Somalia introduces national digital ID system for bank customers

This system is expected to address several challenges that have long affected Somalia's financial sector, including identity fraud, money laundering, and inefficiencies related to outdated identity management systems.

The National Identification and Registration Authority (NIRA) has entered into a partnership with the Somali Bankers Association (SBA) to introduce a National Digital Identification system for bank customers in Somalia.

This collaboration was formalised through the signing of a Memorandum of Understanding (MoU) and represents a significant advancement in the modernization of the country's banking sector.

More To Read

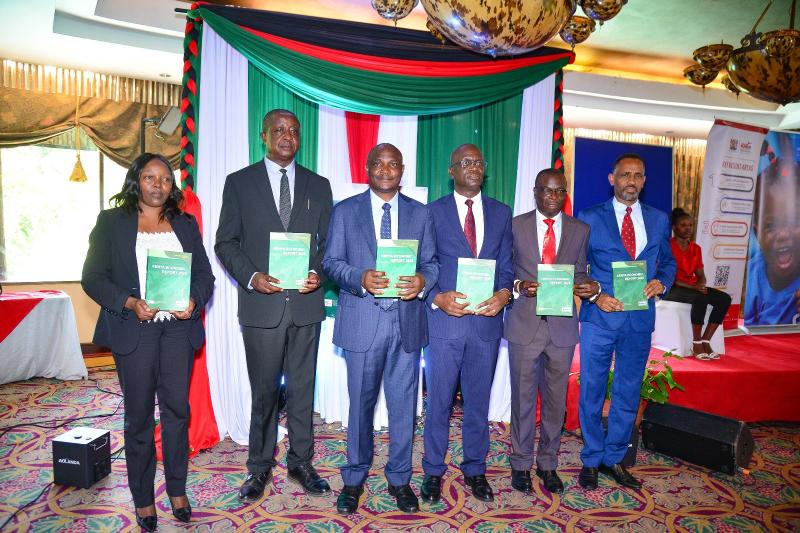

Somali Deputy Prime Minister Salah Ahmed Jama, along with other key government officials presided over the launch in Mogadishu.

The primary objective of the new system is to streamline the process of customer identification, enhance security measures, and align Somalia's banking practices with international standards.

Under the new system, Somali citizens will be able to access banking services using a Unique Identification Number (UIN) linked to their National ID.

This system is expected to address several challenges that have long affected Somalia's financial sector, including identity fraud, money laundering, and inefficiencies related to outdated identity management systems.

Accurate customer information

By providing accurate customer information and reducing financial risks, the National ID system aims to build greater trust within the banking sector and promote economic growth.

The integration of the UIN with banking services is anticipated to simplify banking processes, ensure the accuracy of customer data, and reduce the costs associated with managing fragmented identities. This, in turn, is expected to make Somalia's banking sector more secure and efficient, thereby contributing to the country's economic development.

NIRA has already made it possible for Somali citizens to register for, obtain, and utilise their National ID, which is essential for accessing a variety of important services.

In collaboration with the Somali Bankers Association, efforts are being made to raise public awareness about the importance of the National ID in enhancing economic progress and ensuring secure access to financial services that meet global standards.

NIRA Director General Abdiwali Tima'adde emphasised that this partnership is about more than just identification. It is about empowering Somali citizens to fully engage with the global financial system while mitigating risks such as fraud, money laundering, and other legal issues.

"This partnership between NIRA and the SBA is about more than just identification, It's about empowering Somali citizens to fully participate in the global financial system and mitigate risks such as fraud, money laundering, and other legal violations," he said.

Deputy PM Salah Ahmed Jama highlighted the National ID's critical role in the ongoing National Transformation Plan (NTP). He noted that the agreement with the Somali Bankers Association is a crucial step toward formally integrating Somalia's economy with the global financial system.

Somalia's Central Bank Governor, Abdirahman Mohamed Abdullah, pointed out that as the banking sector progresses toward establishing a Credit Reference Bureau, the National ID with its UIN will serve as a key reference. This will ensure accuracy and reliability in credit evaluations.

Top Stories Today