Kenya faces fresh debt crisis as Treasury projects Sh253 billion revenue shortfall

According to documents submitted by the National Treasury, the Kenya Revenue Authority had collected Sh2.26 trillion by the end of April 2025, falling short of its Sh2.51 trillion target.

Kenya is staring at a renewed debt crisis as the National Treasury projects a Sh253 billion revenue shortfall, just weeks before the close of the 2024/25 financial year.

According to documents submitted by the National Treasury, the Kenya Revenue Authority (KRA) had collected Sh2.26 trillion by the end of April 2025 against a target of Sh2.51 trillion.

More To Read

- Treasury given 60-day ultimatum to deliver debt management framework

- KRA introduces simplified PAYE filing system effective July 1

- Financial autonomy: Mombasa Governor Abdulswamad Nassir urges Ruto to empower counties

- Car importers sue KRA over new tax formula, warn of 145 per cent price hike on used vehicles

- Ruto government allocates Sh680 million for State House renovation despite budget cuts, public outrage

- Controller of Budget hit by Sh70 million slash despite calls for increased funding

The gap has triggered an urgent review of the government’s financing plan, with Treasury officials indicating that more borrowing, both locally and externally, will be required to bridge the deficit.

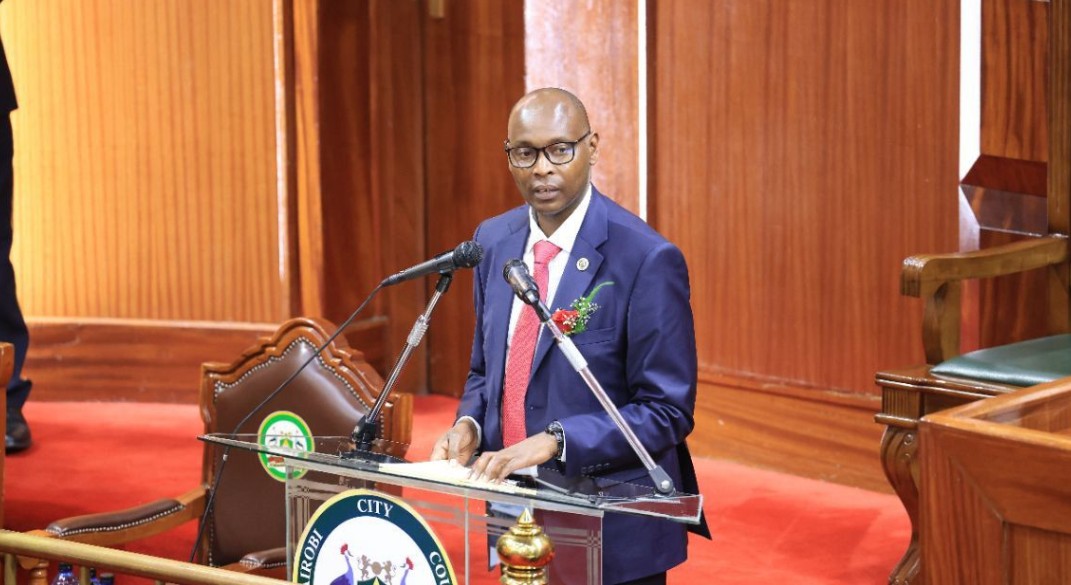

“We have prepared the Supplementary Estimates III to accommodate the changes and align the budget with the new developments,” Treasury Cabinet Secretary John Mbadi said in a memorandum to Parliament.

As a result of the missed targets, the government has revised the ordinary revenue target downwards to Sh2.49 trillion from the earlier projection of Sh2.58 trillion. The appropriation-in-aid (AiA), which refers to internally generated revenues retained by ministries and departments, is now projected at Sh489 billion.

Mbadi attributed the underperformance to a shortfall in ordinary revenue amounting to Sh195.3 billion and an AiA gap of Sh57.7 billion.

With limited fiscal space, the Treasury has ruled out additional tax increases, leaving borrowing as the only viable option to finance the remainder of the 2024/25 budget.

Widening fiscal deficit

Consequently, the country’s fiscal deficit is expected to widen to Sh797.7 billion, overshooting the Sh761 billion limit earlier approved by the National Assembly in July 2024 under the Supplementary Appropriation Act.

On March 9, 2025, National Treasury Principal Secretary Chris Kiptoo told the National Assembly’s Finance and National Planning Committee that the government had already surpassed its domestic borrowing ceiling by Sh220 billion. This was against the Sh263.2 billion limit sanctioned by MPs in July 2024.

To plug the budget hole by June 30, the government is expected to borrow Sh441.8 billion from foreign lenders and Sh355.9 billion from the domestic market. The level of borrowing is likely to exacerbate Kenya’s public debt burden, which stood at Sh10.6 trillion as of December 31, 2024.

The Treasury’s 2025 Medium-Term Debt Management Strategy submitted to Parliament shows that the Sh10.6 trillion comprises Sh5.2 trillion in domestic debt and Sh5.4 trillion from external sources.

The figure represents 63 per cent of the country’s gross domestic product (GDP), well above the 55 per cent benchmark for debt sustainability. Under current policy, the Treasury has until November 1, 2028, to bring the present value of public debt within the 55 per cent debt-to-GDP threshold.

The planned borrowing spree comes despite earlier commitments by the National Treasury to reduce the cost and risk of public debt by mobilising concessional resources from bilateral and multilateral development partners.

Top Stories Today