KAM demands regulatory reforms to boost Kenya’s manufacturing competitiveness

KAM Chief Executive Tobias Alando noted that the private sector is the country’s second-largest employer of wages, after the government, underscoring the importance of supporting manufacturing for economic growth.

Kenya’s manufacturing sector is calling for a regulatory overhaul, with the Kenya Association of Manufacturers (KAM) outlining key reforms to strengthen competitiveness.

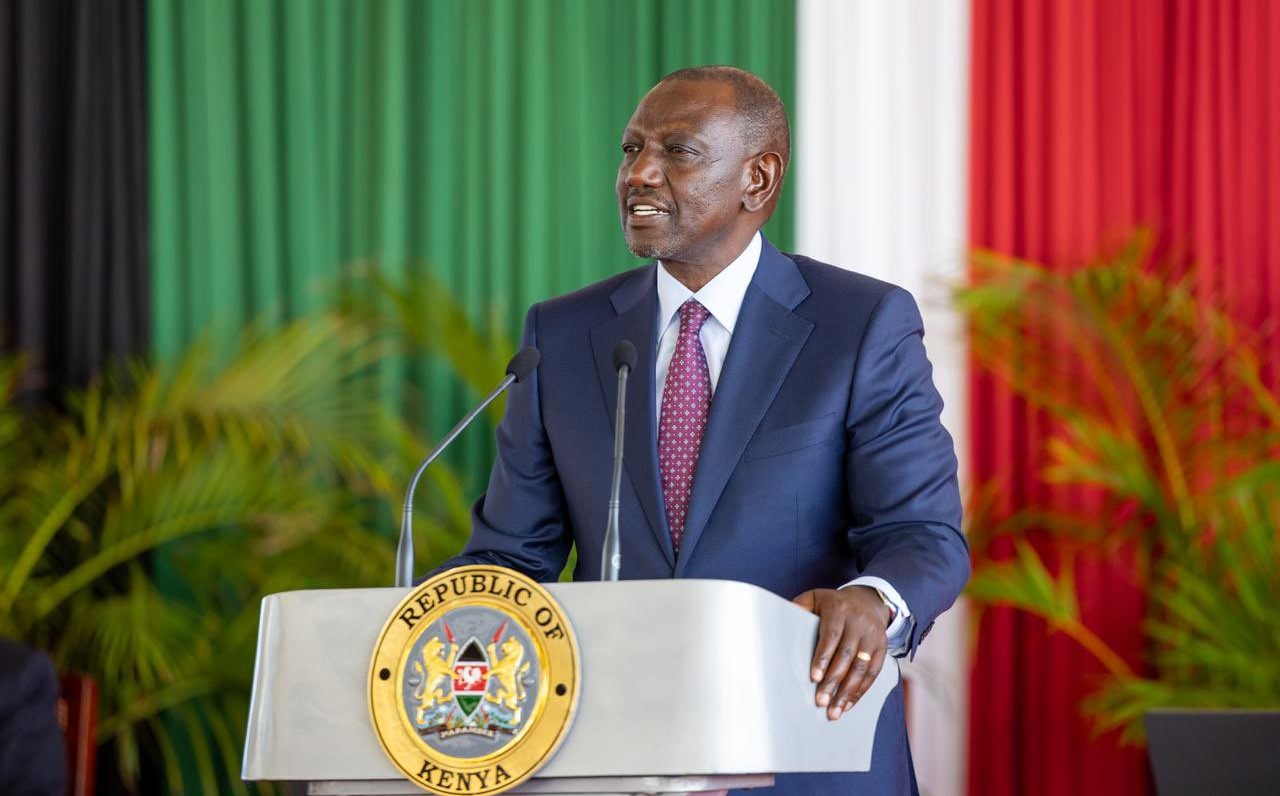

The appeal was made during a high-level regulators' forum organised by the Office of the Deputy President and chaired by Chief of Staff and Head of Public Service Felix Koskei.

More To Read

- Kenya’s industrialisation blueprint falls short as manufacturing stagnates - Review

- SMEs sound alarm over rising failure rates amid investment gaps

- Grade 10 textbook supply at risk as Sh11 billion debt stalls printing

- KAM CEO Tobias Alando warns instability in Tanzania threatens regional trade

- NTSA releases list of licensed vehicle body builders and assessors

- Payment of pending bills breathes new life into construction, manufacturing sectors

The meeting brought together representatives from ministries, departments and agencies, regulators, and the private sector to explore coordinated measures to unlock the potential of the manufacturing industry.

KAM Chief Executive Tobias Alando stressed the impact of regulatory oversight on businesses and highlighted the sector’s vital role in driving sustainable development, innovation, and productivity.

He noted that the private sector is the country’s second-largest employer of wages, after the government, underscoring the importance of supporting manufacturing for economic growth.

Challenges

Alando pointed to several challenges limiting competitiveness, including unpredictable policies, high costs of industrial inputs, regulatory burdens, illicit trade, expensive energy, and cash flow constraints linked to pending bills and VAT refunds. He called for reforms to ensure stable policies, reduced regulatory costs, stronger action against illicit trade, and a more enabling business environment.

The Finance Bill 2025 proposes to cut the timeframe for lodging Value Added Tax (VAT) refund claims from 24 months to 12 months.

Specifically, Section 32 of the Bill seeks to amend Section 17(5)(d) of the VAT Act (2013), which currently allows registered persons to claim refunds within 24 months from the date the tax becomes due. The amendment would halve that period, giving businesses only 12 months to apply for refunds.

Outstanding VAT refunds

Earlier this year, KAM raised concerns that outstanding VAT refunds owed to its members by the Kenya Revenue Authority (KRA) — estimated at over Sh15 billion — are creating significant cash flow challenges.

The association recommended doubling the current Sh2.5 billion monthly allocation to KRA for VAT refunds.

“Liquidity is the 'blood' that keeps the businesses running. The government should ensure the timely refund of VAT to businesses. This should include immediate settlement of the estimated Sh15 billion outstanding VAT refunds and increasing monthly allocation of VAT refunds to at least Sh4 billion,” KAM said.

“The National Treasury usually allocates Sh2.5 billion per month to the KRA for VAT refunds against a requirement of about Sh4 billion per month. This has several ripple effects, such as cash flow constraints, increased cost of doing business, reduced competitiveness, as well as slowed investment and expansion.”

Top Stories Today