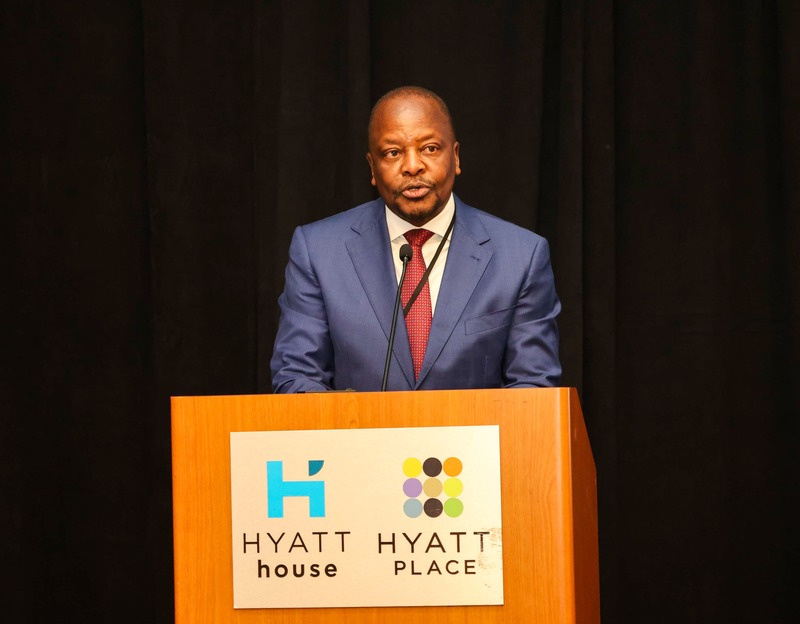

In 2022, newly elected Kenyan President William Ruto promised to reduce the cost of living. But his failure to do so has only fueled the recent protests. Inflation has hovered from around 6% to nearly 8% since 2021. Typical monthly costs, even without rent, have increased to US$533, or around $6,000 a year. Yet the average annual income per person in 2023 was just $2,110.

Meanwhile, recent heavy rains have worsened the plight of many in Kenya. Downpours from October 2023 to May 2024 led to the worst floods the country has seen since 1997. As well as taking the lives of close to 300 people and displacing some 278,380, the rains ruined 168,000 acres of crops and killed more than 11,000 livestock.

Slum dwellings along the capital’s riverbanks were swept away, while the government bulldozed 40,000 remaining homes within 30 meters (about 100 feet) of the Nairobi River for safety reasons. Yet no temporary housing was offered, leaving many homeless.

Who is protesting?

As a result of years of economic woe, worsened by this environmental disaster, conditions were ripe for discontent even before the summer. Then the Kenyan government released the June 2024 budget. Included were new tax increases, among them a 16% tax on bread, a 25% levy on cooking oil and taxes on family essentials such as diapers and sanitary products for women.

Kenya is a young country, with a median age of around 20 years old. In Nairobi’s population of around 5.5 million people, those age 19 to 22 make up the majority.

These are the youth of Nairobi that led the protests, storming the National Assembly on June 25 as politicians took refuge in an underground tunnel.

On June 26, Ruto withdrew the proposed tax increases. In further concessions, he fired the bulk of his cabinet, and Kenya’s police chief resigned in the face of accusations of police brutality against protesters.

But Gen Z remained unsatisfied and continued to protest.

This should be no surprise. While the withdrawal of the tax bill removed immediate concerns, nothing was promised to address the deep-seated economic and social issues that young, poor Kenyans have shared with me over the years.

“Sometimes, or most of the time, the money intended for poverty reduction in the slum end up being used for other things. … [It is either] stolen or, because of corruption, only little is left available for use to benefit the community,” one resident of the Mukuru slum told me in 2020. Another said: “Our problems are passed from one government to another. They come during elections to ask for votes; thereafter they go, never to come back for any meaningful development.”

Servicing foreign loans

Poor management of the economy and the mounting national debt that Kenya faces are in large part to blame for the lack of available money for poverty reduction. Around 60% of Kenya’s tax revenues goes to paying off foreign debt, and the remaining 40% is spread thin.

Under Ruto, the national debt has grown to around $80 billion – that’s nearly three-quarters of Kenya’s gross domestic product. This amount puts the country into a high-risk category for defaulting on its loans. The burden of servicing this national debt is already huge, and a default could further impinge on the Kenyan economy.

Fears of a default prompted the proposed hike in taxes. However if the new tax bill had passed, it would have resulted in a widespread financial setback for households across the economic spectrum. Higher-earning Kenyans would have had to pay a combined rate of 40% annually. There were also several regressive taxes, such as sales and value-added taxes, that would have disproportionately hit Kenya’s poorest. The levy on petroleum, for example, was to be hiked from 8% to 16%.

Stolen promises

Walking back the tax bill hasn’t solved Kenya’s problems, and on Aug. 19, Kenya’s new finance minister said that some of the proposed taxes would be introduced as the country looks to service its foreign debt.

But debate over how to service foreign debt does little to help the lot of Gen Zers in Nairobi’s slums. What they want is, in the words of one young slum resident I spoke to in 2020: “Modern housing, manufacturing companies to employ people, health programs, improved roads, education, training for skills, improved security and increased food production.”

Those are all things promised to them 14 years ago in Kenya’s changed constitution – but it was seemingly stolen from them as the country’s government looks to balance its budget and service mounting and unsustainable foreign debt.

Top Stories Today