Central Bank pressures 13 banks to meet Sh10 billion core capital requirement

The move follows amendments to financial sector laws late last year when the President signed the Business Laws (Amendment) Bill into law.

The Central Bank of Kenya (CBK) has asked 13 commercial banks to submit detailed plans on how they intend to increase their core capital to Sh3 billion by the end of this year and Sh10 billion by 2032.

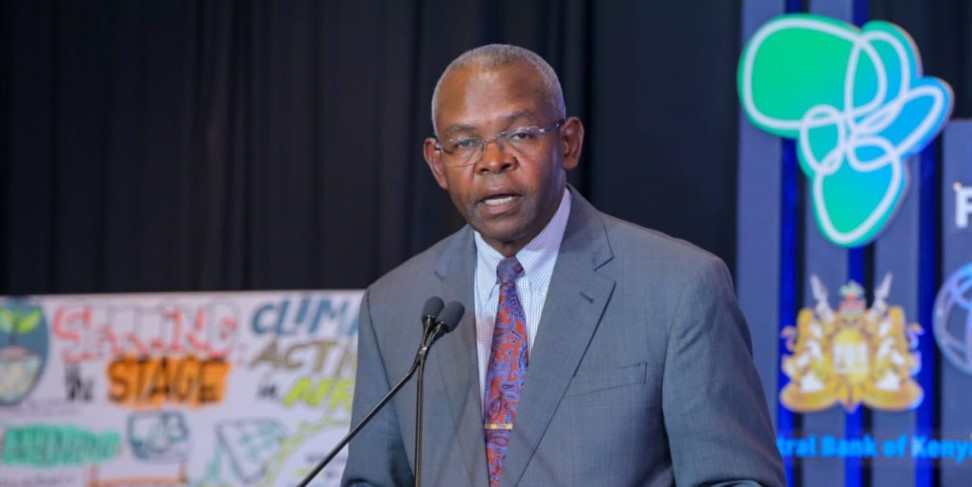

CBK Governor Kamau Thugge revealed this during a virtual post-Monetary Policy Committee (MPC) briefing on Thursday.

More To Read

- Banks oppose CBK plan to peg lending to Central Bank Rate, cite credit access risks

- Most Kenyan employers to freeze hiring in 2025 despite economic optimism – CBK survey

- SRC controversy casts shadow over Moturi's Central Bank board nomination

- Banks face additional reporting rules as sector moves to spur green credit growth

- CBK, commercial banks disagree over benchmark for determining lending rates

- Kenyan shilling rebounds with 14 per cent year-on-year gain in Q1, 2025

However, he did not disclose the names of the affected banks.

"We have written to 13 commercial banks with core capital below Sh3 billion, requesting them to outline how they will meet this year's requirement and provide a comprehensive strategy for reaching Sh10 billion in the long run," Thugge stated.

The move follows amendments to financial sector laws late last year when the President signed the Business Laws (Amendment) Bill into law.

The changes affected the Banking Act, the Central Bank of Kenya Act, and the Microfinance Act, aimed at strengthening the banking sector.

Since 2012, commercial banks have maintained a minimum core capital of Sh1 billion. However, a previous attempt to raise it to Sh5 billion in 2015 was unsuccessful.

According to the latest banking supervision report, 11 banks have yet to meet the Sh3 billion core capital threshold required by the end of this financial year.

These include Bank of Africa, Premier Bank, Habib Bank, M-Oriental Bank Kenya, Credit Bank, Paramount Bank, Development Bank, HFC, UBA, Middle East Bank, and Access Bank. Additionally, Consolidated Bank and Spire Bank, now sold to Equity Bank Holdings, had previously failed to meet the current Sh1 billion requirement.

The push for higher capital requirements follows a similar move in Uganda, which recently raised its minimum core capital to Sh5.1 billion, leading to downgrades for several banks, including Kenya's ABC Capital Bank.

Non-performing loans

Meanwhile, banks have made slight progress in reducing non-performing loans (NPLs), with the ratio dropping to 16.4 per cent in January from 16.5 per cent in November and 16.7 per cent in September 2024.

The improvement is linked to borrowers making better efforts to meet loan obligations as the cost of living eases due to a stable currency and lower credit rates.

A year ago, NPLs had nearly reached 18 per cent amid a weakened shilling and high inflation.

Kenya's overall inflation stood at 3.3 per cent in January 2025, up from 3 per cent in December 2024 but still within the target range of 5±2.5 per cent.

Core inflation dropped to 2 per cent from 2.2 per cent over the same period, mainly due to lower prices of processed food items such as sugar, maize, and wheat products.

To support lending, the CBK on Wednesday cut the base rate by 50 basis points to 10.75 per cent.

The move is expected to lower the average commercial lending rate, which currently stands at 16.9 per cent, down from 17.2 per cent in December.

The regulator also reduced the cash reserve ratio (CRR) by 100 basis points to 3.25 per cent from 4.25 per cent to further ease lending conditions and boost cash flow to the private sector.

Top Stories Today