President Ruto signs seven Bills into law to enhance tax system, governance

Among the major pieces of legislation passed is the Tax Laws (Amendment) Bill, which introduces sweeping reforms to the country's tax regime.

President William Ruto on Wednesday assented to seven critical bills aimed at enhancing Kenya's tax system, improving governance, and promoting business growth.

Among the major pieces of legislation passed is the Tax Laws (Amendment) Bill, which introduces sweeping reforms to the country's tax regime.

More To Read

The Bill, introduced by National Assembly Majority Leader Kimani Ichung'wah, seeks to align Kenya's tax policies with international best practices while providing relief to employees, retirees, and businesses.

A key provision allows taxpayers to deduct contributions to post-retirement medical funds and the Affordable Housing Levy from their tax liabilities, thus alleviating the burden of double taxation.

Furthermore, the Bill increases the mortgage interest deduction limit from Sh300,000 to Sh360,000, encouraging homeownership among Kenyans.

"The amendments will promote local manufacturing, enhance agricultural growth, and incentivise investment in Kenya, which aligns with the Bottom-Up Economic Transformation Agenda," reads a summary of the Bill.

The Bill also introduces an economic presence tax for non-residents and a minimum top-up tax for multinational companies, ensuring that global firms contribute fairly to Kenya's economy.

In a move to boost Kenya's housing sector, the government also expanded tax exemptions to encourage more investments. For instance, mortgage interest deductions have been increased, and pension contributions now enjoy more favourable tax treatment.

Additionally, the Bill supports local farmers by offering excise duty exemptions for spirits made from agricultural products.

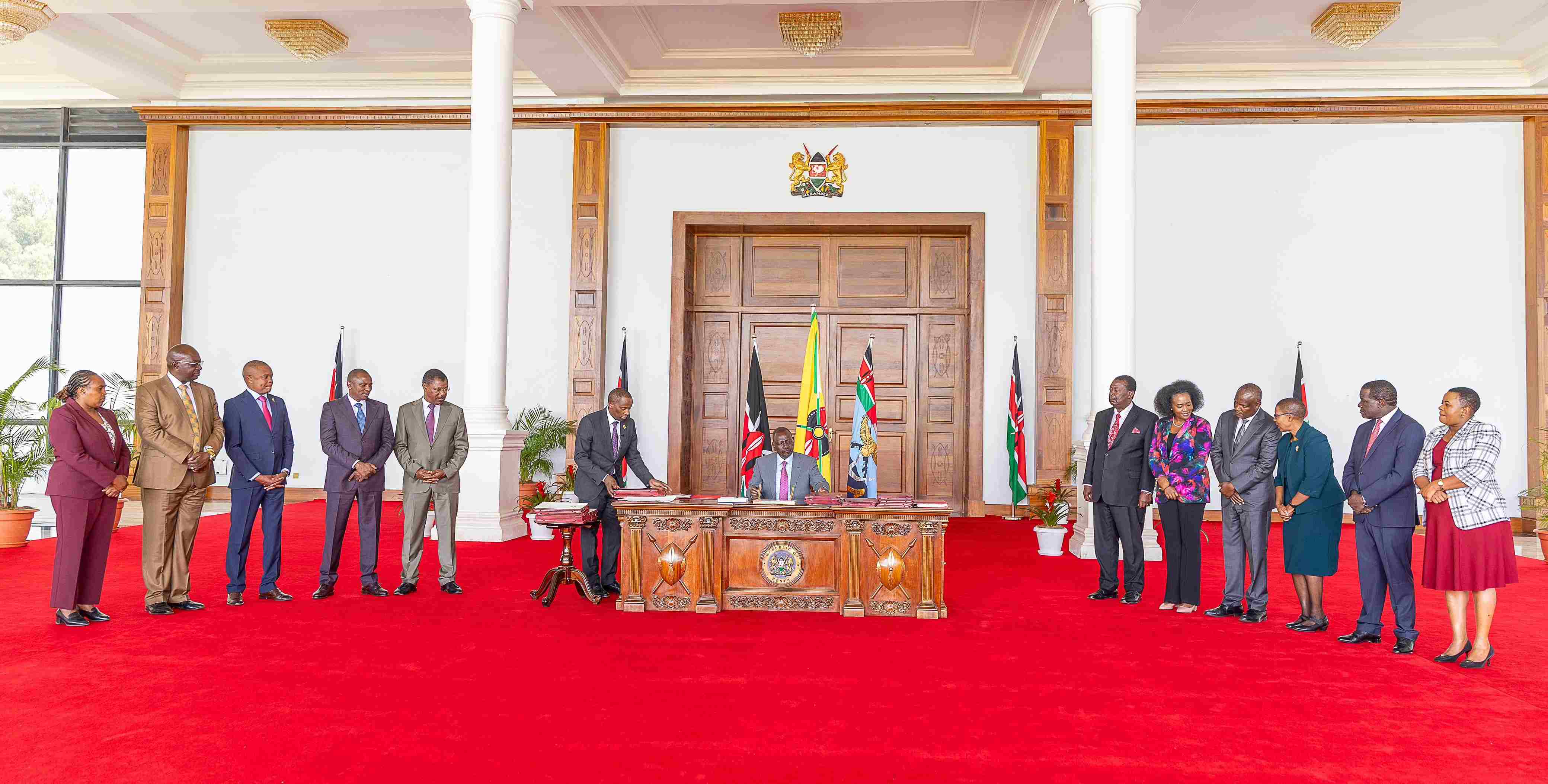

Those who witnessed the signing ceremony include Attorney General Dorcas Oduor, Speaker of the National Assembly Moses Wetang'ula, Cabinet Prime Secretary Musalia Mudavadi and John Mbadi (CS Treasury), MPs Ichungw'ah (Kikuyu), Kimani Kuria (Molo) among others.

KRA Bill

Another significant piece of legislation signed into law is the Kenya Revenue Authority (Amendment) Bill, also sponsored by MP Ichung'wah.

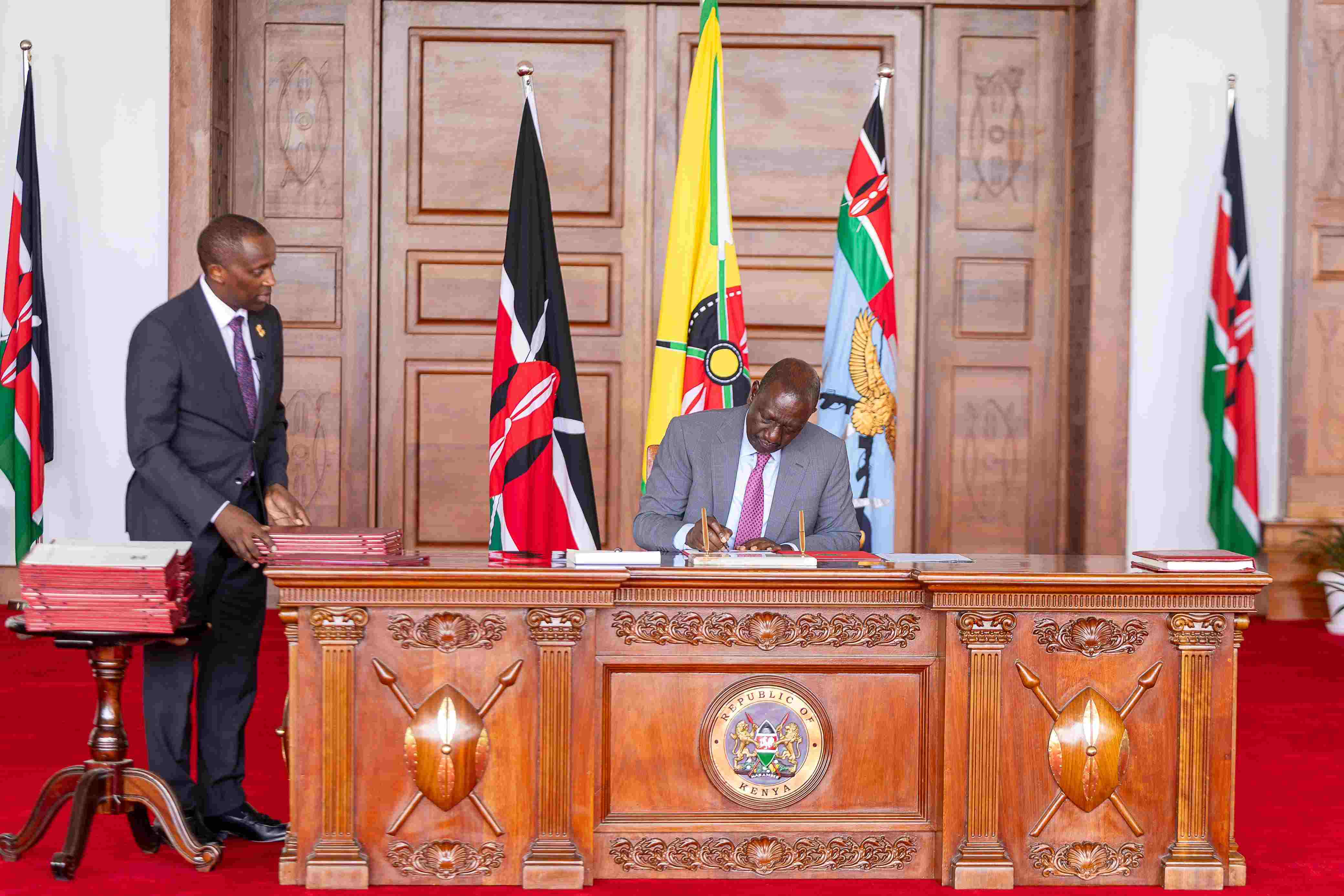

President William Ruto signs to law several bills at State House, Nairobi on December 11, 2024. Present at the signing ceremony were Attorney General Dorcas Oduor, Speaker of the National Assembly Moses Wetang'ula, Cabinet Prime Secretary Musalia Mudavadi, John Mbadi (CS Treasury), MPs Ichungw'ah (Kikuyu), Kimani Kuria (Molo) among others. (Photo: PCS)

President William Ruto signs to law several bills at State House, Nairobi on December 11, 2024. Present at the signing ceremony were Attorney General Dorcas Oduor, Speaker of the National Assembly Moses Wetang'ula, Cabinet Prime Secretary Musalia Mudavadi, John Mbadi (CS Treasury), MPs Ichungw'ah (Kikuyu), Kimani Kuria (Molo) among others. (Photo: PCS)

This bill strengthens the Kenya Revenue Authority (KRA), particularly its collaboration with educational institutions such as the Kenya School of Revenue Administration (KESRA), to improve revenue collection and ensure efficient tax administration.

The bill also empowers the KRA Commissioner-General to appoint Deputy Commissioners, enhancing operational efficiency.

The Kenya Roads Board (Amendment) Bill was also signed into law, which reduces the membership of the board from 13 to nine members.

This amendment aligns with the Mwongozo Code of Governance for State Corporations, which emphasises efficient leadership and management.

It is expected that this streamlined board structure will improve the oversight and management of Kenya's road development projects.

Meanwhile, the Ethics and Anti-Corruption Commission (Amendment) Bill brings much-needed reforms to the fight against corruption.

The Bill assented to President Ruto states that the Chairperson of the Commission must possess qualifications equivalent to those required for a High Court judge, enhancing the capacity of the Commission to provide leadership and strategic direction.

This amendment is part of a broader effort to promote good governance in the country.

The Statutory Instruments (Amendment) Bill introduces stricter compliance mechanisms for statutory instruments, allowing Parliament to publish the nullity of regulations that are not submitted properly.

This move aims to improve transparency and ensure that the public is aware of the legal status of various regulatory instruments.

Moreover, the Bill increases penalties for non-compliance, aiming to deter businesses and individuals from bypassing the rules.

The Business Laws (Amendment) Bill now law, introduces significant changes to the business landscape in Kenya. Among other provisions, it mandates increased core capital requirements for banks, sets up a licensing framework for non-deposit-taking credit providers, and strengthens consumer protection in the financial services sector.

These changes are expected to foster greater stability in Kenya's financial system while also making it easier for businesses to thrive.

Additionally, the Tax Procedures (Amendment) Bill clarifies the requirements for electronic tax invoices and introduces simplified compliance processes for small businesses and small-scale farmers.

It also restores import duties on certain raw materials to protect the local steel industry, providing a much-needed boost to Kenya's manufacturing sector.

Top Stories Today