Revenue gaps, budget misalignments hurting service delivery, warns Auditor General

The Auditor General attributed the low absorption of 56.5 per cent of the development budget by County Governments in the last financial year to unrealistic budget targets and delayed procurement processes.

Revenue gaps, budget misalignments, and procurement delays continue to undermine service delivery, Auditor General Nancy Gathungu has warned.

More To Read

- Only two of 63 performance audits discussed by MPs since 2012 - Auditor General

- Counties exposed as Auditor General flags major in emergency preparedness

- County expenditure share by sector (FY2023/24)

- MPs back move to amend finance law to align audit timelines with Constitution

- State agencies, counties owe Kenya Power Sh4.67 billion in unpaid bills - Auditor General

- Over 16,000 in the dark as Kenya Power struggles to procure essential meters, transformers

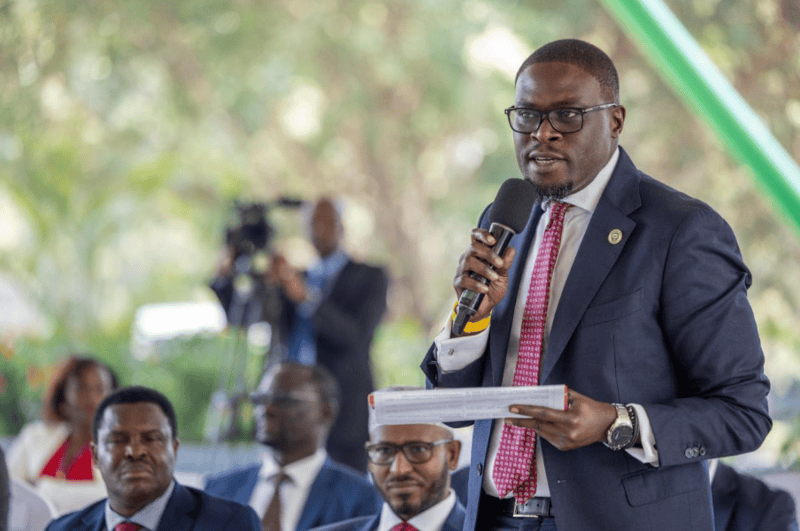

Speaking on November 20 before the Budget and Appropriations Committee in Machakos County, when she presented audit findings on the FY 2024/25 budget and the first quarter of FY 2025/26, Gathungu recommended tighter financial controls and enhanced revenue forecasting to prevent the accumulation of pending Bills.

She highlighted that the difference between projected and actual revenues collected by both national and county governments remains a major challenge, disrupting service delivery and contributing to unpaid Bills.

The Auditor General attributed the low absorption of 56.5 per cent of the development budget by County Governments in the last financial year to unrealistic budget targets and delayed procurement processes.

She further cited delays and shortfalls in exchequer funding, poor alignment between the budget and cash plan, budget reductions under Supplementary 1 Estimates, and occasional IFMIS system downtime as key obstacles in budget implementation.

To improve financial management, Gathungu urged stricter fiscal discipline, realistic revenue forecasting, transparent budget execution, limitation of public debt, and enforcement of accountability in public resource management.

She also stressed the need to enhance foreign exchange reserves and diversify exports to strengthen economic performance.

As for her Office’s performance, the Auditor General reported that it absorbed Sh8.084 billion, representing 98 per cent of its actual budget of Sh8.174 billion for FY 2024/25, a level of performance she contrasted with other sectors that recorded lower absorption.

For the current financial year, her Office has utilised Sh2.5 billion out of Sh8.689 billion allocated.

Committee chairperson Samuel Atandi commended the Auditor General for her leadership in digital procurement and high budget absorption.

“The Office of the Auditor General has shown exemplary fiscal discipline in budget absorption. It was also the first public entity to embrace electronic government procurement,” he noted.

Atandi also recognised her efforts to enforce audit and parliamentary recommendations through amendments to the Public Finance Management Act, 2012, and the Public Audit (Amendment) Bill, 2025.

Committee members raised questions on the causes of pending Bills, audit timelines, and the performance of the e-GP system.

Gathungu emphasised the importance of amending the PFM Act to introduce individual accountability for accounting officers, noting that most pending Bills stem from fiscal indiscipline.

She recommended that ministries, departments, and agencies submit financial documents monthly instead of quarterly to improve audit timelines.

Regarding her office’s lower absorption in the first quarter of FY 2025/26, she cited procurement challenges due to the e-GP system, which has affected all government entities.

The Committee will conclude its review with the Controller of Budget, Margaret Nyakang’o, and use the findings to guide Parliament and inform future budget cycles.

Top Stories Today