Counties operating 2,421 commercial bank accounts illegally - Controller of Budget

By Maureen Kinyanjui |

This marks a sharp rise of over 400 accounts compared to the 2,000 reported in the previous financial year.

County governments are in the spotlight after the Controller of Budget (CoB), Margaret Nyakang'o, revealed that they are operating 2,421 commercial bank accounts illegally as of September 30, 2024.

This marks a sharp rise of over 400 accounts compared to the 2,000 reported in the previous financial year.

Keep reading

The report, covering the first quarter of the Financial Year 2024-2025 highlighted Nakuru as the leading county with 301 accounts, followed closely by Bungoma (300), Baringo (292), and Kiambu (292).

Machakos reported 221 accounts, while Elgeyo Marakwet followed with 155.

Nyakang'o noted that such practices are in violation of the Public Finance Management (PFM) Act and its regulations, which mandate that county accounts must be operated through the Central Bank of Kenya (CBK).

"The only exemption is for imprest bank accounts for petty cash and revenue collection," she said, noting the challenge posed by these unauthorised accounts in tracking public expenditure effectively.

Counties like Nairobi, Narok, and Nyandarua did not disclose their commercial bank accounts.

However, in the last review, Nyandarua had 86 accounts flagged as not adhering to public finance regulations.

Justification

Despite these findings, governors have defended the existence of multiple accounts.

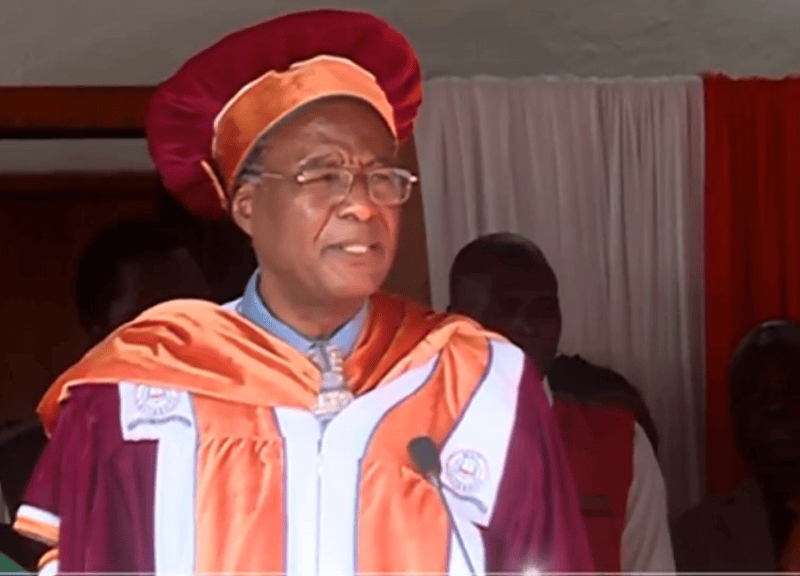

Council of Governors Chairman Ahmed Abdullahi argued that they are lawful and necessary.

"Counties are required to open and operate bank accounts in commercial banks for revenue retention and expenditure," said Abdullahi, citing the Facility Improvement Financing Act, 2023, which allows counties to operate these accounts for health facilities and donor-funded projects.

Abdullahi added that conditions attached to development grants often require the creation of special-purpose accounts to manage funds.

"It is not practical for counties to operate only one account without flouting existing laws," he argued.

While some counties have reduced their account numbers, others have seen significant increases.

Bungoma reported a decrease from 352 accounts in FY 2023-2024 to 300, while Migori dropped from 208 to 76. Conversely, Kiambu's accounts surged from 52 to 292, and Machakos opened 190 new accounts, now totaling 221.

Counties with fewer accounts include Turkana (26), Homa Bay (26), and Mombasa (25). The report also flagged several counties for failing to submit financial reports on time, causing delays in budget implementation reviews.

In addition, CoB Nyakang'o reiterated the need for counties to comply with PFM regulations and ensure accounts are centralized under CBK for better oversight.

"County governments should ensure that bank accounts are opened and operated at the Central Bank of Kenya as the law requires," she recommended, adding that timely submission of financial reports would enhance budget implementation.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!