Shilling strengthens to 15-month high amid low dollar demand

Kenya's apex bank, the Central Bank of Kenya (CBK), quoted the shilling at Sh128.65 on Friday last week, a level that was last witnessed in March 2023.

The shilling has continued its strengthening streak against the dollar, rising to a level last witnessed 15 months ago.

Kenya's apex bank, the Central Bank of Kenya (CBK), quoted the shilling at Sh128.65 on Friday last week, a level that was last witnessed in March 2023.

The gain could be attributed to increased earnings from agriculture exports amid reduced demand for dollars among importers.

More To Read

- Mbadi confirms Treasury deliberately influencing shilling’s value against dollar

- Kenyan shilling rallies against major world currencies

- Weakened shilling leaves Kenya’s diplomatic missions struggling with operations, staff welfare

- Kenyan shilling stable versus dollar, LSEG data shows

- How the US is daring the world to find a dollar alternative

- Kenyan shilling's appreciation sees debt service expense drop by Sh66.2bn

Data by the Kenya National Bureau of Statistics (KNBS) shows Kenya's earnings from exports grew by 15.4 per cent in 2023 to hit Sh1 trillion for the first time in history.

Tea is ranked as the country's top export earner for the year, bringing in Sh188.7 billion, followed by horticulture at Sh187.4 billion.

The Central Bank of Kenya. (Photo: File)

The Central Bank of Kenya. (Photo: File)

The shilling in the past year to February this year has received a beating from the greenback, pushing it to the low of Sh161 sometime in January.

This meant tougher times for consumers, with the country being a net importer; hence, importers were spending extra costs to buy the much-sorted dollars for importation.

For instance, compared to the period before the local currency started depreciating, in early 2020, importers were spending about Sh101 to buy a single dollar for their imports.

Fast forward to January this year, the shilling had lost close to 60 unit values, an equivalent of 59 per cent depreciation.

This meant importers were spending Sh59 more to buy a dollar for importation compared to the period before it started weakening, with the costs passed down to consumers.

However, the shilling started recovering against the dollar in February after the government partially paid part of the inaugural Sh250 billion ($2 billion) Euorobond that is due this June.

It paid back around Sh190 billion ($1.5 billion) in February, boosting investor confidence.

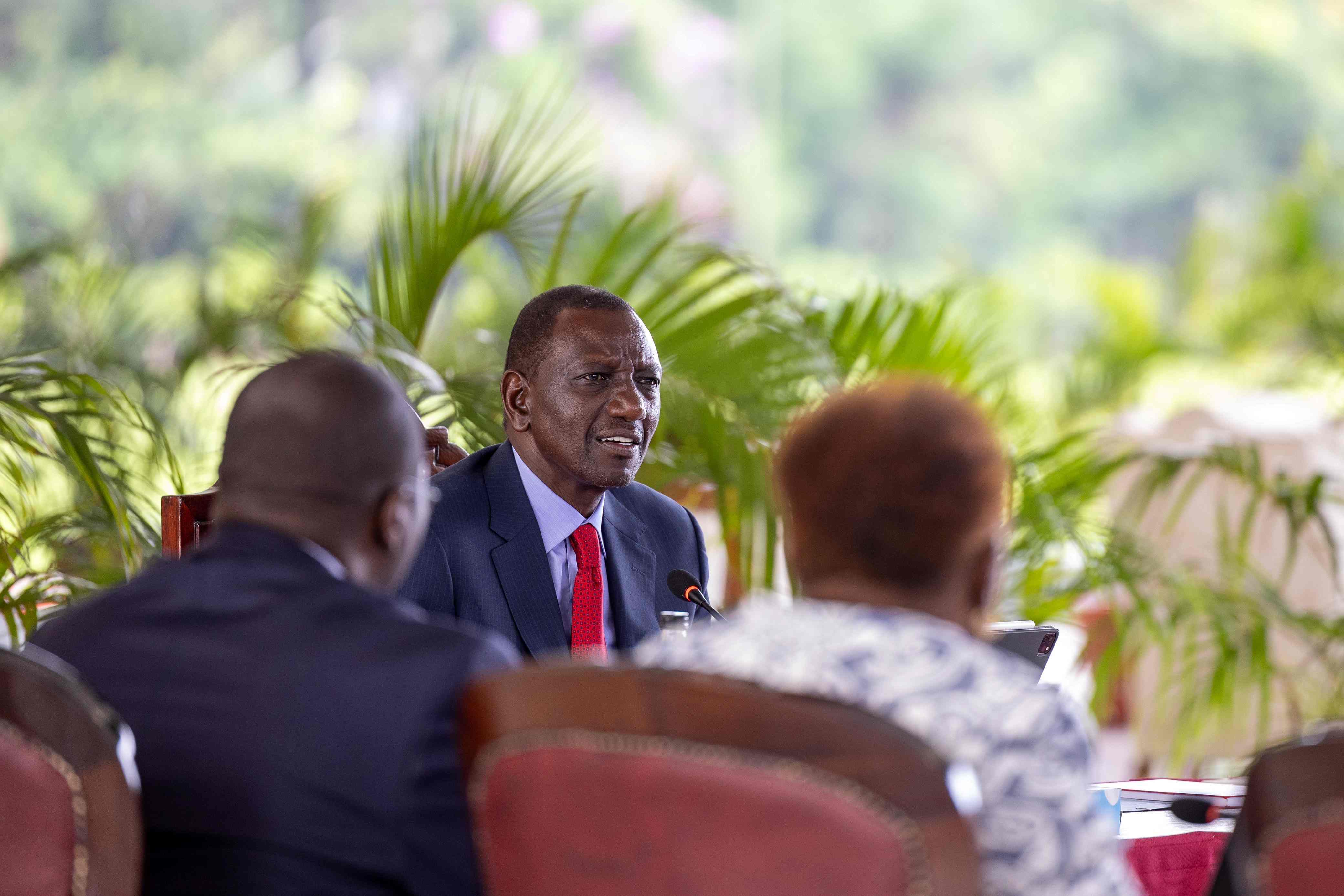

While commenting on the settlement in February, President William Ruto noted that the successful buyback boosted the local currency.

President William Ruto chairs a cabinet meeting at State House, Nairobi, on May 2, 2024. (Photo: PCS)

President William Ruto chairs a cabinet meeting at State House, Nairobi, on May 2, 2024. (Photo: PCS)

"Investor confidence has been significantly enhanced, resulting in the appreciation of the shilling against the US dollar," Ruto said.

He also noted that the strengthening of the shilling did enough to ease the country's debt pressure by cutting down on debt servicing costs.

To date, compared to the January high, the shilling has gained about 33 unit values or a 20 per cent gain.

It means importers are now spending Sh20 less to buy a dollar for imports compared to January, meaning more relief to consumers and prompting a decrease in the general cost of living.

Inflation has been on the decline in the past three months in a row, from 6.9 per cent in January to 6.3, 5.7, and 5.0 per cent in February, March, and April, respectively.

The level, however, rose marginally to 5.1 per cent in May, on the back of an increase in some food commodities, which outweighed the decrease in other products.

Top Stories Today