Frequent commodity price shifts impacting household budget plans - Study

With the trend largely attributed to manufacturers and suppliers, these fluctuations may reflect the challenges faced by the industrial sector in the country.

In his mid-40s, David Etiang, a father of two and resident of Kasarani-Mwiki, has grown increasingly concerned about the frequent fluctuations in commodity prices, particularly in retail stores. He observes that this trend has become a weekly occurrence, disrupting his monthly budgeting plans.

"It's disorienting. Planning daily and weekly budgets, especially for foodstuffs and the children's school supplies, has become challenging," he says.

More To Read

- Kenya sees major boost from visa-free policy as tourist numbers hit 1.8 million

- KNBS data shows uneven food price shifts as inflation dips slightly

- How digital platforms are creating new pathways for youth, with riders taking home up to Sh70,000 monthly

- Busia destroys Sh21.9 million worth of heroin, bhang in anti-drug operation

- Economic value of unpaid domestic and care work in Kenya

- Study finds Kenya’s unpaid household labour worth Sh2.5 trillion annually

A spot check conducted over the past month by Eastleigh Voice in various retail stores around the Kasarani area supports Etiang's observations.

The survey revealed that within a three-week period, the price of a 500ml pack of a particular milk brand fluctuated between Sh55 and Sh52 at different times during the month. Other essential commodities, such as sugar and bar soap, experienced price variations of approximately Sh7 and Sh5, respectively, across different weeks. Notably, these changes were not attributed to the retail stores' discount policies.

Happiness Nakhuva echoes these concerns, noting that since the beginning of the year, she has purchased the same commodities at varying prices within intervals of less than two weeks. "I've particularly noticed this with sugar and bar soap."

Boniface, another Kasarani resident, has also observed weekly fluctuations in cooking oil prices, describing the trend as unpredictable.

This pattern of constant price fluctuations is arguably not just a concern for Nairobi neighbourhoods but likely affects consumers across the country. Those interviewed expressed frustration with the unpredictability of prices, which complicates household budgeting.

For many, these constant changes present a significant challenge, undermining their ability to plan and leaving them uncertain about what to expect when shopping.

Etiang points out that this is one reason he remains sceptical about claims of a reduced cost of living over the past year, despite Kenya National Bureau of Statistics (KNBS) inflation figures.

This situation raises questions about consumer protection at a time when disposable incomes are shrinking.

Commenting on the matter, the Retail Trade Association of Kenya (RETRAK) acknowledges that price fluctuations are an unfortunate situation for consumers but asserts that they are beyond the control of retailers.

"We are price takers. Prices are, 95 percent of the time, dictated by suppliers and manufacturers. Supermarkets rarely change prices on their own. Unfortunately, we are customer-facing and usually bear the blame," said RETRAK CEO Wambui Mbarire.

Market analyst and investor Mihr Thakar also sympathises with consumers, noting that commodity prices tend to fluctuate in line with supply-demand dynamics and monetary value.

"When products are manufactured locally, amidst stable monetary policy, such fluctuations can be reduced, but never eliminated," Thakar said.

He suggests a mix of caution and adaptability, urging shoppers to stay informed and seek out strategies to minimise the impact of price changes on their budgets. For instance, he advises consumers to incorporate a range of values within their household budget plans to account for uncertainty.

With the trend largely attributed to manufacturers and suppliers, these fluctuations may reflect the challenges faced by the industrial sector in the country.

The latest Market Update report by estate agents Knight Frank indicates that several markets in Kenya are struggling to gain traction amidst persistent economic challenges. It notes that Kenya's industrial sector, in the six-month period to December 2024, remained constrained by high production costs, particularly electricity tariffs. This additional burden is often passed down to consumers.

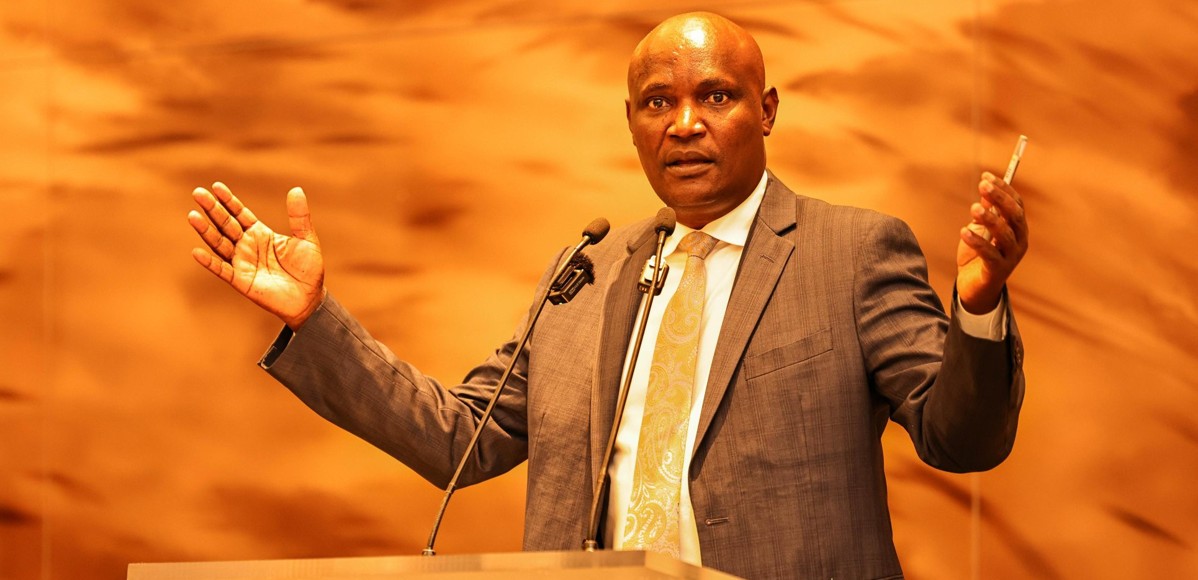

Mark Dunford, CEO of Knight Frank Kenya, emphasises that realising the country's manufacturing potential towards long-term economic resilience and predictability requires decisive and strategic interventions.

"Implementing targeted tax incentives for local manufacturers, enhancing infrastructure development, ensuring access to affordable energy, and strengthening policy frameworks will be essential in fostering industrial growth and driving long-term economic resilience," Dunford said.

Top Stories Today